This post is brought to you by CIMB.

CIMB’s next-generation banking app, CIMB OCTO, will gradually replace the CIMB Clicks app. With the surge in digital payments, CIMB OCTO is built from the ground up to be centred around personalisation, state-of-the-art resilience, enhanced stability and tighter security.

Here are 6 things you can do with CIMB OCTO that you can’t with the CIMB Clicks app!

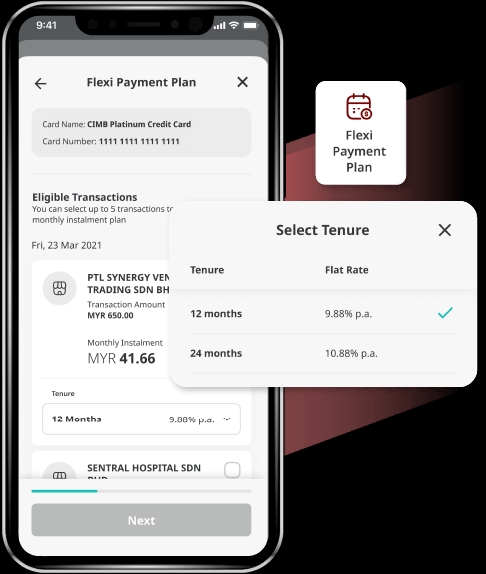

Convert your credit card spending to instalments

Don’t worry about making purchases you have always wanted. You can convert your purchases of RM500 and above into affordable monthly instalments of up to 24 months at interest rates as low as 5.99% p.a. with the CIMB Flexi Payment Plan/Flexi Payment Plan-i. It can be done through CIMB OCTO in just a few taps, with no documents required and zero processing fees.

e-Fixed Deposit with Special Rate

Make your money work harder with eFD, available anytime and anywhere. With just a few taps, you can make placements effortlessly through CIMB OCTO. If you need to uplift your placement urgently, you can do so easily without the hassle of visiting a branch. This convenience ensures that your financial needs are met swiftly and securely, giving you more control over your money.

CIMB now offers an exclusive rate of up to 3.7% p.a. when you make the placement through CIMB OCTO. This promotion is valid until the 31st of July 2024 and is available exclusively via CIMB OCTO.

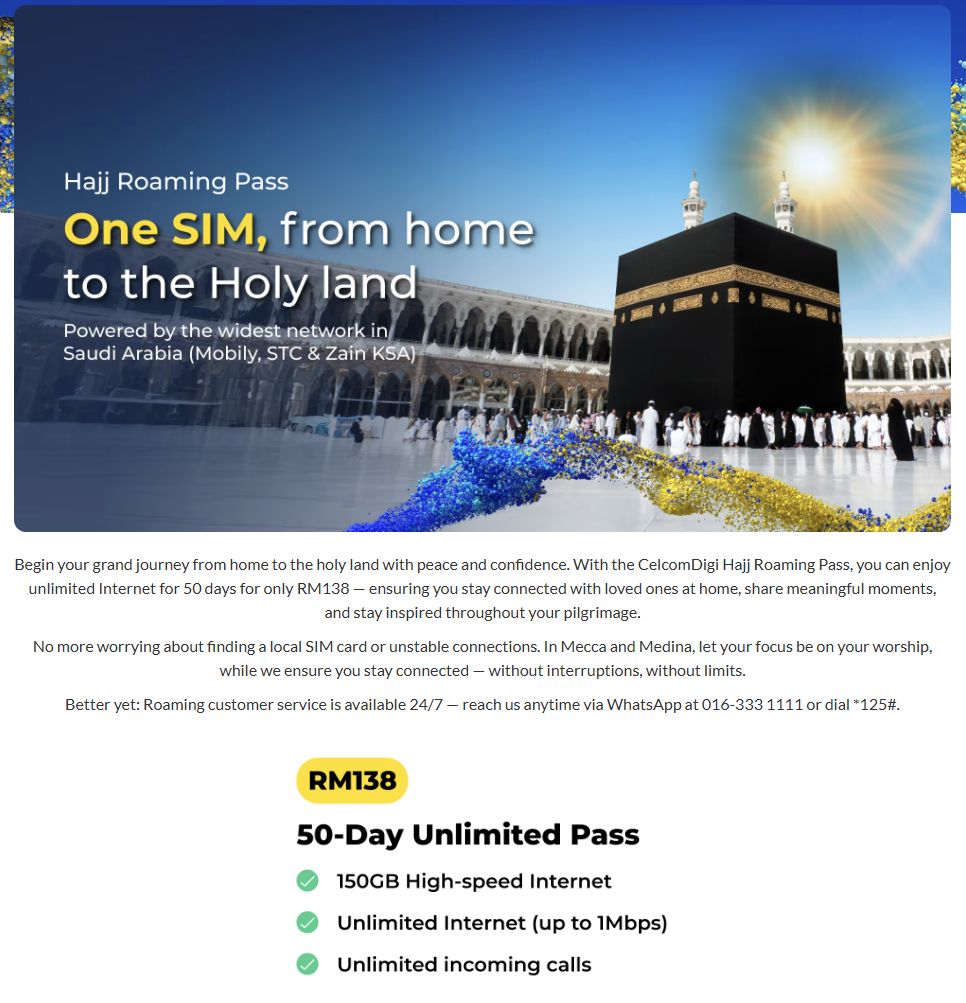

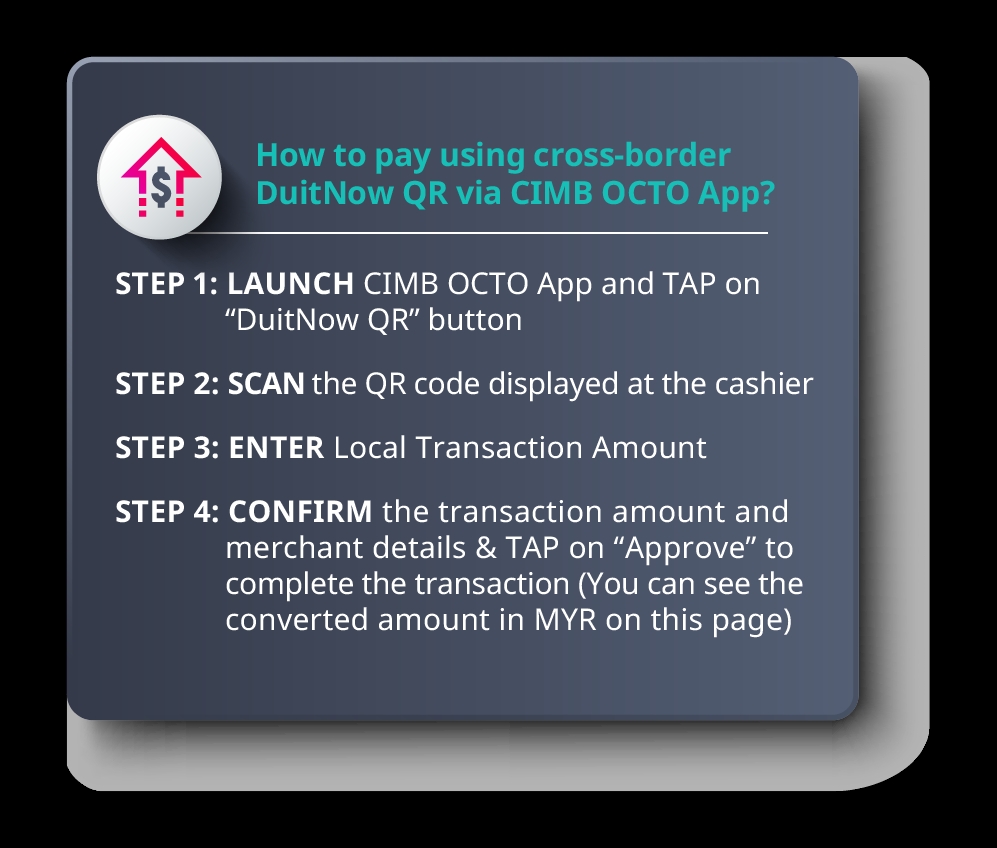

Seamless cross-border payments

Carrying heaps of cash to make payments when travelling overseas is a thing of the past with CIMB OCTO’s cross-border payment services. With DuitNow QR, you can make payments in Singapore, Thailand, Indonesia and China by looking for NETS, PromptPay, QRIS, and Alipay supported QR codes, respectively.

The transaction amount will be converted to MYR in real time based on CIMB’s competitive exchange rates and deducted from your linked account. This makes payments overseas as seamless as making payments with DuitNow QR in Malaysia.

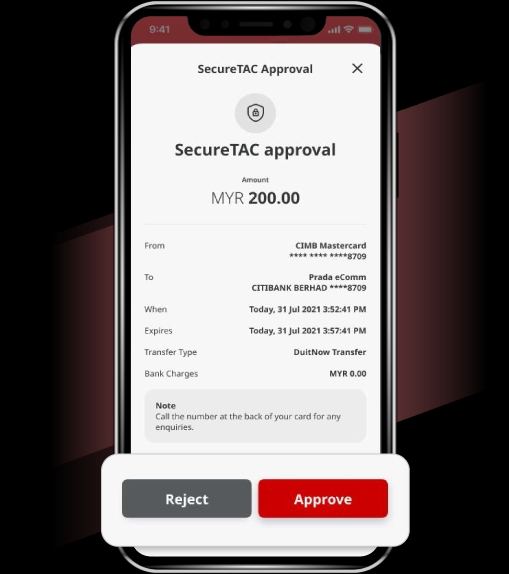

SecureTAC for online credit card transactions

When it comes to financials, banking and security go hand-in-hand. Due to the vulnerability of SMS TAC verification, CIMB has switched to a more secure app verification – SecureTAC – which provides tighter security and encryption. While SecureTAC is available on the CIMB Clicks app, SecureTAC via CIMB OCTO allows you to approve online credit card transactions!

CIMB’s SecureTAC verification can only be registered to one device at a time for added security. So whenever you make an online transaction, you’ll receive a notification from CIMB OCTO on the registered device for approval.

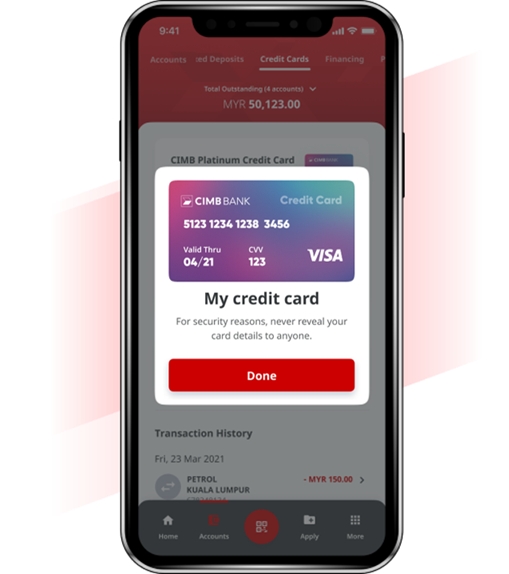

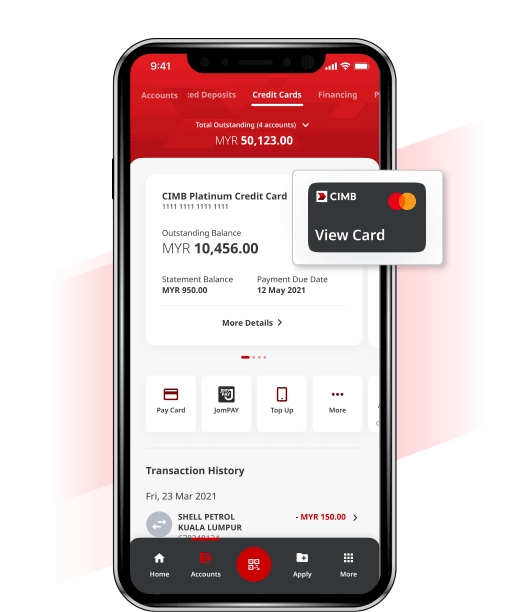

View your card details

Have you ever been in a situation where you’re at the checkout page and you need your card details, but your wallet is in another room? With CIMB OCTO, you can easily reference your card details on the app.

Under the Credit Cards tab, just tap on “View Card” and you’ll be able to see the card number, expiry date, and CVV.

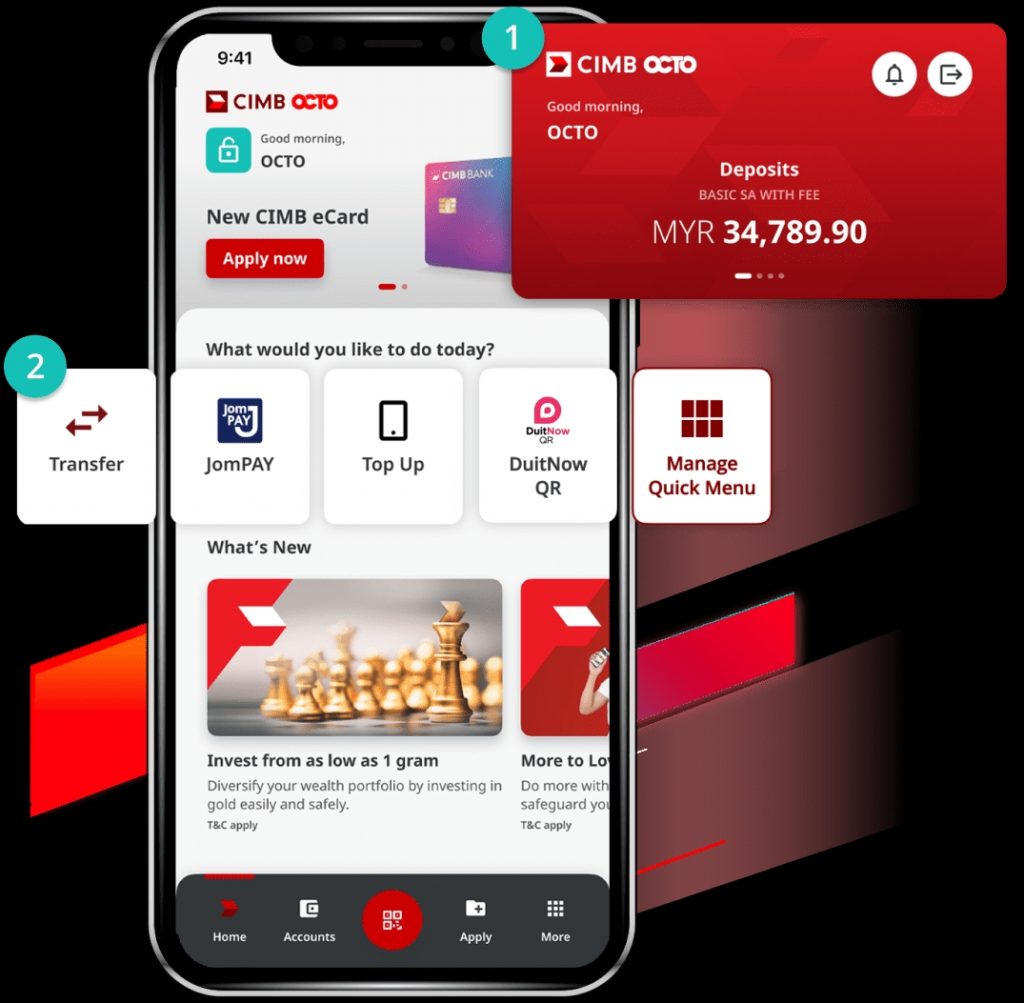

Personalise the home screen to your banking needs

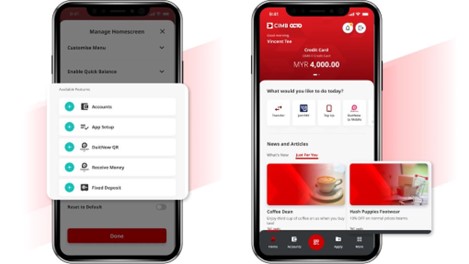

Every individual has their own banking preferences. Therefore, CIMB OCTO lets you personalise the app home screen to suit your needs. You can choose which account balance you want to view on the home screen and customise the account name for easier reference.

To access CIMB’s services faster, the app has a Quick Menu bar which you can tailor to your needs. So if you use QR payments frequently, you can place DuitNow QR in the first position.

Last but not least, you can switch up the home screen layout by choosing and arranging Transaction History, What’s New, and Just For You. For users who enjoy the exclusive offers from CIMB for dining, shopping, travel, and more, you can move the Just For You tile to the top, making it the first thing you see when you launch CIMB OCTO.

Start your new banking experience with CIMB OCTO

CIMB OCTO is the go-to app today and users are highly encouraged to discover the various new features the app has to offer.

The CIMB Clicks app is no longer available for download, but existing users will still be able to access the CIMB Clicks App on their mobile devices until it is fully phased out in the first quarter of 2025, giving users sufficient time to migrate to CIMB OCTO.

When switching to CIMB OCTO for the first time or logging in from a new device, there will be a 12-hour cooling-off period as a precautionary measure to safeguard your account security and prevent unauthorised access.

Start your new banking experience with CIMB OCTO by downloading it from the Apple App Store, Google Play Store and HUAWEI AppGallery. Alternatively, you can find more information on CIMB OCTO on CIMB’s website.