The Ministry of Transport (MOT) has finally revealed the new road tax structure for electric vehicles. The new rate will be put in place from 1 January 2026 onwards after the expiry of the exemption on EV road tax which will take place on 31 December 2025.

EV road tax Malaysia price structure

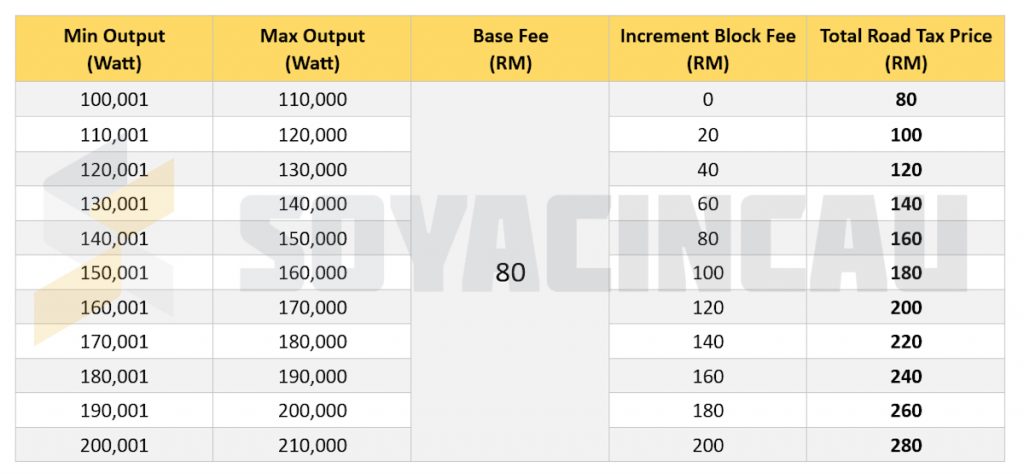

The new EV road tax pricing in Malaysia is based on the power output of the EV. The general pricing structure is divided into 11 main groups.

Specifically, Group A covers up to 100kW while Group B to J starts from 100.001kW up to 1,010kW with each having a range of 109.999kW. Then, there is also Group K which is for EVs with a power output of more than 1,010kW.

Each group has also been divided into a block of 9.999kW. This means for every 9.999kW, there will be an additional fee on top of the base group pricing.

All in all, the new EV road tax pricing generally ranges from RM20 to RM20,000. Transport Minister, Anthony Loke has said that the pricing will be checked every 5 years to measure its impact on the government’s revenue and its effectiveness on Malaysia’s transition to zero emission vehicles.

How is the new EV road tax Malaysia pricing calculated?

Let’s use the 150kW power output as the basis for our calculation. After all, quite many mainstream EVs have such power output including BYD Atto 3, BYD Dolphin Extended Range, Chery Omoda E5, and GAC Aion Y Plus.

So, the 150kW output belonged to EV Group B, covering power output from 100.001kW to 210.000kW. This group has a base road tax price of RM80 and an increment block fee of RM20 per 9.999kW.

Hence, a 150kW EV will have an increment block fee of RM80. Together with a base price of RM80, you are looking at the total road tax price of RM160 for an EV with 150kW power output.

Will the EV road tax in Malaysia be more expensive in 2026?

The new EV road tax pricing will be much LOWER than the original structure starting in 2026. Under the old structure, the owner of a 150kW EV will have to pay RM1,024 for road tax.

Where do I find the power output of my EV?

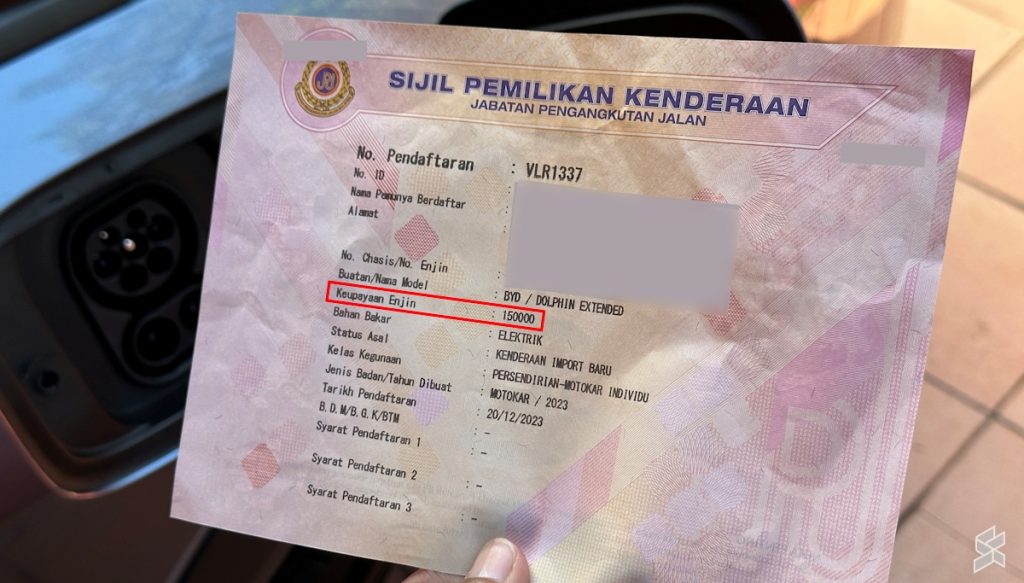

The power output of your EV is stated in your Vehicle Ownership Certificate (VOC) which is fondly called by many as the “vehicle grant”.

The power output is listed as the “Keupayaan Enjin” in the document. Alternatively, you can check out the figure in the digital road tax inside the MyJPJ app.