Last month in a surprising announcement it was revealed that the credit card collaboration between Apple and Goldman Sachs has come to an end. This partnership, was specifically created to enable Apple to launch its Apple Card credit card, a symbol of innovation in the financial technology sector. The Apple Card, known for its user-friendly features and strong integration with Apple products, is now at a crossroads as the two companies go their separate ways.

The reasons behind this split are multifaceted. Apple’s insistence on high approval rates for the card increased the risk for Goldman Sachs, leading to operational difficulties. Additionally, Apple’s unique customer support demands, such as providing assistance through iMessage, and its no-fee policy have limited Goldman Sachs’ ability to generate revenue from the venture.

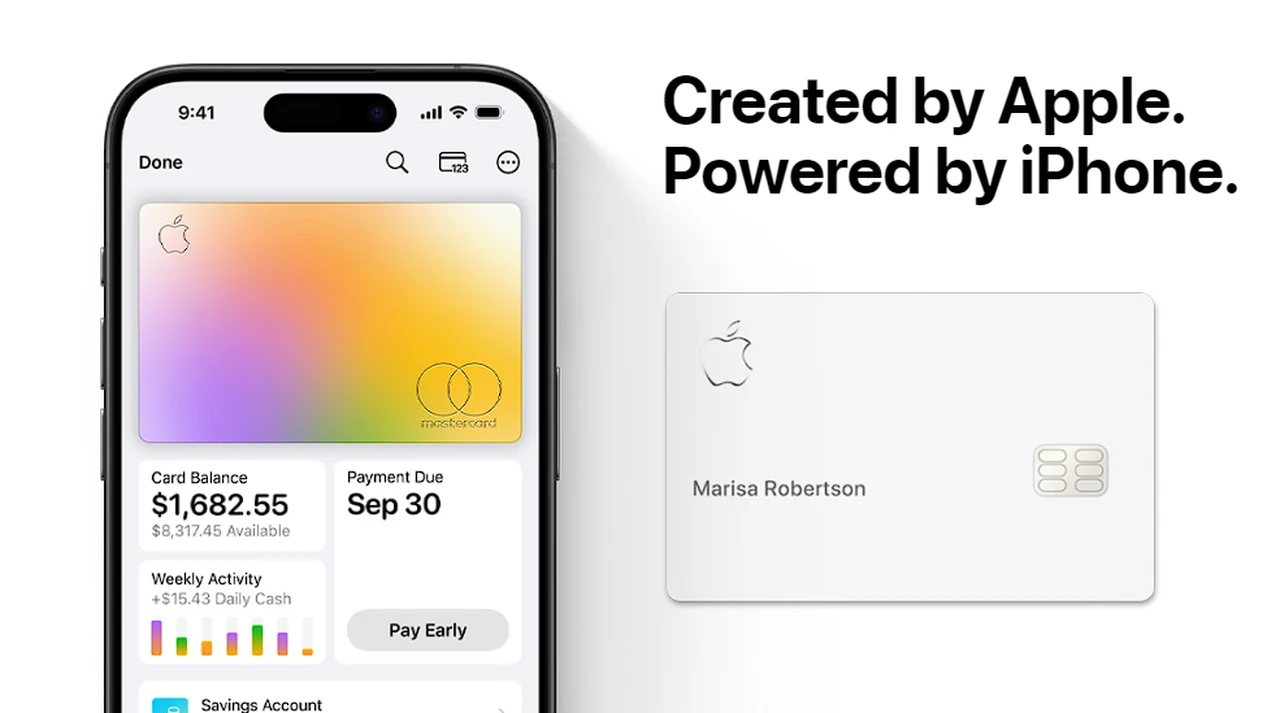

When the Apple Card was launched, it was met with much fanfare. It allowed Apple to offer 0% financing on its products, which boosted sales and reinforced customer loyalty. The card’s seamless integration with the iPhone’s Wallet app and the daily cash back rewards were standout features that differentiated it from other credit cards on the market.

Why are Apple and Goldman Sachs parting ways?

Despite these customer-centric innovations, the financial impact on Goldman Sachs has been substantial. Reports indicate a staggering $3 billion loss since the card’s debut in 2019. This significant financial hit has forced Goldman Sachs to reconsider the viability of the partnership.

What will happen to the Apple Card?

As Goldman Sachs prepares to withdraw from the agreement, the future of the Apple Card hangs in the balance. Apple is now tasked with finding a new partner to sustain the card’s unique offerings and favorable terms. This change is crucial for Apple and its customers, as the company aims to preserve the card’s benefits and popularity.

The end of the Apple and Goldman Sachs partnership marks a notable shift in the fintech landscape. The Apple Card has made a considerable impact on the industry, but the economic burden on Goldman Sachs has necessitated a new direction. The outcome of Apple’s search for a replacement partner will be a defining moment for the Apple Card and will be watched with interest by both consumers and industry observers.

Image Credit : Apple

Filed Under: Apple, Technology News, Top News

Latest aboutworldnews Deals

Disclosure: Some of our articles include affiliate links. If you buy something through one of these links, aboutworldnews may earn an affiliate commission. Learn about our Disclosure Policy.