After rumours began to circulate last month, the Employee’s Provident Fund (EPF) has officially announced the restructuring of members’ accounts. Set to take place next month, the restructuring will involve the implementation of Account 3.

How will EPF split my contributions from 11 May onwards?

As part of the implementation which is scheduled to take place on 11 May 2024 and applies to all EPF members under the age of 55, EPF will also give new names to members’ accounts. Specifically, Account 1 and Account 2 are now known as Akaun Persaraan and Akaun Sejahtera, respectively while the new Account 3 is officially called Akaun Fleksibel.

This is how EPF describe the role of each account type:

- Akaun Persaraan (Account 1): accumulates savings that will serve as income during retirement

- Akaun Sejahtera (Account 2): addresses life cycle needs that contribute to well-being during retirement

- Akaun Fleksibel (Account 3): provides flexibility for short-term financial needs. Savings in this account can be withdrawn at any time according to members’ needs.

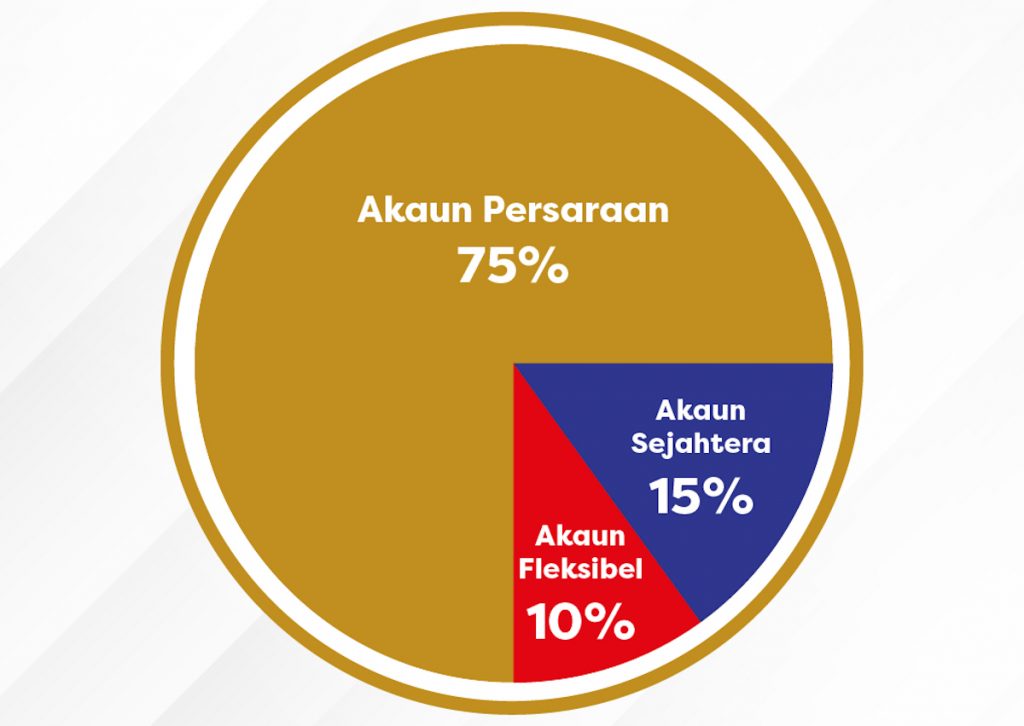

For the sake of clarity, we are still using the original numerical labelling for these accounts. Meanwhile, all EPF contributions will be split three ways according to these percentages starting from 11 May:

- 75% will go into Account 1

- 15% will go into Account 2

- 10% will go into Account 3

What is going to happen to the savings inside my existing EPF accounts?

In general, nothing is going to happen to them. This is because all of the existing savings inside your Account 1 and Account 2 will still be there while the new Account 3 will start at RM0.

Does the new account structure affect my EPF dividends?

According to a report by Bernama, the dividends will remain the same across all three accounts although this may change in the future. This has also been confirmed by EPF’s official X account.

That being said, the original announcement and the FAQ section on EPF’s website somehow did not talk about dividends.

EPF is allowing a one-time transfer from Account 2 to Account 3

Interestingly enough, the implementation of Account 3 also provides the opportunity for EPF members to withdraw some of their funds. This is because EPF is allowing a one-time transfer from Account 2 to Account 3 from 11 May to 31 August 2024.

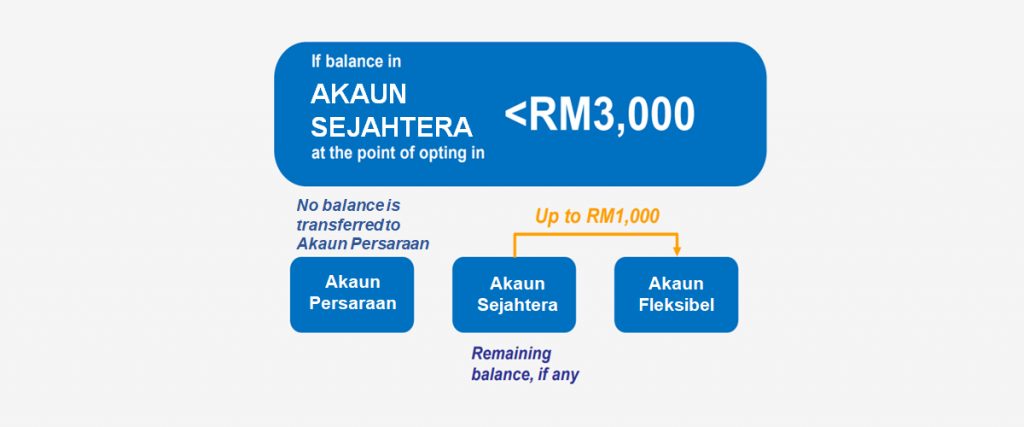

However, you can’t simply withdraw any amount that you like though. The actual withdrawal amount depends on the savings that you currently have in Account 2.

If Account 2 balance is RM3,000 and above, 1/3 of the balance will be transferred to Account 3 and another 1/6 of the balance will go to Account 1. If the Account 2 balance is less than RM3,000, things are slightly different:

- Account 2 balance of RM1,000 and below: all savings will go to Account 3.

- Account 2 balance of more than RM1,000 but still below RM3,000: RM1,000 will be transferred to Account 3 while the rest will remain in Account 2.

You can apply for this one-off transfer through the KWSP i-Akaun app which is available on Apple App Store, Google Play, and Huawei AppGallery starting from 11 May. Alternatively, you can also do it via Self-Service Terminals at all EPF branches nationwide.

How can I withdraw savings from EPF Account 3?

You can apply to withdraw the money from Account 3 by using the KWSP i-Akaun app or by visiting EPF branches. The money would then be disbursed directly into your bank account although do note that there is a minimum withdrawal amount of RM50.

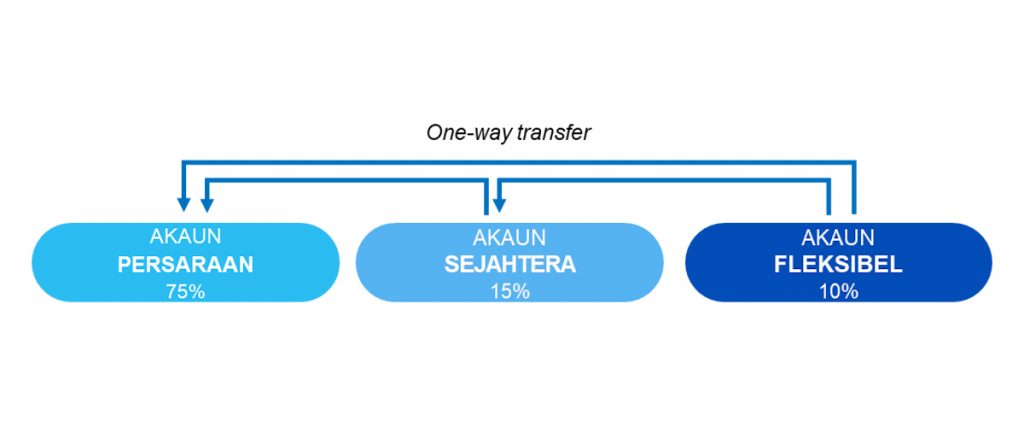

Can I transfer savings from EPF Account 3 to Account 1 or Account 2?

Let’s say that you prefer to save all of your EPF contributions for your retirement and want to move the savings in Account 3 to Account 2 or/and Account 1. Yes, you can do so but do note that this is a one-way transfer.

In other words, you would not be able to take back the money that you have transferred from Account 3 to Account 2 or Account 1. Furthermore, you have to physically visit an EPF branch to submit your application to perform the transfer.

I don’t like the new 3-account structure. Can I opt out of it and have just 2 EPF accounts?

If you are not a fan of the 3-account structure and prefer to stay with the existing 2-account system, there is nothing you can do about it.

As noted earlier, EPF will implement the new account structure this coming May on all members that are under the age of 55 years old and did not provide any option for members to opt out of it.