Apple’s significant impact on the market tends to draw attention from companies that might not have otherwise entered a specific product category—aka “The Apple Effect.” With the entrance of Apple Vision Pro, one such entity to follow suit is Stryker’s Mako, a robotic surgery group initially founded as a standalone company by Rony Abovitz, the founder and first CEO of AR unicorn Magic Leap.

Abovitz founded Mako Surgical in 2004, and left the medical robot company when it was acquired by Stryker for $1.65 billion in 2013, or just around three years after Magic Leap was founded by Abovitz in stealth mode.

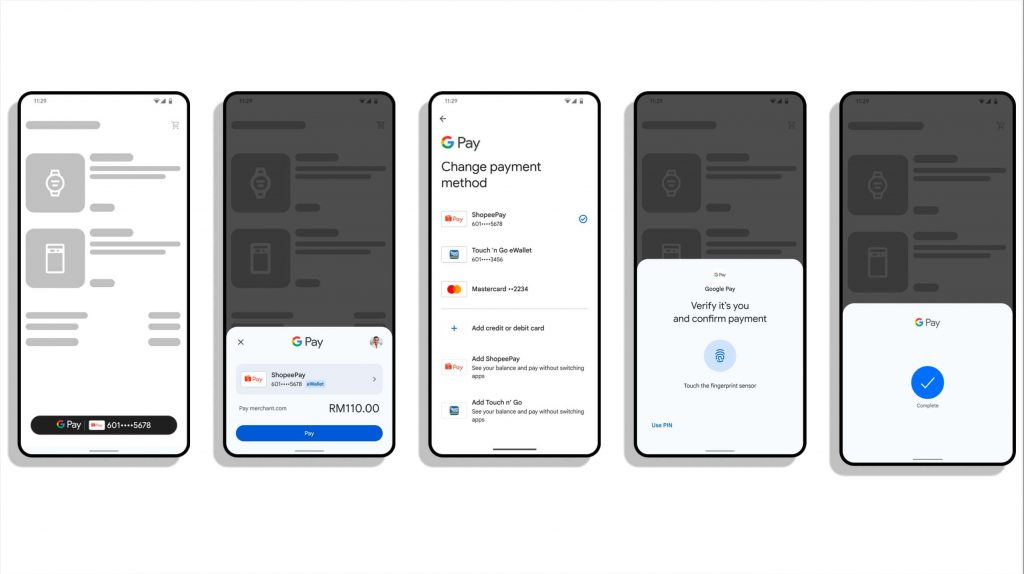

Now, Vision Pro users can download the myMako app, which lets surgeons visualize and review surgical plans in an immersive way. It’s not exactly ironic that Mako (by way of Stryker) chose Vision Pro and not Magic Leap, but the link is certainly telling of how the broader market is reacting to Apple’s first headset.

Released in 2018, Magic Leap’s first headset actually had a lot in common with Vision Pro; it was multi-thousand dollar standalone mostly targeted at developers and professionals. At risk of comparing mixed reality Apples too closely to augmented reality oranges, one of the key differentiators was the lack of broad app integration that would make it more usable for prosumers looking for “the next big thing.”

There are a few more reasons ML1 didn’t fare well. It was supposed to change the entire industry, but with a relatively narrow field of view (FOV) and less-than-cutting edge optics, it was famously lambasted by Oculus founder Palmer Luckey at launch as a “flashy hype vehicle that almost nobody can actually use in a meaningful way, and many of their design decisions seem to be driven by that reality.”

Precisely one pivot and one CEO change later, which would see Abovitz eventually leave the company, Magic Leap abandoned any notion of serving prosumers, instead appealing solely to enterprise with the launch of Magic Leap 2 in 2022.

To boot, myMako is very much the sort of thing that could have launched on any number of XR headsets—Magic Leap (1 or 2), Microsoft HoloLens (1 or 2), or any VR headset for that matter, as it basically presents surgeons with 3D images obtained from computer topography (CT) based scans. Many such examples of pre-op medical apps already exist, including SurgicalAR from Medivis, which launched on HoloLens 2 prior to coming to Vision Pro last month.

So why Apple, and why now?

Big Apple, Big Stability

For the newcomers like myMako, some of it may come down to the stability Apple represents. As a the second-most valuable company in the world behind Microsoft, Apple not only brings brand cache, but a whole interlocked ecosystem of apps and services that appeal to a wider audience, ranging from prosumers to professionals—something Microsoft tried to do with Windows Universal Apps on HoloLens, but failed to make it into the sort of general computing device Vision Pro is now.

Notably, a part of Vision Pro’s immediate success can be attributed to its support for over a million iOS apps, and more than a thousand visionOS natives. And that’s in spite of its $3,500 price tag.

And unlike Microsoft, Apple’s primary focus on consumer hardware makes it the ideal “rising tide to lift all boats” when it comes to XR headsets. Now a little over one month since launch, we’re starting to see how the competition is reacting to Vision Pro.

Meta CEO Mark Zuckerberg has gone on record to say he thinks Quest 3 is just “better for the vast majority of things that people used mixed reality for.” Fighting words aside, Meta announced late last month it was partnering with LG on what is rumored to be Quest Pro 2, which ought to more directly compete with Vision Pro.

Meanwhile, Samsung has partnered with Google to release its own Vision Pro competitor, which will include Android XR at its core—a first salvo from the beleaguered AR/VR team at Google, which previously headed its dashed Daydream platform ambitions and internal AR glasses research, which was also summarily shuttered.

It seems ‘The Apple Effect’ is pushing every major hardware company to rethink its next steps on the road to XR, and how it will remain competitive with the Big Apple in the long term now that Vision Pro is here. Whatever the case, it’s certainly enough to bring XR-adjacent companies like Stryker’s Mako sub-brand into the fold, which we expect will continue as Apple prepares its cheaper, more accessible follow-up to Vision Pro, which is reportedly arriving sooner than expected.