Boost Bank, Malaysia’s third digital bank, is the most complicated of the lot. While its “embedded banking” proposition was supposed to provide a seamless digital banking experience, we discovered that its integration with Boost eWallet was broken. Once the accounts are linked, Boost eWallet users could view a combined balance (eWallet + Bank balance), however, they can’t top-up or spend using funds saved in the Boost Bank account.

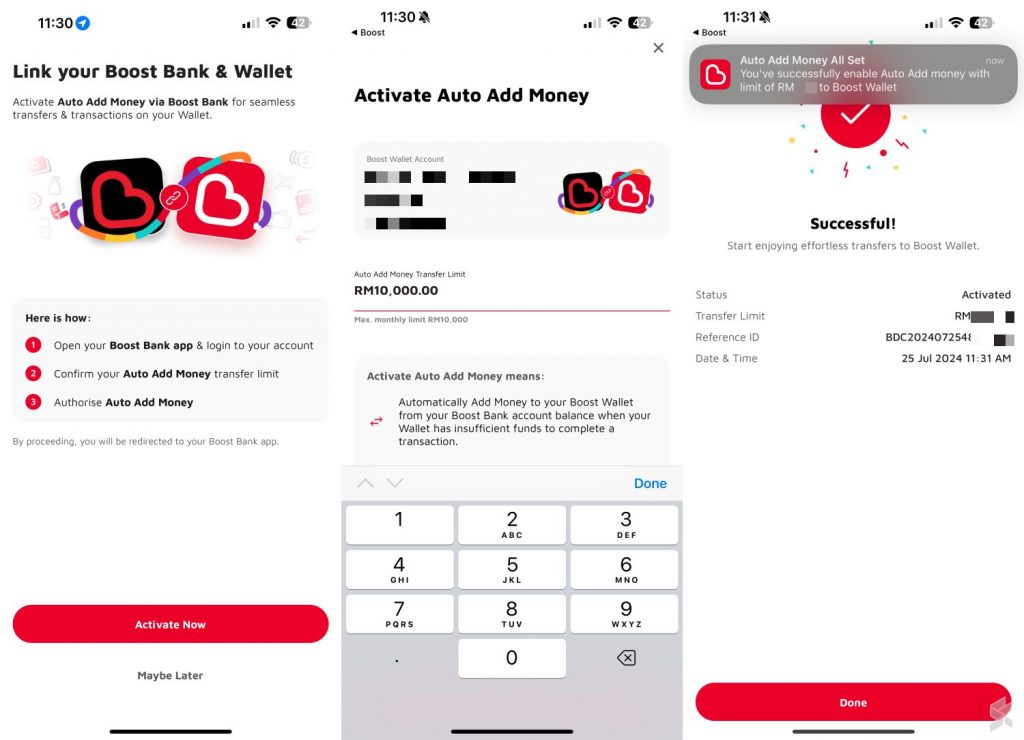

Nearly two months after its launch, Boost Bank has finally introduced a band-aid solution by allowing Boost eWallet users to “Auto Add Money” from their Boost Bank account. It is similar to the auto-reload function in Boost eWallet but this specific Boost eWallet to Boost Bank feature can only be activated via Boost Bank.

How to enable Auto Add Money from Boost Bank to Boost eWallet

Here are the steps to activate the Auto Add Money feature which will automatically transfer funds from Boost Bank to Boost eWallet:

- Launch Boost eWallet app, then tap on “Bank” on the home screen. A PIN is required to proceed.

- Once you’re transferred to the Bank screen, tap on the gear icon (Settings) in the top right corner of the screen

- Tap on “Link to Boost Wallet”

- Toggle “Auto Add Money” which allows the wallet to auto-reload from your bank account

- You can set the monthly maximum transfer limit.

- Approve the Auto Add Money feature, and you’re done.

How does Auto Add Money from Boost Bank to Boost eWallet work?

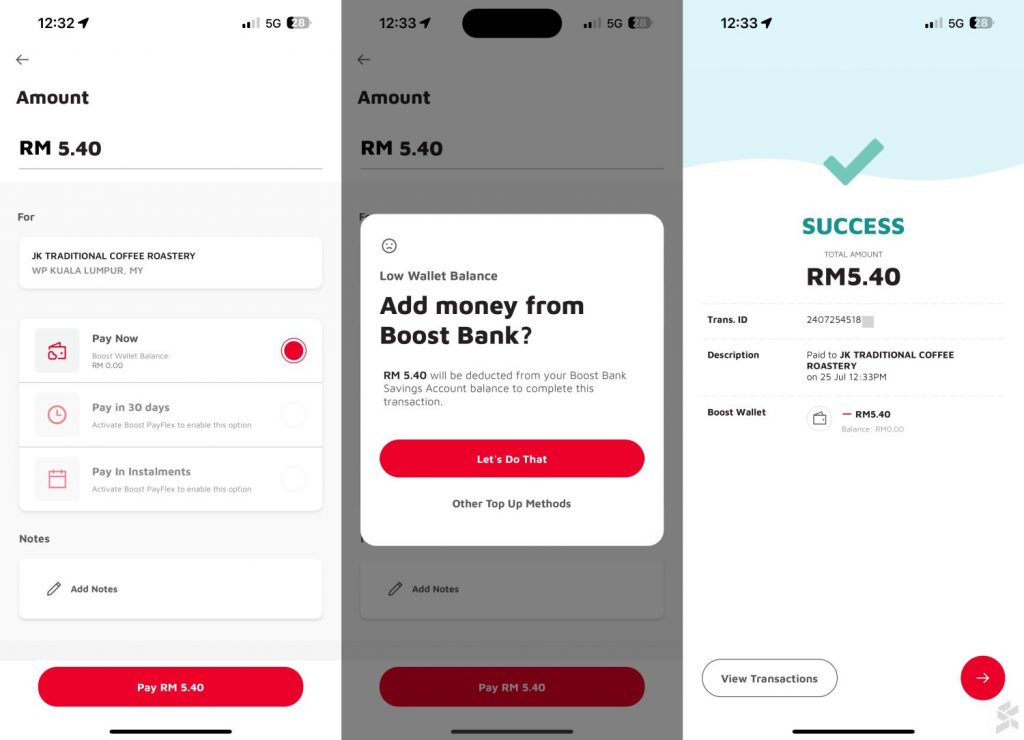

Once enabled, your Boost eWallet will automatically take funds from your Boost Bank if you have an insufficient balance. For example, if you’re making a transaction valued at RM10 but your eWallet balance is RM4, the feature will automatically pop up a message that RM6 will be deducted from your Boost Bank account. You can choose to proceed or top up your eWallet from other payment methods.

Similarly, if your Boost eWallet account has zero balance, it will ask whether you would like to deduct the full transaction amount from your Boost Bank account.

Basically, the auto-add money function is quite similar to Touch ‘n Go eWallet’s Quick Cash Out feature if you’ve enabled Go+ investment.

Previously, Boost eWallet users could reload their eWallet from practically any major bank in Malaysia except for Boost Bank which kinda of defeats the purpose of its embedded banking proposition.

Boost Bank to introduce Debit Card soon

Boost Bank was supposed to launch its Debit card this month which will enable its bank account users to spend at Visa merchants worldwide and make cash withdrawals at the ATM. With about a week remaining, there are still no signs of the debit card release.

As part of its introductory promo, Boost Bank currently offers a 4% p.a. daily interest rate for its Savings Jar if you spend a minimum of RM50 each month at a merchant partner with Boost eWallet. On top of that, you’ll need to deposit and maintain a minimum of RM2,000 in your Boost Bank account to be eligible for the promo. The 4% p.a. daily interest rate promo is set to end on 30th September 2024 but Mydin remains the only participating merchant. Other partners such as CelcomDigi, Servay, Bataras, CKS, Farley, and Boulevard are still listed as Coming Soon.