In the intricate ecosystem of modern businesses, financial health serves as the heartbeat that sustains growth and stability. When the heartbeat falters, the entire organisation is at risk. This is where the pivotal role of CFO solutions comes into play.

CFO (Chief Financial Officer) solutions are not just financial management strategies; they are the lifelines that rescue businesses in turbulent times, ensuring both monetary recovery and strategic expansion.

1. Understanding CFO Solutions

CFO solutions encompass a comprehensive suite of financial strategies, practices, and expertise that extend far beyond mere number crunching. These solutions are meticulously designed to optimise financial operations, enhance profitability, and mitigate risks. A skilled CFO, equipped with a profound understanding of financial intricacies, serves as the captain steering the ship through uncertain waters.

2. The Healing Touch on Finances

Amid financial distress, CFO solutions act as a beacon of hope. They provide a systematic approach to assessing, analysing, and addressing financial challenges. By delving deep into financial data, a CFO identifies the root causes of economic woes, be it liquidity issues, declining margins, or mounting debt. Armed with insights, they formulate strategic plans to nurse the ailing finances back to health.

3. Business Recovery in Difficult Situations

Adversity often strikes without warning, leaving businesses needing more certainty. CFO solutions, however, restore order. During economic downturns or crises, CFOs navigate the complex terrain of cost reduction, cash flow management, and debt restructuring. They not only safeguard the financial foundation but also pave the way for recovery and sustainable growth.

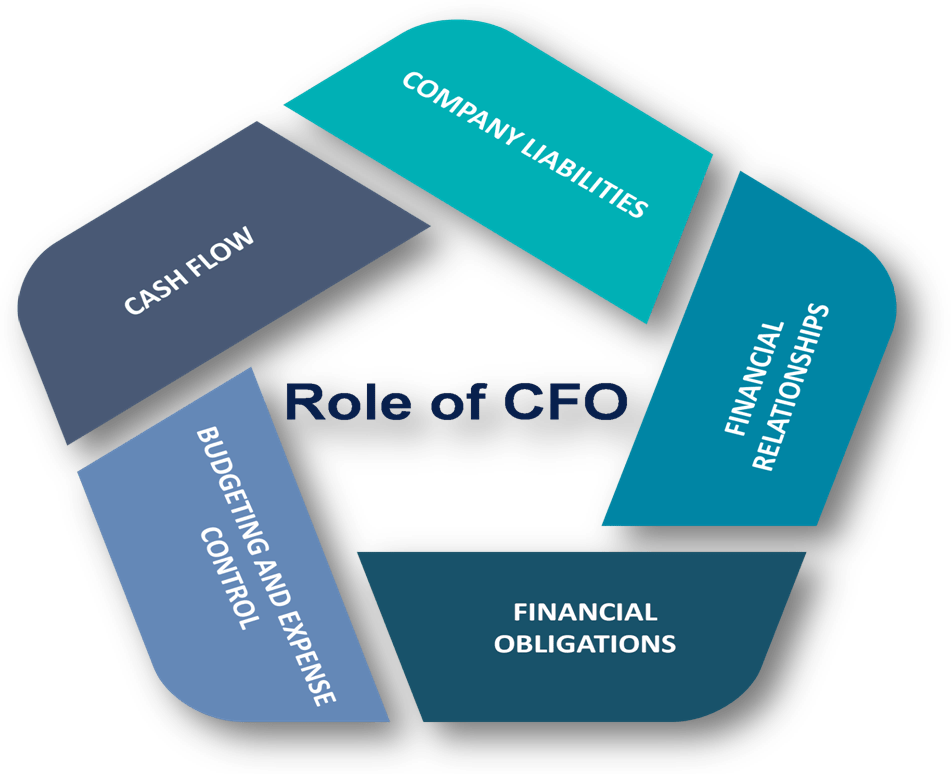

4. The Crucial Role of CFO Solutions

The importance of CFO solutions is realised mainly during difficult financial situations. Their expertise transcends number manipulation; they are strategic partners who align financial decisions with overarching business goals. CFOs collaborate with other departments, integrating financial insights into operational strategies, thereby fostering a holistic approach that drives business success.

5. Elements of CFO Solutions

CFO solutions encompass a myriad of components aimed at comprehensive financial optimisation. These may include:

- Financial Analysis and Reporting: Thorough analysis of financial statements, identifying trends, patterns, and areas of concern to inform strategic decision-making.

- Budgeting and Forecasting: Crafting realistic budgets and forecasts that serve as roadmaps for resource allocation and business planning.

- Cash Flow Management: Ensuring the availability of sufficient cash to cover operational needs, investments, and unforeseen contingencies.

- Risk Management: Identifying, assessing, and mitigating financial risks to safeguard business assets and continuity.

- Cost Management: Analysing costs across the organisation and implementing strategies to optimise expenses without compromising quality.

- Capital Structure and Financing: Crafting optimal capital structures and exploring financing options to support growth initiatives.

- Debt Management: Strategising debt repayment and renegotiating terms to alleviate financial burdens.

- Strategic Decision Support: Offering financial insights to guide strategic decisions, whether it’s expansion, mergers, or product diversification.

Image source: https://enterslice.com/

Conclusion

CFO solutions are not just financial prescriptions; they are the antidote that heals businesses wounded by financial hardships. With their holistic data-driven approach, CFOs wield the power to not only restore financial vitality but also fortify businesses for the future. CFO solutions emerge as the compass that navigates businesses towards resilience, growth, and enduring success in an ever-evolving business landscape. Dun & Bradstreet, a leading business intelligence platform, offers such solutions to elevate businesses to new heights.

Dun & Bradstreet’s CFO solutions go beyond traditional financial management. By harnessing the power of data, these solutions provide CFOs with real-time visibility into their company’s financial health and performance. With access to comprehensive, up-to-date information, CFOs can identify trends, anticipate challenges, and seize opportunities. This allows businesses to stay agile and make strategic adjustments that keep them ahead of the curve.