Malaysia is expected to announce the winner of the second 5G network bid soon which is seen as a move to dismantle elements of monopoly on 5G infrastructure. The Malaysian Communications and Multimedia Commission (MCMC) started accepting bids for the second 5G network in July 2024 and four major telcos have submitted their applications.

The question is, who will be given the mandate to build the nation’s second 5G network?

Why is a second 5G network needed?

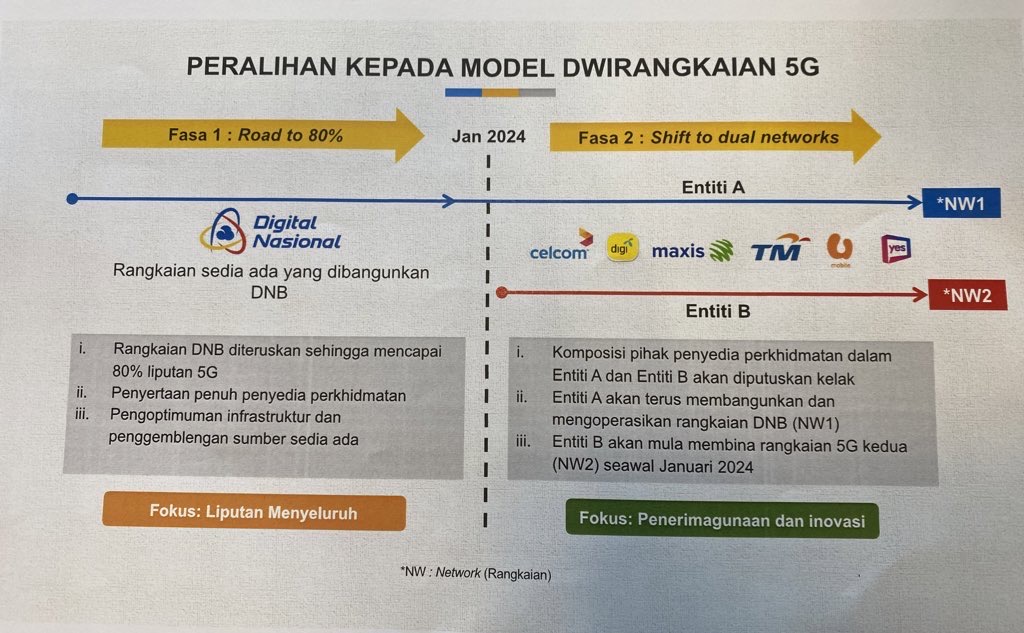

The Malaysian government announced in May 2023 the transition from a Single Wholesale Network (SWN) to a Dual 5G Network model. The decision was made to ensure competition for 5G network deployment and establish redundancy for 5G infrastructure.

As revealed by Communications Minister Fahmi Fadzil, Digital Nasional Berhad’s (DNB) network rollout reached 80.2% 5G population coverage on 31st December 2023, surpassing its accelerated target of 80% 5G population coverage by the end of last year.

While DNB’s accomplishment to hit 80% 5G population coverage within 2 years is among the fastest in the world, the expansion of 5G coverage in Malaysia seems to have slowed down significantly this year. As shared by Fahmi recently, Malaysia’s 5G coverage currently stands at 81.9% which is less than a 2% increase over 9 months.

Another crucial issue is the lack of indoor 5G coverage, especially in dense urban areas.

A strong and sustainable dual network model

Several conditions were needed to be fulfilled before the second 5G network is allowed. Besides having 80% 5G population coverage deployed by DNB, the transition to Dual Networks also requires the full participation of telcos in DNB. In December 2023, five telcos (CelcomDigi, Maxis, U Mobile, TM and YTL) signed the Share Subscription Agreement to acquire a stake in DNB, and in April 2024, directors representing each telco were appointed to conclude the due diligence process.

At the moment, four telcos – CelcomDigi, Maxis, U Mobile and YTL cumulatively own 65% of DNB, while TM’s SSA with DNB was terminated as it failed to secure a time extension to obtain their shareholder’s approval.

For a dual 5G network model to work, Malaysia needs two strong entities to accelerate 5G development with healthy competition. Fahmi said the MCMC will act as a regulator to ensure no dominance by one particular entity or mobile network operator and a level playing field.

Some parties have alleged that a second network will kill off DNB. Digital Minister Gobind Singh, who is also the minister overseeing DNB, has refuted claims that DNB could end up as a ‘white elephant‘ under the dual 5G network model.

The reality is that Malaysia as a whole is still reliant on DNB as the sole 5G provider. As of today, all existing telcos including CelcomDigi, Maxis, U Mobile, YTL and TM, have existing 5G access agreements of up to 10 years to utilise DNB’s wholesale services.

Since it will take some time for the second 5G network to be established and achieve widespread coverage, DNB will continue to gain recurring revenue from existing access agreements with the telcos.

In terms of pricing to consumers, both ministers have assured that the MCMC will ensure that the price of 5G under the dual network model will be maintained.

From the looks of it, the MCMC must ensure that both 5G networks can function sustainably with strong financial backing and market share of subscribers.

Who is expected to win the second 5G network bid?

With TM possibly out of the 5G race due to the incompletion of SSA with DNB, the three remaining candidates for the second 5G network are CelcomDigi, Maxis and U Mobile. At the moment, it isn’t clear if MCMC will appoint just one or two telcos as the winner.

The strongest candidates to take up the new 5G network job are CelcomDigi and Maxis, the two largest telcos in Malaysia. If one of them is appointed, they can leverage its existing network infrastructure which has been ready for 5G. Both telcos are equally capable of enabling indoor 5G coverage quickly which is one of the major concerns of consumers.

To ensure a fair and sustainable dual network model, it is possible that the MCMC would either pick CelcomDigi or a consortium of Maxis and U Mobile, to lead the new 5G network. A consortium approach isn’t new as we’ve seen Starhub-M1 having a joint venture to rollout 5G in Singapore to compete with Singtel.

According to CIMB Securities analysis’, it expects Maxis to be the winner for the second 5G network as CelcomDigi, a Government-Linked Company, is likely to be the preferred party to lead DNB which started as a 100% state-owned network. The report added that the second 5G network is expected to have better quality of service versus DNB as the rollout is mapped on their existing network grid which allows a more seamless handover between 2G/4G and 5G networks.

However, having just Maxis to build the second 5G network doesn’t seem to be a level playing field against the other 4 players in DNB.

CelcomDigi currently has 20.2 million subscribers (Q2 2024 report), about 44% market share, while Maxis has 12.7 million subscribers (Q2 2024 report) which is equivalent to about 28% market share. Meanwhile, U Mobile claims to have over 9 million subscribers in 2023, which is about 20% market share.

If Maxis and U Mobile move on to establish a new 5G network, this would leave CelcomDigi, TM and YTL to continue manage and expand DNB’s 5G network.

Similar to DNB, the second 5G network must also provide 5G access to other telcos at competitive wholesale pricing. This is where the regulator has to step in to ensure fair and sustainable wholesale pricing for both 5G networks. Most importantly, the MCMC must provide clear and measurable 5G rollout targets to DNB and the second 5G network.

It has been speculated that the MCMC could announce the winner of the second 5G network bid as early as this week.

![[Industry Direct] Opening a New Chapter in VR Gaming – ‘The ChicKing Dead’ Enters Early Access! [Industry Direct] Opening a New Chapter in VR Gaming – ‘The ChicKing Dead’ Enters Early Access!](https://roadtovrlive-5ea0.kxcdn.com/wp-content/uploads/2025/04/2_CKD_Screenshots_1-640x360.jpg)