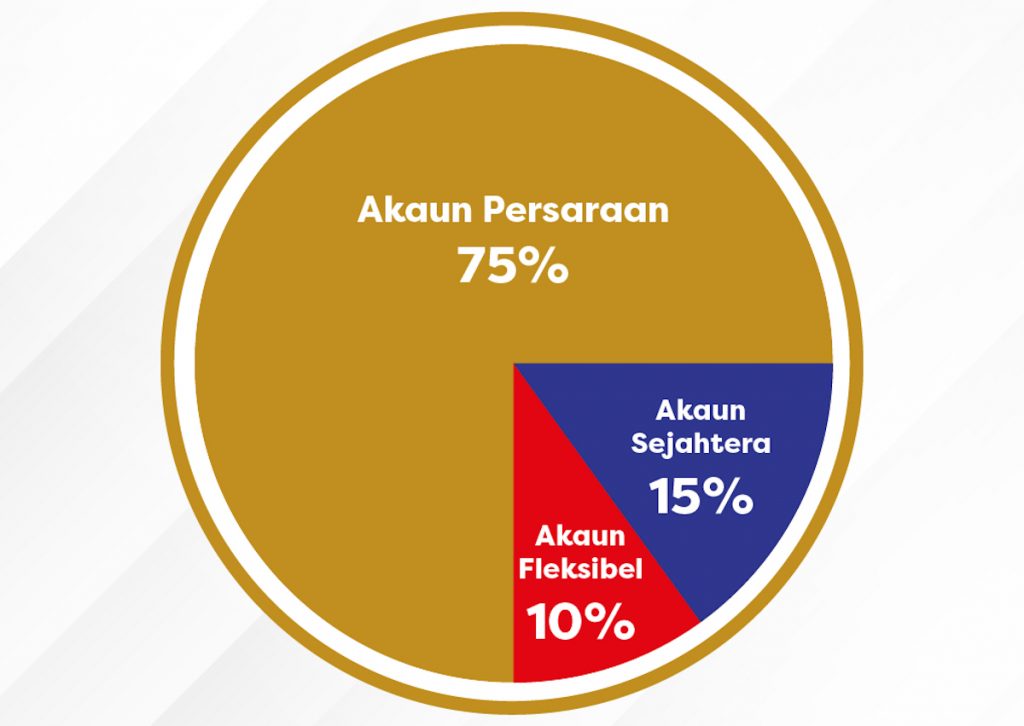

Employee’s Provident Fund (EPF) has recently announced the implementation of the new 3-account structure which will take place on 11 May. As it turned out, the new structure covers mandatory and voluntary contributions.

Voluntary contributions follow the same 75:15:10 ratio

In response to our query, the official X account of EPF has said that all new contributions including those that are categorized as Self-Contribution will be split into three accounts:

Formerly known as Account 1 and Account 2, they have now been renamed Akaun Persaraan and Akaun Sejahtera, respectively. With the implementation of the new 3-account structure, the Account 1 ratio will be increased from 70% to 75% while Account 2 will be decreased from 30% to 15%.

On the other hand, 10% of the EPF contributions from 11 May onwards will go to Account 3 which is officially called Akaun Fleksibel. However, do note that this account will start at RM0 unless you opt to take the one-time transfer from Account 2 to Account 3 which can be done between 11 May to 31 August 2024.

The voluntary contribution cap currently stands at RM100,000 per year

At the moment, there are several types of EPF voluntary contributions which include self-contribution, i-Saraan, and i-Suri. There is also something called the Account 1 Top Up Savings which allows EPF members to make additional contributions to other family members.

Regardless of the voluntary contribution type, there is a limit on how much you can deposit to the EPF account. Specifically, the current limit is RM100,000 per year.

It may sound not much to some out there but the new limit has just been implemented last year. Not only that, it is much higher than the previous limit which was set at RM60,000 per year.