This post is brought to you by Hong Leong Bank.

These days, consumers are spoilt for choice with digital banking apps available on the market. People sign up for different banking apps to enjoy different benefits. Certain banks provide rewarding bonuses, while some give numerous cashback as you spend. However, managing multiple apps can be a hassle.

Hong Leong Bank has a solution for you, and it’s the HLB Connect app – a platform that provides all those benefits mentioned above and more in just one app, and can tailor features to its customers’ different needs.

Are you a person who loves adventures and lives life to the fullest?

Do you like adventures and to live life to the fullest? Then HLB Wallet’s Multi-Currency Feature (Pay&Save Account/-i) is made for you. When travelling abroad, it enables you to exchange to the foreign currency you want, anytime, anywhere with competitive exchange rates. You can even buy foreign currencies when they are at a favourable rate before you travel!

Beyond that, you can get unlimited instant cashback whenever you transact with HLB Wallet.

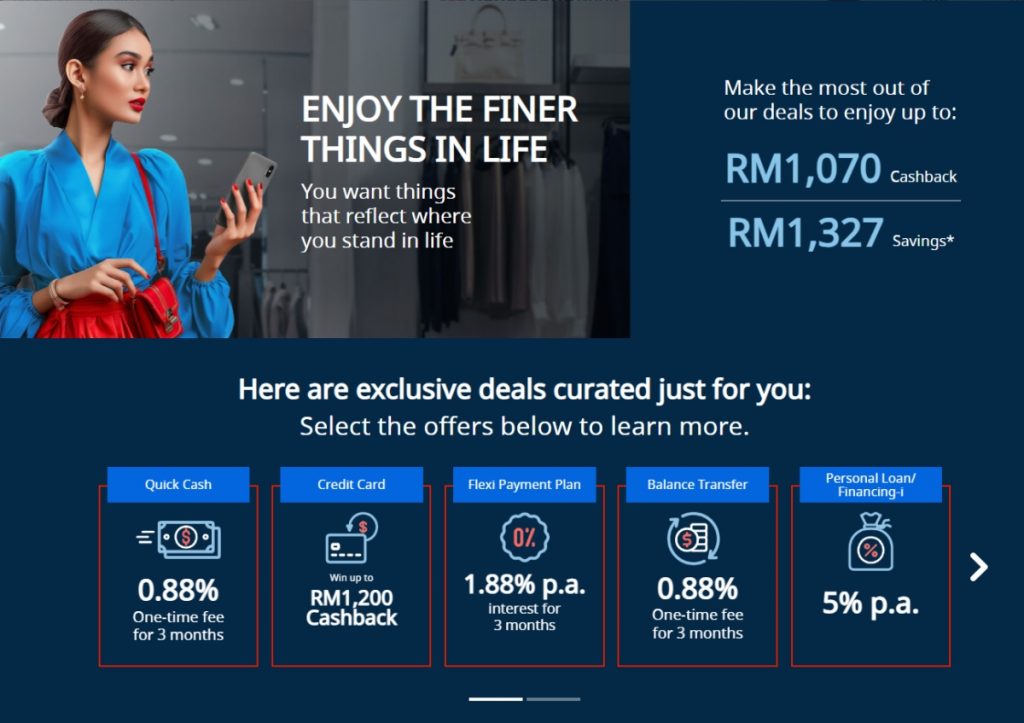

Are you a person who enjoys the finer things in life?

HLB Wealth’s online investment feature allows you to grow savings and diversify your investments. Interested in getting a guaranteed cashback of RM188 and standing a chance of winning an iPhone 15 Pro? Just spend with HLB’s credit card. Investing in unit trust via HLB Wealth will also offer you a chance to bring Sony wireless headphones home!

Are you the family man or woman who puts your family first?

Pocket Connect can help parents like you to kickstart good financial habits in your kids. Made for kids below 12 years old, the HLB Pocket Connect app is Malaysia’s first Pocket Money App designed to help your child learn how to earn, spend, and save responsibly in a fun and interactive way.

With the app, you can send pocket money to your kids. You can even let your kids help out with some housework to earn some extra pocket money. Aside from that, to prevent your children from overspending, you can not only set spending limits, but also monitor your children’s expenses to decide where they can spend, and even block or freeze a card when needed.

To access the HLB Pocket Connect app, parents simply need to open a 3-in-1 Junior Account for their children.

Are you planning for a secure retirement you deserve?

Looking to retire soon? HLB’s eFixed Deposits allow you to secure your financial growth.

HLB Connect gives you the flexibility to make early partial withdrawals from your eFD and still earn eFD interest on remaining balances.

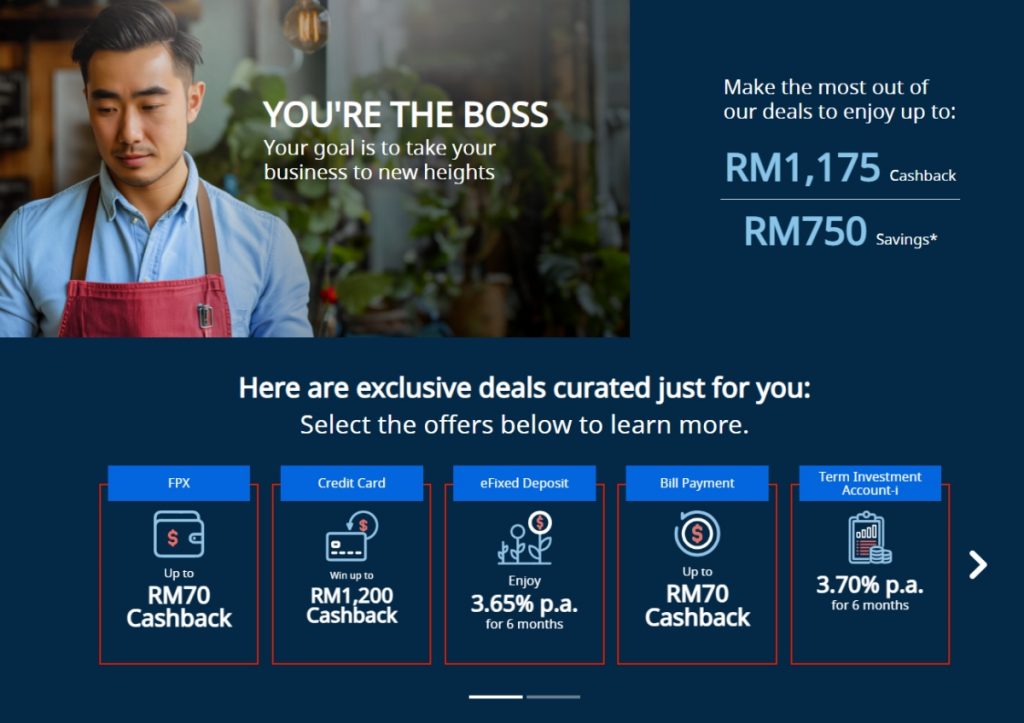

Are you a boss who’s looking to simplify your business banking experience?

Are you looking for a fuss-free banking experience for your business that isn’t complicated? HLB Connect also provides support for your sole proprietorship business.

To make your banking experience simpler, HLB Connect for Sole Proprietor comes with the Admin Clerk feature which enables you to delegate day-to-day tasks to your assistant or employee.

They can then access your HLB Business Account to:

- Perform fund transfers and bill payments

- Save favourite beneficiaries or payees for future transactions

As the business owner, you will have full control of your Admin Clerk’s access and transaction settings, such as:

- Set permitted transaction types

- Set daily transaction limits

- Enable, disable, or change an Admin Clerk’s access

Other benefits and conveniences of using HLB Connect Sole Proprietor for your business include:

- Pay suppliers locally easily via online Fund Transfer

- Pay overseas suppliers from over 200 countries with competitive foreign exchange rates from as low as RM 10

- Pay business utilities i.e. water, WiFi, and electricity via online bill payments

- Withdraw cash from any HLB ATM without a debit card by using the HLB Connect app

- View and download up to 2 years of e-Statements

- Single access for both your Business & Personal Account

Are you a teenager looking for a smart and futuristic digital finance platform?

So, you’ve officially “graduated” from your childhood and are now officially a teenager who can finally start to learn how to manage your money responsibly. You can apply for HLB Wallet to go cashless and get instant cashback worth up to RM 10 each month when you transfer funds, pay with QR, pay bills, or reload. Yes, that’s spending with no cash, and you can even get some of your money back too!

HLB Wallet also comes with a Visa Debit Card, allowing you to simply “tap and go” to make a payment. To activate an HLB account, you can visit HLB’s nearest branch.

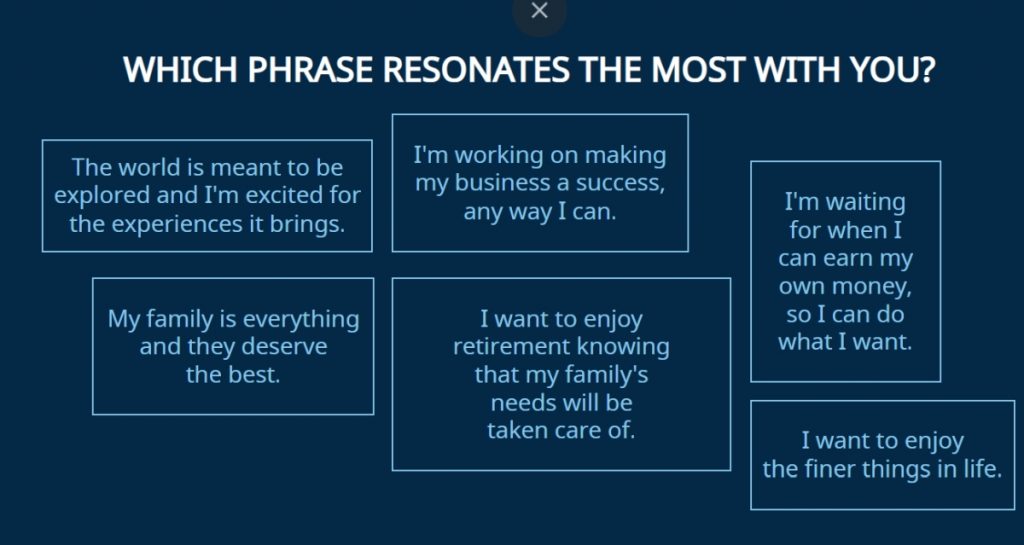

No matter who you are, there’s a deal for you!

Just in case you still can’t decide which feature(s) you need, don’t worry. Just head on to HLB and answer a simple quiz to discover the right product for you. You will then be presented with personalised promotions that fit your needs.

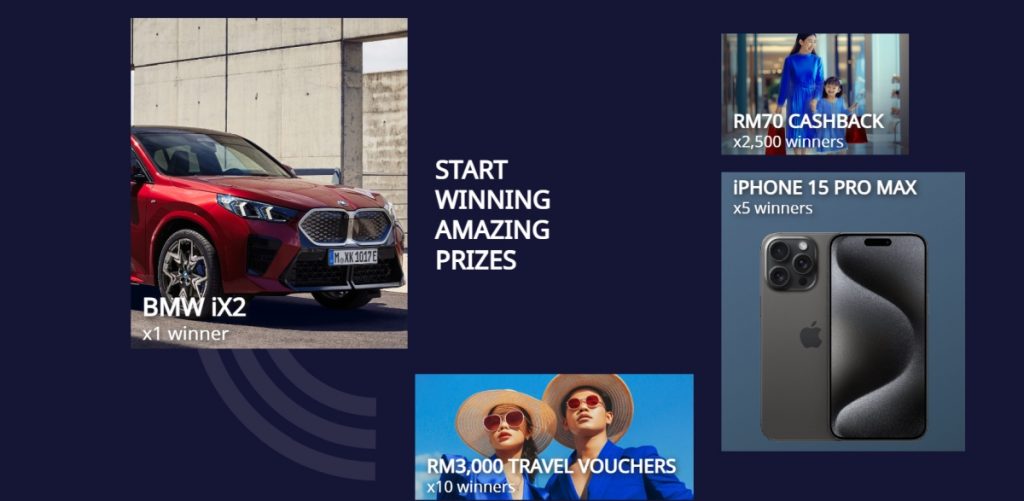

Win amazing prices, from now till 7th September!

You can stand a chance to win amazing prices, including a BMW iX2 and an iPhone 15 Pro Max by just performing eligible transactions to earn transaction points, from now (8th July) till 7th September 2024.

For more info on HLB’s Digital Bank+ deals, do head on to Hong Leong Bank’s official website, or check out Hong Leong Bank Malaysia’s official Facebook page.