After months of waiting, Boost Bank has finally introduced its Debit Card, allowing its digital bank customers to spend and withdraw cash worldwide where Mastercard is accepted. Existing Boost Bank customers can apply for the Debit Card today and get the virtual Mastercard immediately.

Boost Bank Debit Card now available for free

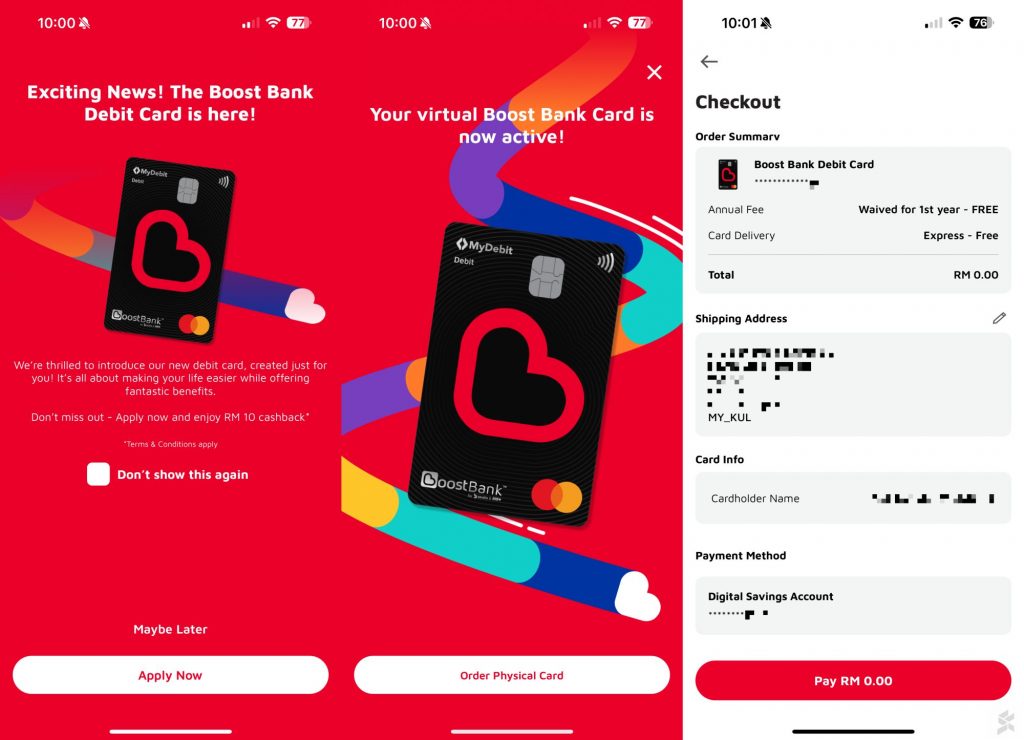

To apply for the Boost Bank Debit Card, you’ll need to update your Boost Bank app to the latest version from the Apple App Store and Google Play Store. When you launch the updated app, you’ll be greeted with a pop-up announcing that the Debit Card is here and you can apply with just a couple of taps and customise the name that will be printed on the back of the card.

According to the digital bank, they are offering RM10 cashback but there are still no details about their Debit Card cashback campaign on their official channels.

At the moment, the debit card is offered for free as Boost Bank is waiving the annual fee and card delivery fees. Boost Bank had previously teased the Black and Red cards but it appears that users will only be issued the Black card for now.

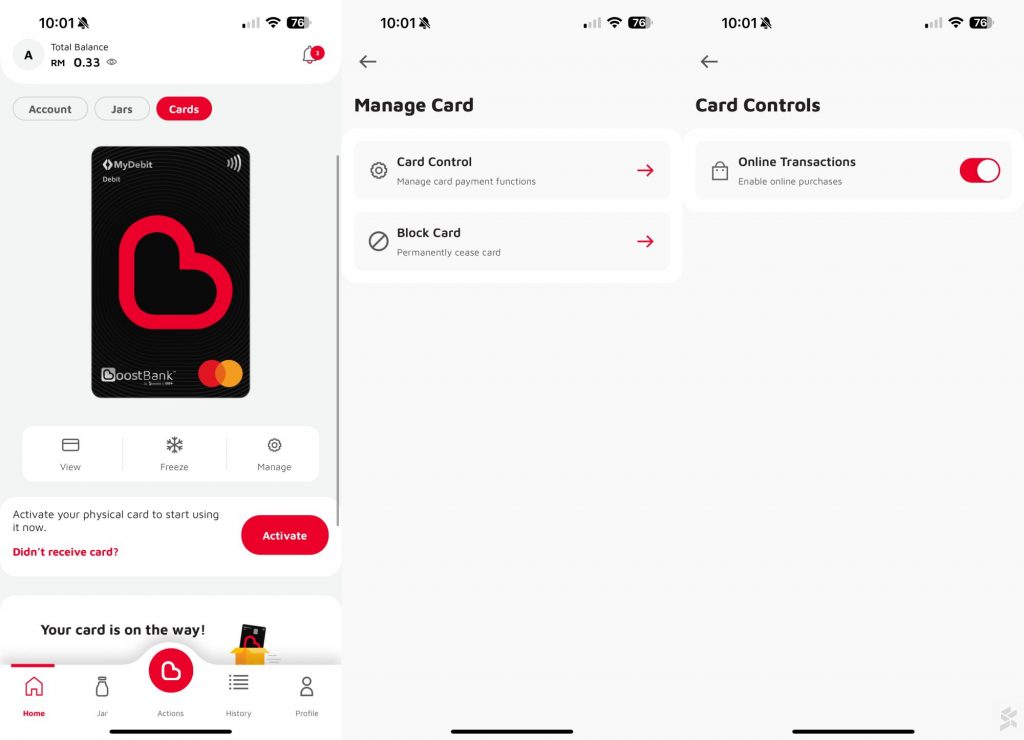

While waiting for the physical card to arrive, you can start spending for online and in-app transactions using the virtual debit card number. From the Boost Bank App, you can tap on the “Cards” tab and view the card details such as the 16-digit number, CVV and Expiry Date. The app also allows you to manage the card settings including enabling/disabling online transactions and to freeze/block the card.

Boost Bank Debit Card Fees and Charges

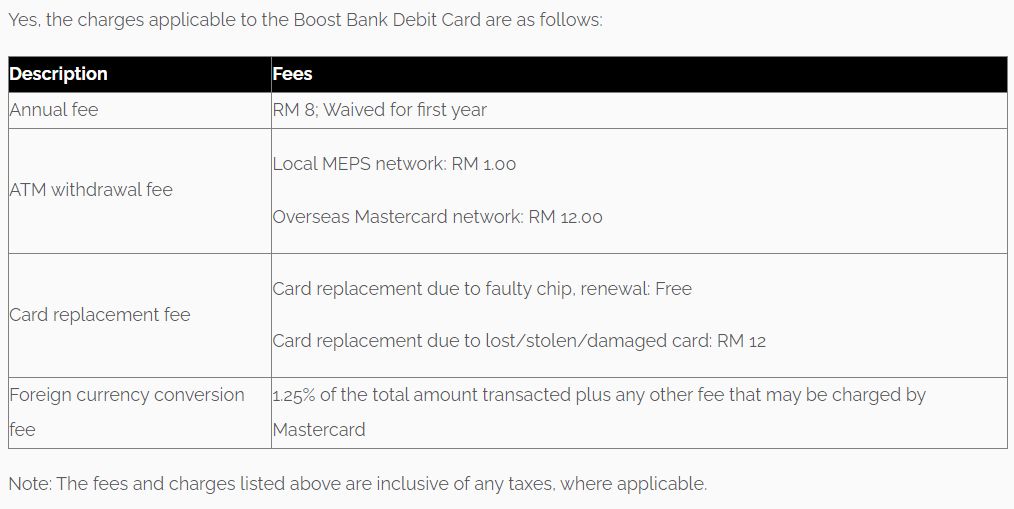

According to Boost Bank’s FAQ, there’s an annual fee of RM8, which is currently waived for the first year. If you lose your card, a replacement costs RM12.

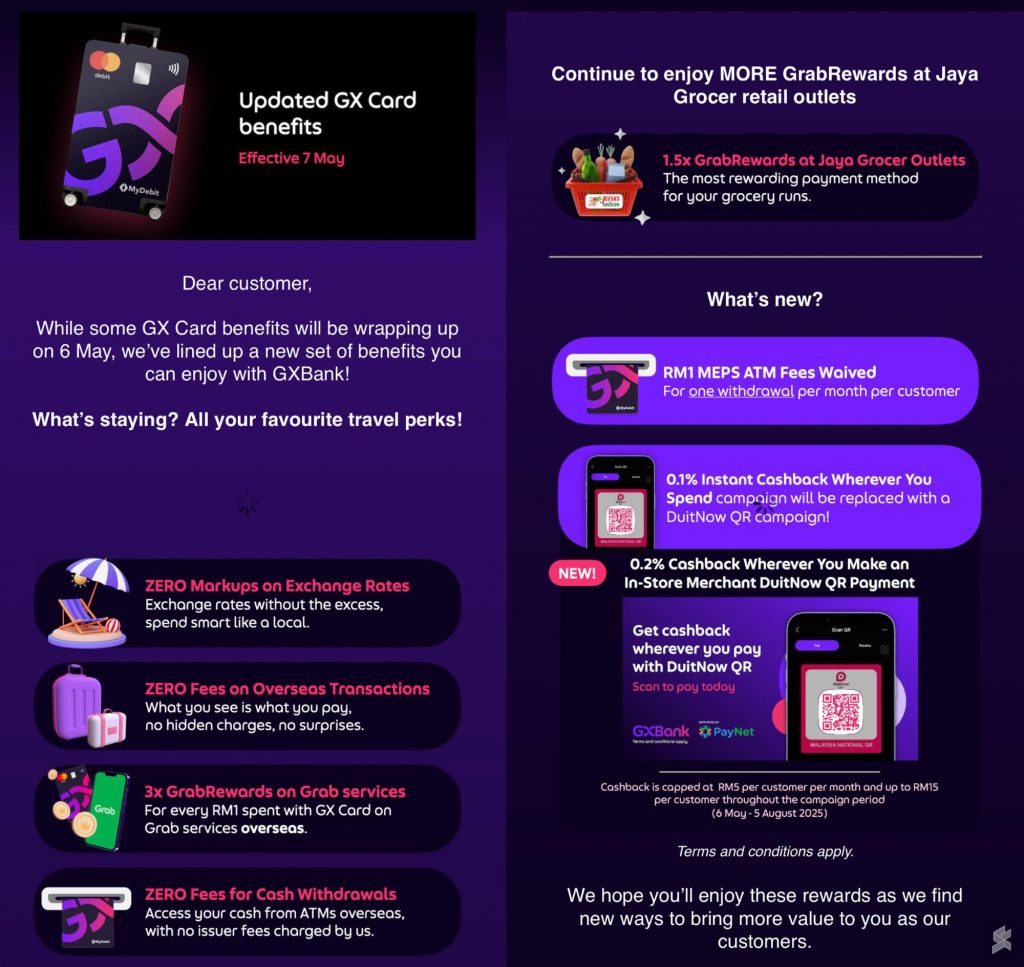

The Debit Card can be used to withdraw cash from your Boost Bank account, the digital bank is charging a RM1 fee if you use a local MEPS ATM or RM12 for overseas ATMs on the Mastercard network.

When it comes to foreign currency transactions, Boost Bank is charging a 1.25% fee on the total amount transaction and there are other fees that may be imposed by Mastercard. From the looks of it, Boost Bank may not be ideal for overseas usage as the ATM withdrawal fees and FX markup fees are higher than other digital banks and eWallet providers.

In case you missed it, Boost Bank has revised its Savings Account offering and they have gotten rid of the complicated tiers which required customers to maintain RM2,000 in their bank account to unlock higher interest rates. Boost Bank now offers 2.5% p.a. daily interest for its Savings Account and a higher 3.6% p.a. to 4.0% p.a. if you keep your money in their Savings and Special Jars.

For DuitNow QR payments, Boost Bank users are still required to use their Boost eWallet app. For a seamless experience, they have recently introduced an auto-add money feature which will automatically reload money from your Boost Bank account when your eWallet balance is insufficient.

We’ve reached out to Boost Bank to find out more about its current Debit Card campaign and cashback promo.