This post is brought to you by Visa.

Malaysians are well versed in contactless payments – we are one of the top countries in the ASEAN region to have embraced tap-to-pay, and e-wallet transactions to purchase items or pay for services. Contactless payment is convenient, secure and accepted just about everywhere.

Contactless payment, powered by Visa, is used by all levels of society – from the elderly to the young, from the affluent to the everyday person. It is so easy – you just tap and pay.

It is easier to pay for your purchases than using cash – you don’t need to think about change or space in your wallet or change in your pockets. You just tap your card onto the reader and voilà – you have paid for your purchase.

But there is one more way to pay that is available to Malaysians – Mobile Contactless Payment. In a nutshell, you use your phone or your smartwatch to pay instead of taking out your NFC-enabled cards or launching your mobile e-wallet app. How’s that for convenience?

For example – if you want to pay for your groceries at a supermarket, you can just take out your smartphone, activate your wallet and pay with a tap at the checkout machine.

Meanwhile at the petrol pump, just tap your smartwatch on the NFC reader, and the payment can be processed right away. Your phone is safe in your pocket while your petrol flows into the car – all paid and secure.

Visa’s Mobile Contactless Payment is the most convenient and efficient way to pay these days; your smartphone or your smartwatch is always with you. Not only it is convenient, but usage is also growing in Malaysia. In 2021, 40% of users paid using their smartphone or smartwatch. Last year? 57%. For context, the ASEAN average is 66%.

You may wonder why the usage is rising. For one, more smartphones come with NFC built-in – even the lower-end models. So now more people can enjoy contactless payment with their smartphones, a function previously only available to owners of higher-end devices.

Secondly, and most importantly, is that mobile contactless payment is safe and more secure. Visa’s Token Service protects each transaction made, so all transactions are always backed by the security offered by Visa.

Setting up Visa Mobile Contactless Payment is easy:

- Add your Visa Card to your payment-enabled smartphone or smartwatch

- Look for the Contactless symbol on the terminal at checkout

- Hold your phone or device over the symbol to pay

- Once the transaction is approved, you can walk away with your purchased items.

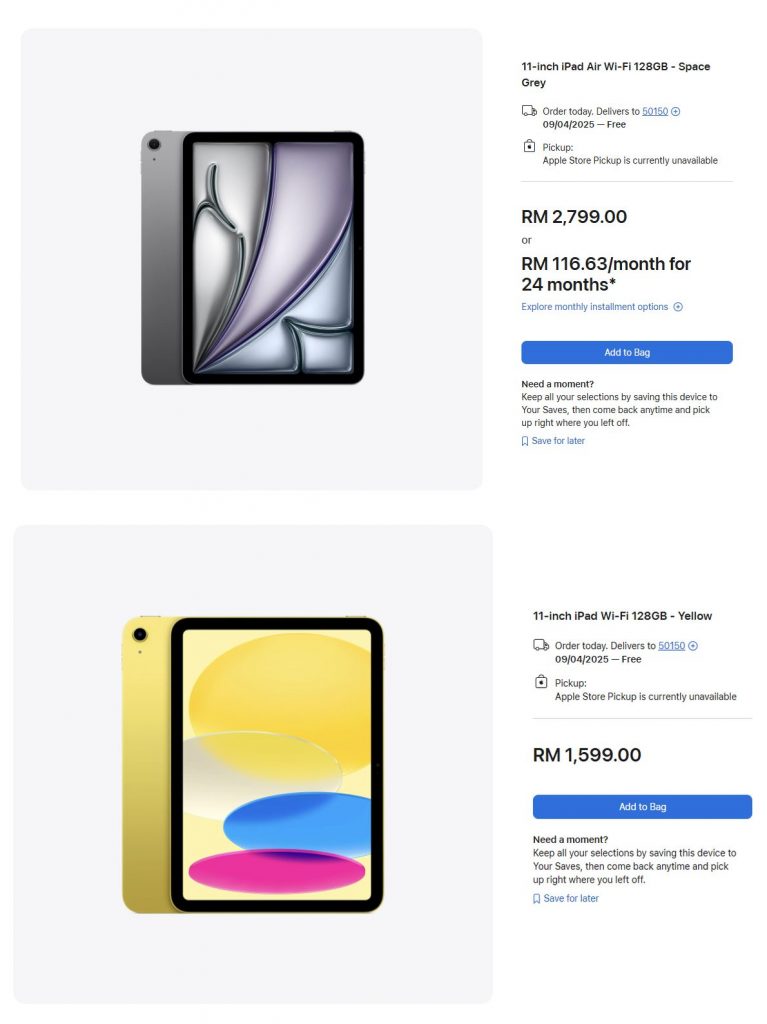

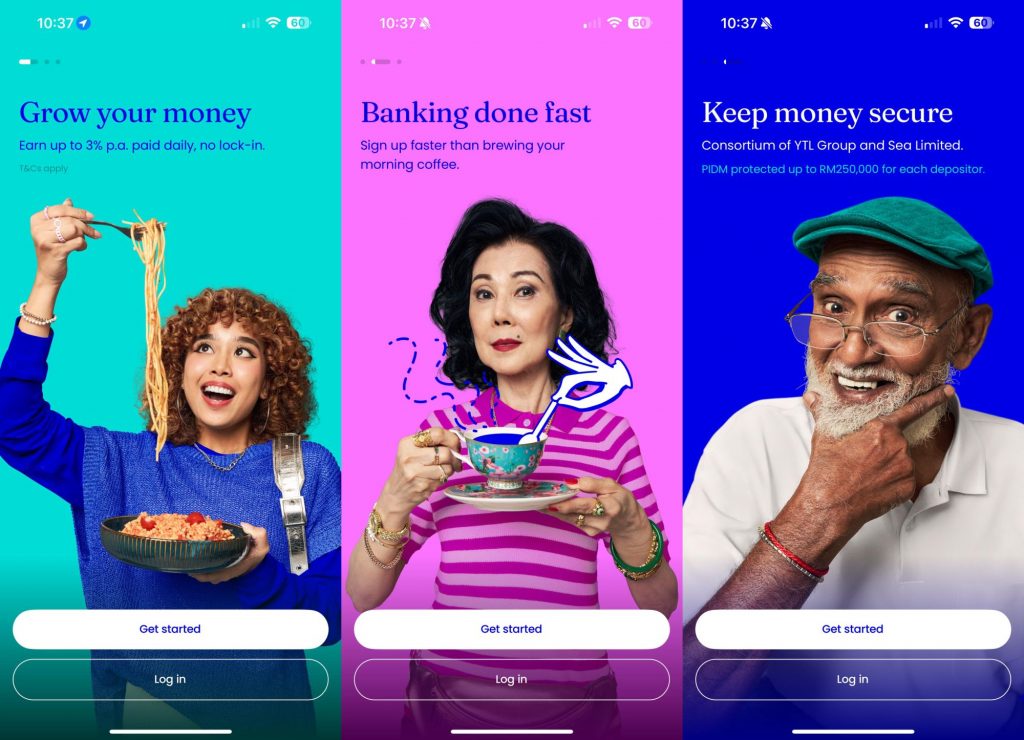

In Malaysia, the major mobile wallets support Visa Mobile Contactless Payment – Apple Pay, Google Pay and Samsung Pay. Additionally, most of the major banks also support the mobile wallet; you do need to add the cards into your mobile wallet first before paying.

In any case, it is just a simple one-time step. Follow the instructions on the mobile wallet app to add your bank card for mobile contactless payments.

What makes mobile contactless payment secure is that mobile wallets do not depend on an internet connection to work. The registered card details on these platforms are sent to the card issuer’s network during registration – in this case Visa.

Each account detail is linked to Visa’s system with a Digital Account Number in the form of a token and an accompanying token key. This information is then kept in the secure section of the mobile device.

When the payment transaction is processed, the information is validated by Visa’s network with the token key in the smartphone. Once validated, the actual card details are decrypted from the token and passed on to the bank to authorise the payment.

All of this is happening within the device, so the internet is not required and thus it is a safe transaction for all.

There you have it, the best way to pay for your purchases is with your smartphone or smartwatch, so start tapping to pay with your phone.

Learn more at www.visa.com.my.