The views of the participating entrepreneurs are theirs.

Most people in the United States don't set foot in their dream home right away, I know. Instead, they usually start with something simple and build up gradually. When they are ready to sell, they try to improve and increase the value of the property to increase their income. Even if you are thinking about selling your business, the smart move is to consciously work to increase the value of the company, the value of the company.

Business value is the total value of your business. However, owners should be aware that a number of deductions will be taken from this figure due to debt and transaction costs such as legal advice and business brokerage. It reminded me of selling my first house and then I saw how much we sold it for and several people got a piece.

Many entrepreneurs don't dig as deep to add value to the company as they should. This is because they feel more comfortable in organizational positions in which they have some experience. But if you want to create maximum value for yourself, your team and your brand legacy, you need to feel comfortable. The good news: if you understand this, you can consciously control the value of a company.

RELATED: If you really want to get a good deal, let the other party win

How to increase business value

Like many other organizational projects, increasing the value of the company requires good planning. But no plan will work if you don't know what you really want. So start by setting clear expectations. This could mean selling within five years and trying to increase the company's value to $ 1 million or $ 100 million.

Once you have those parameters, ask yourself, "How can we achieve this?" You will realize how much it costs to add value and close the sale, and that's okay. Documentation of the performance (usually on a 12-month basis), estimates to be made, marketing, negotiations and other necessary work must be submitted. It's a big reason 54% of real estate agents say it takes six to 11 months to close a sale.

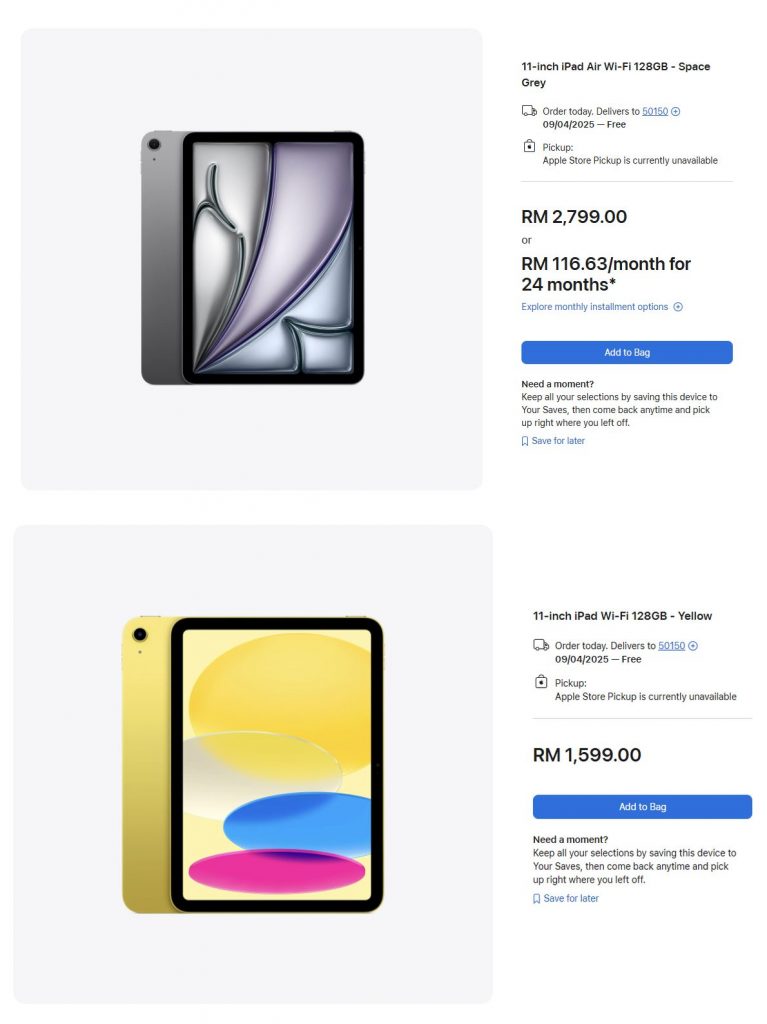

You also need to find your valuation range, which usually requires you to base it on financial metrics such as earnings before interest, taxes, depreciation and amortization (EBITDA). Hire professionals to see the dynamics of your business such as size and sector. You can then find some "comparable" or "companies" similar to yours and find out what they sell. Each compensation value is calculated as five times your financial metric, for example: B. EBITDA. By studying the ups and downs of your salary, you will discover the range in which your business can sell. This scenario is similar to your real estate agent telling you at what price they sell similar homes in your area.

As you develop this profile for your industry, determine each company's contribution to pricing. When selling a home, you should consider factors such as a finished basement, proximity to transportation, or low-energy appliances. The competitive factors that determine a company's value can be a dedicated workforce, intellectual property, or the number of strong brands in a company. Can you bring any of these drivers into your business? So you can take your business to the top of the leaderboard.

When looking at value drivers, remember that not everyone sees them equally. If you are buying a house and have small children running around the garden, the pool can be a negative factor. If you imagine your family relaxing by the pool every summer, maybe it's happiness. Therefore, it's important to know what types of buyers attract certain factors when you sell your business, and to isolate or identify the factors that attract the types of buyers you want to sell.

Related: How to add value to your business through marketing

Get ready to grow

In many cases, when a company goes through the above process, it finds that it needs to change a plan or way of doing business in order to sell at the desired time and price. The latter often means supporting growth faster. How you grow depends on your culture and resources, but it can also include options like investing in sales and marketing.

In the age of social media, expanding your online presence can be a great way to add value and grow. Your website and social media channels offer the opportunity to provide a higher "wow factor" that will make people excited and ready to engage with you. Statistics support the idea of the importance of social success. 77% of consumers would choose a brand over a competitor if they had a positive social media brand experience, and 91% of executives expect their company's social media marketing budget to increase over the next three years. So make sure your online channels reflect the same experience people have with you in person.

When setting growth goals, remember that small percentages can make you think there isn't much of a difference – 5% doesn't seem too far off 8%. However, if you charge higher rates for several consecutive years, the cost can run into the millions.

As you prepare to sell, it is even more important to reduce your tolerance for things that do not benefit the company in order to achieve maximum possible growth and final valuation. Ultimately, this reduction in tolerance should lead to an improvement in the way you run your business.

See also: 5 ways to create value with your intellectual property

Creating business value supports everyone

Many homeowners who don't plan well before selling their home have a hard time making the repairs they should have done in advance. They never liked these updates and instead were duped and put under pressure by sales.

Don't make your mistake. By trying to create additional business value before closing the business, you gain more control over your decisions and feel the satisfaction of putting it all together. Most importantly, it helps you evaluate your leadership style more critically and further improve your leadership. Because it moves you and your business forward, it's a win for everyone.