The High Court today ruled that CTOS Data Systems Sdn Bhd (CTOS) does not have the power to formulate its own credit score. According to Judge Datuk Akhtar Tahir, there is no provision in the Credit Reporting Agencies Act 2010 (CRAA) to empower the company to formulate a credit score for its customer, nor create its own criteria or percentage to formulate a credit score.

The agency is only allowed to be a repository of the credit information for its subscribers, he added later. “By formulating a credit score, it has gone beyond its statutory functions.”

Who is CTOS?

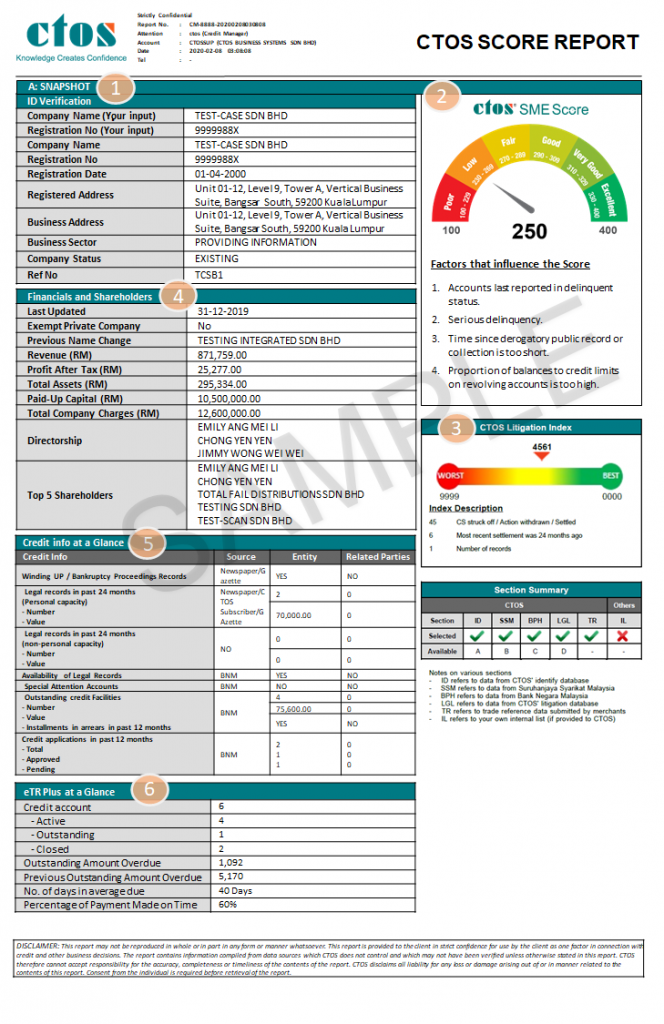

CTOS is a private agency that collects information from various sources, such as banks, financial institutions and other sources such as legal firms to create a credit report. This credit report is then used by banks and financial institutions to asses an individual or a company’s creditworthiness and repayment capabilities for loans and other financial products.

It will then create a credit score based on the information, and calculate a score with a range between 300 and 850 points, with the higher value equal to a good credit score.

What the lawsuit against CTOS entails

This court ruling is for a suit by a resort owner in Pulau Perhentian. She sued CTOS for inaccurate credit rating, which allegedly resulted in loss of reputation, personal loses as well as business losses.

She found out that CTOS created a negative report for her based on inaccurate data collected by the agency. This resulted in a rejected car loan application in May 2019. Based on the inaccurate information, she said that the defendant had given her a low credit score leading to loss of confidence from financial institutions.

According to NST’s report, the businesswoman said that she communicated with CTOS to check and update the inaccuracies with her data. Still, CTOS ignored her communications and did not update their database. Commenting on this, Judge Datuk Akhtar said CTOS could have held back the information pending verification, or at least alerted the subscribers/applicants that a verification is underway, but instead they maintained the status quo.

CTOS was instructed to pay the defendant RM 200,000 in damages plus RM50,000 in legal costs. The question is what does this mean for CTOS moving forward – can they still create credit scores or will they just be relegated to an information database company?

[SOURCE]