Maybank has just launched its Goal-Based Investment (GBI) feature which aims to make it easy for Malaysians to get started in long-term investment while boosting financial literacy and education. Available on the MAE app and Maybank2u website, the GBI feature aims to empower users to achieve their financial goals through a seamless digital experience. The entire process can be done on the app and you won’t need to visit a physical branch.

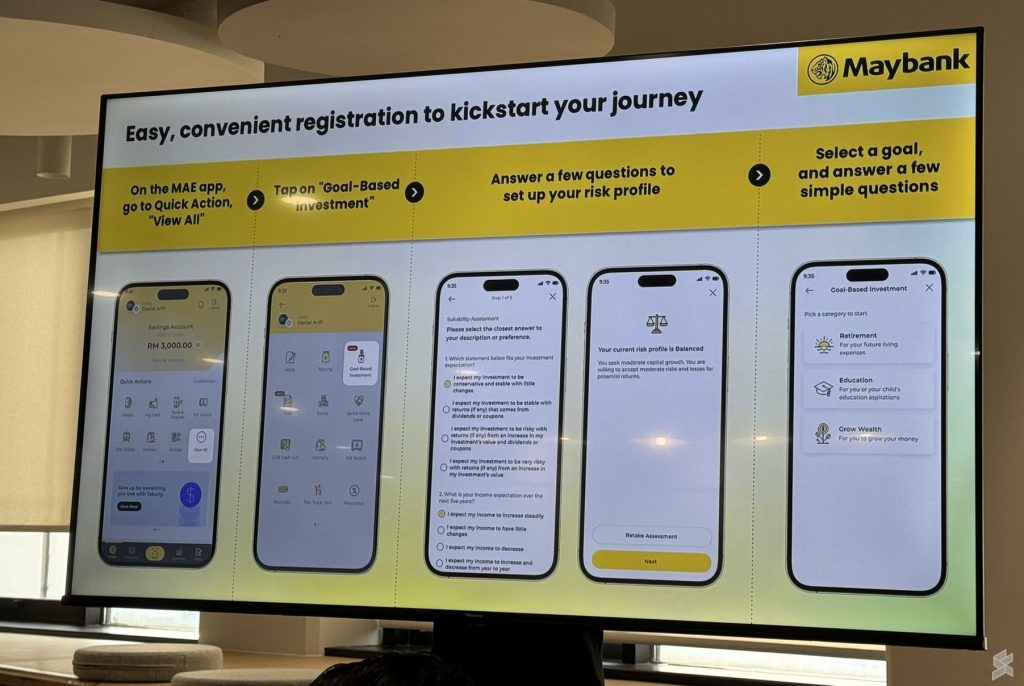

GBI is a unit-trust product and users can set goals based on their financial objectives. At the moment, users can start investing towards a retirement goal, education or to grow their wealth to achieve a personal purpose. The feature is accessible to all users through the MAE app and you can find it under Quick Actions by tapping View All, and then tap on Goal-Based Investment.

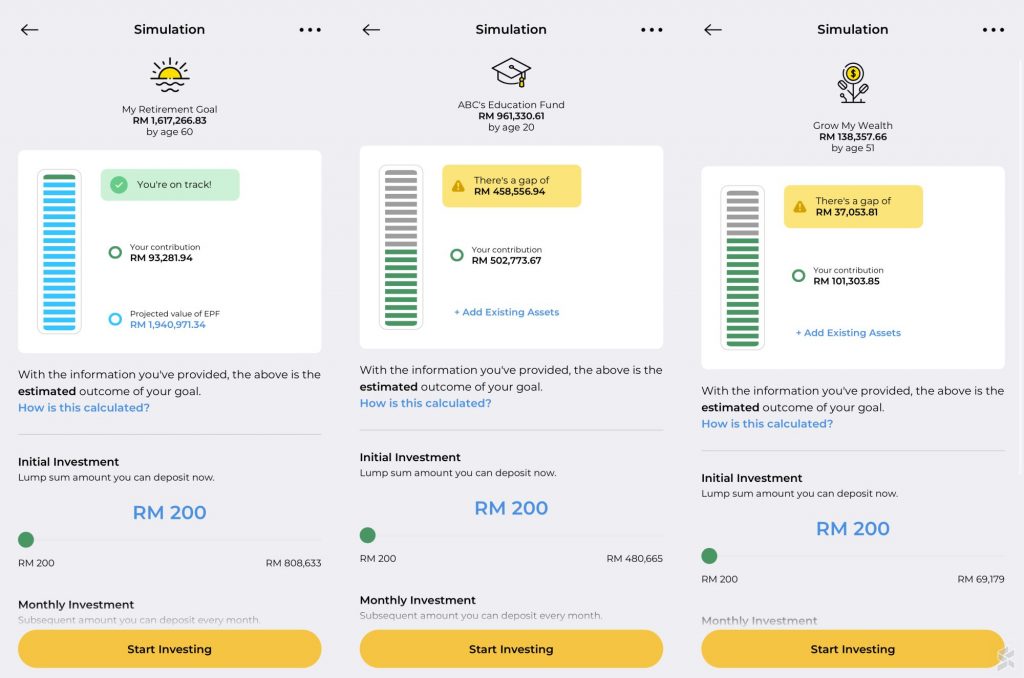

To make it easier for anyone to get on board, GBI requires a minimum amount of RM200 and customers can start investing in funds with 0% sales charge with no lock-in period.

At the moment, the 0% sales charge is offered until 25th June 2024 and Maybank says its fees are competitive between 0-1.5% sales charge. GBI will offer both conventional and Shariah funds, but at the time of writing, only Shariah funds are available.

Maybank’s Group CEO of Community Financial Services, Syed Ahmad Taufik Albar said the Bank understands that those who are just starting to invest can get overwhelmed and may not know where to start, while some may be worried about high fund management or processing fees. Maybank Goal-Based Investment helps to remove these barriers by making investing accessible and affordable for everyone, requiring only a low investment amount and providing a guided experience through digital banking platforms.

With a low entry point of RM200, Maybank believes GBI will allow more people to experiment with investing for themselves. Whether they start with aggressive or conservative investment, the GBI feature will enable youths to understand and eventually lead to better financial literacy and education.

Existing MAE customers can get started almost immediately and new investors are required to create a new Unit Trust account which can be activated digitally in just a few taps. Once that’s done, they can choose their portfolio based on their risk appetite and then create a goal for their investment.

Maybank GBI allows customers to choose their unit trust funds manually or pick an automated curation that’s customised based on their own risk assessment, goal and timeline. When setting a new investment goal, GBI will ask simple questions based on their expected outcome and it will automatically generate a simulation which takes into consideration the inflation rate.

The simulation would also allow users to add on other sources of savings or investments to pool in your total investments to achieve your goal. For example, when setting the retirement goal, you can add your current EPF savings and GBI will include the protected value at retirement.

When setting goal for education, you can even select the type of course and the targeted country. As expected, the set goal to study in the UK versus Malaysia and Singapore. You can try the simulator on Maybank’s GBI page.

While the minimum monthly investment is RM200, there are no penalty fees if you miss your set monthly investment target. The interface is pretty straightforward and you can see at a glance if you’re meeting or falling behind your investment target. If you’re falling behind the goal, you can catch up by performing a one-time lump sum top up.

Users can also stop the GBI or make changes to their investment goals at any time but it will take about 2-3 business days to withdraw the funds to your main account. Do note that GBI is meant for long-term investment. For users requiring a short-term option with the flexibility for instant withdrawal, MAE has a savings account linked Tabung feature.

GBI is also open to non-Maybank customers and they can get sign up through the MAE app by applying for a savings or current account which takes about 10 minutes. An eKYC process will be required for new account holders which involves performing a fund transfer from another bank account registered under the same name.

Besides Malaysia, the GBI feature is also available to Maybank Singapore customers via the Maybank2u SG (Lite) app and Maybank2u web. For more info, you can visit Maybank2u’s Goal-Based Investment page.