If you often reload your Boost eWallet using your credit card, take note that all reloads will now incur a convenience fee. Since 15th March, Boost charged a 1% Convenience Fee on credit card reloads exceeding a monthly waived limit of RM1,000. However, the eWallet provider had quietly removed the monthly waived limit effective 14th October 2024 and they have also revised the convenience fee rate.

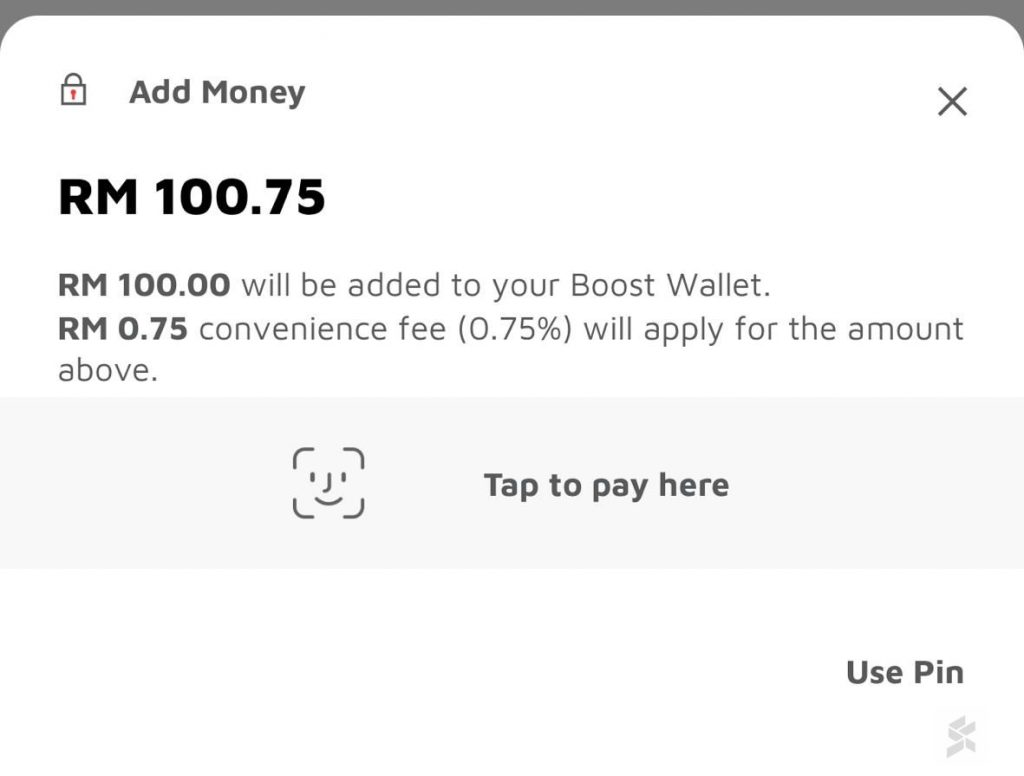

According to Boost, they are now imposing a convenience fee of 0.75% on all credit card reloads even for the minimum amount of RM20. This means if you reload RM100, you will be charged an additional RM0.75.

However, it is worth pointing out that the 0.75% fee by Boost is lower than its competitors such as Grab, TNG eWallet and BigPay which impose a 1% fee on credit card reload.

BigPay introduced the blanket 1% charge in August 2023, followed by TNG eWallet in February 2024. Grab introduced its 1% credit card reload fee which took effect in September 2024, however, the fee is exempted if you use their co-branded Maybank Grab Mastercard Credit Card.

The free credit card reloads offered by eWallets were seen as a cheaper way to cash out funds from their credit card while avoiding expensive cash advance fees. However, such transactions would incur a fee which the eWallet players have been absorbing from the start and is no longer sustainable in the long run.

If you wish to reload Boost and other eWallets without any fee, you can do so via debit card or with DuitNow transfer.

Thanks Wai Peng Heng for the tip!