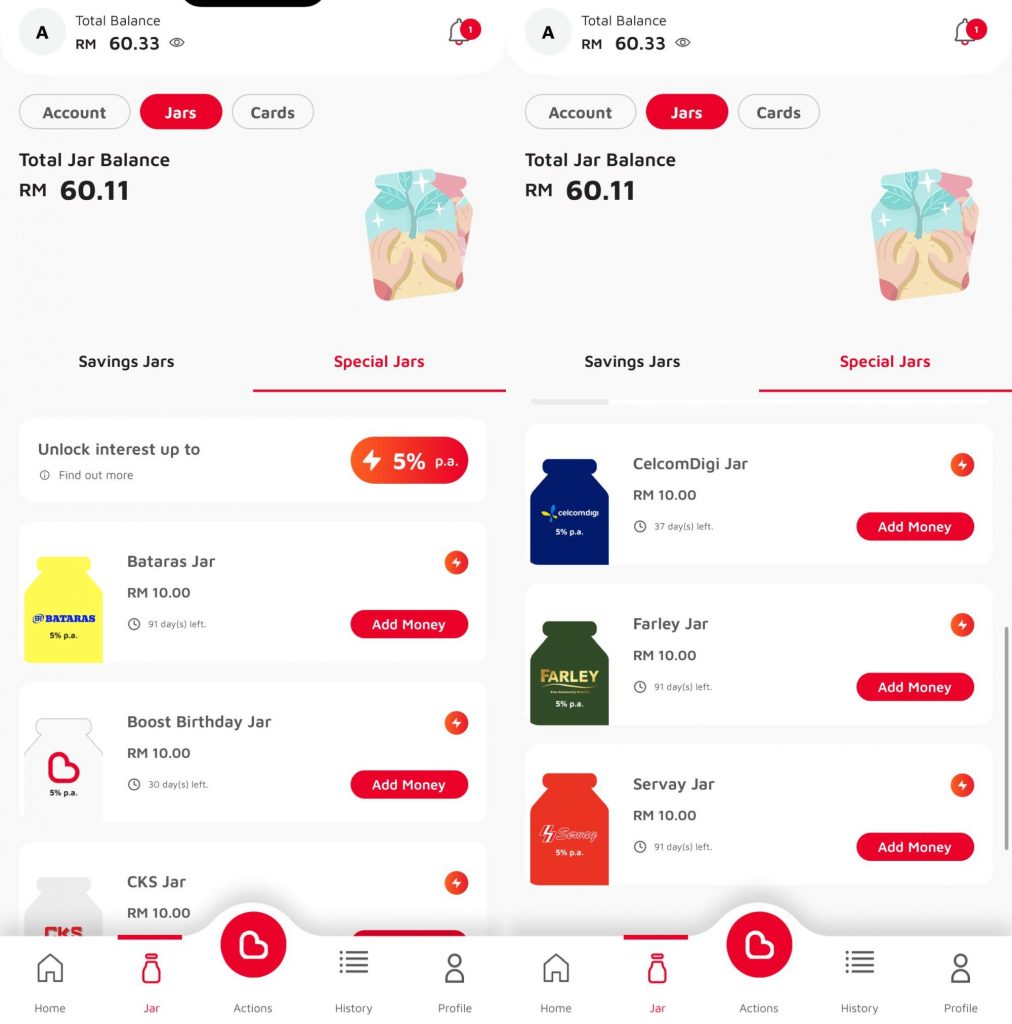

In conjunction with Boost eWallet’s 7th birthday, Boost Bank is now offering a 5% p.a. interest rate for special Savings Jars. On top of that, the digital bank by Axiata and RHB is offering RM10 cashback if you apply for their new Mastercard Debit Card.

Through its partnership with major supermarket and hypermarket chains in East Malaysia, Boost Bank is also offering customers RM5 cashback when they shop at Servay, Bataras, CKS and Farley.

Starting today, Boost Bank customers will be given a total of 6 Special Jars that offer a 5% p.a. interest rate. The Boost Birthday Jar offers 5% p.a. until 31st October while the CelcomDigi Jar offers 5% p.a. until 7th November 2024. Meanwhile, the four supermarket/hypermarket Jars – Bataras, CKS, Farley and Servay, offer 5% p.a. until 31st December 2024.

Take note that the partner jars (CelcomDigi, Bataras, CKS, Farley and Servay) will require minimum spending to maintain the 5% p.a. interest rate promo in the following month. If you fail to meet the criteria, the special jar will be closed and the balance will be transferred back to your Savings Account which currently offers a 2.5% p.a. daily interest rate.

According to Boost Bank’s FAQ, users can deposit a minimum of RM1 up to a maximum of RM1,000,000 per Savings Jar.

To activate the RM5 cashback with East Malaysian retailers, users can redeem with the following codes:

- BOOSTSERVAY for Servay Hypermarket SDN. BHD.,

- BOOSTBATARAS for Bataras SDN. BHD

- BOOSTCKS for CKS RETAIL SDN. BHD

- BOOSTFARLEY for FARLEY (KCH) SDN. BHD.

As part of Boost Bank’s debit card rollout, they are offering RM10 cashback and enjoy annual fees for the first year if you place an order for the physical card from now until 31st December 2024. The card can be ordered from the Boost Bank app under the “Cards” tab and users will be given a virtual card number which can be used for online and in-app spending.

The Boost Bank Debit Card is offered only in Black and it has an annual fee of RM8 which is currently waived. For ATM withdrawals, users will be charged a RM1 fee for MEPS ATMs and RM12 fee for Mastercard ATMs overseas. Meanwhile, foreign currency transactions will be charged a 1.25% fee and other fees imposed by Mastercard.

Commenting on the campaign launch, Boost Bank CEO Fozia Amanulla said, “We are excited to announce a new wave of strategic partnership promotions for our digital bank, aimed at delivering meaningful benefits tailored specifically to the people of Sabah and Sarawak. By collaborating with renowned supermarkets across East Malaysia, we’re bringing our digital banking solutions closer to where our customers need them most.”

She added, “Staying true to our mission of empowering the underserved, we are proud to offer an exclusive 5% p.a. daily interest rate and RM5 cashback on groceries that not only support the everyday lives of Malaysians but also encourage smarter shopping and greater savings for the rakyat. With the strong backing of PayNet’s national payments network and cutting-edge financial infrastructure—including DuitNow QR and DuitNow Online Banking—users can enjoy a seamless, secure, and convenient digital banking experience.”

For more info, you can visit Boost Bank’s official website.