When entering the world of investing, the first step is building a foundation for success. Avoiding costly mistakes requires a clear strategy, patience, and a focus on long-term growth. Whether you’re looking for steady income, growth opportunities, or diversification, this guide simplifies the essentials for getting started.

Key Points

- Define financial goals and align them with your investment choices.

- Diversify across asset classes, sectors, and regions to reduce risks.

- Use technology for precise and informed decisions.

- Focus on dividend-paying stocks for consistent income.

- Monitor economic indicators for smarter investment strategies.

- Avoid chasing high returns and stick to long-term goals.

Define Your Financial Goals Before You Start

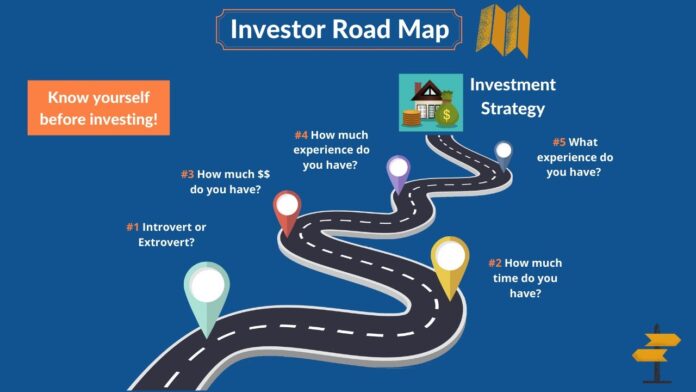

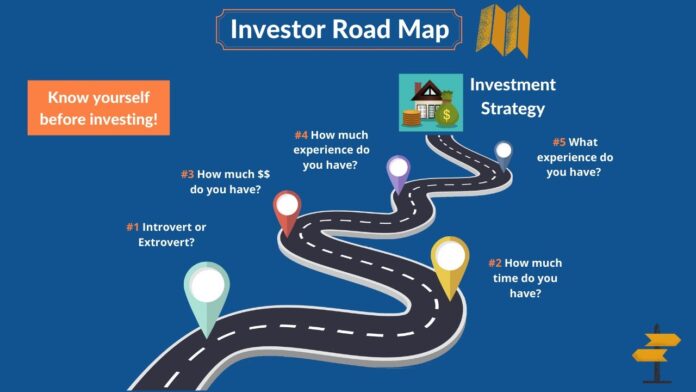

Every investor needs a clear roadmap. Without knowing where you’re heading, making meaningful progress becomes impossible. Defining your goals not only guides your choices but also ensures you’re not taking unnecessary risks. Start by identifying what you aim to achieve. Are you saving for retirement, funding education, or looking for an additional income stream?

Once you’ve pinpointed your objectives, consider your timeline. Short-term goals require liquid and low-risk investments, such as bonds or money market funds. Long-term goals, like retirement, allow for more aggressive strategies. Aligning investments with your timeline helps manage risks and optimizes returns.

Think about your risk tolerance. Some individuals are comfortable with the market’s volatility, while others prioritize preserving their capital. Knowing your comfort level will help determine the right mix of investments for your needs.

Diversify: Don’t Put All Your Eggs in One Basket

Diversification is your safety net against market swings. By spreading your investments, you reduce exposure to any single asset, sector, or region. This strategy minimizes the chances of significant losses while increasing the likelihood of stable returns.

Ways to Diversify

- Invest in multiple asset classes: Include stocks, bonds, and alternative investments like real estate or commodities.

- Sector diversification: Balance investments across industries such as technology, healthcare, utilities, and consumer goods.

- Regional diversification: Adding international stocks or funds can protect against domestic economic downturns.

Diversification also includes varying risk levels within your portfolio. High-risk growth stocks can be balanced with stable dividend-paying investments. This approach ensures you’re positioned for both growth and security.

Learn to Use Automated Trading Strategies for Precision

Manual monitoring of markets is time-consuming and prone to errors. Automated trading strategies streamline the process by using data to make decisions for you. Tools like MultiCharts’ Depth of Market (DOM) can analyze supply and demand, enabling accurate entry and exit points.

For instance, MultiCharts’ DOM shows ten price levels each way, making it easier to spot opportunities. It also estimates profit and loss automatically, saving you from manual calculations. Using automation allows you to make unbiased, data-driven decisions in real-time.

Automation doesn’t replace the need for research but complements your efforts by eliminating emotional reactions. Whether you’re trading frequently or managing long-term investments, tools like these provide a reliable foundation.

Build a Core of Income-Generating Investments

Income-generating stocks are a crucial part of any well-rounded portfolio. These include companies with a strong history of paying dividends, which provide regular income regardless of market conditions. Dividend-paying stocks are attractive for their stability and ability to generate cash flow.

When selecting these investments, prioritize sustainability. Look for a low payout ratio, as this indicates the company has enough profits to reinvest and maintain dividends. Also, consider dividend growth potential. Companies with a track record of increasing payouts demonstrate financial health and stability.

Evaluate Economic Indicators for Smarter Decisions

Economic trends directly affect market performance. Understanding factors like interest rates, inflation, and GDP growth helps you anticipate how different sectors will perform. For example, rising interest rates tend to hurt high-growth stocks but favor value-oriented investments.

Use inflation data to adjust your strategy. High inflation can erode returns, making dividend-paying stocks more appealing for their income. On the other hand, low inflation supports growth stocks, which benefit from stable borrowing costs.

Practical Steps to Build Your Portfolio

Starting with a clear plan makes the entire process manageable. Here’s a step-by-step guide for structuring your investments:

- Set aside dedicated funds: Never use money needed for short-term expenses.

- Choose a brokerage platform: Compare features, fees, and user interfaces before deciding.

- Start with broad-market ETFs: Exchange-traded funds provide instant diversification at low costs.

- Research individual stocks: Once you’re comfortable, focus on dividend-paying equities or growth stocks.

- Review performance regularly: Adjust your strategy annually to stay aligned with goals.

These steps ensure you build a resilient investment base while minimizing risks.

Avoid Common Mistakes

Every investor encounters obstacles. Avoiding common errors saves time and money while keeping you on track.

Key Mistakes

- Chasing high returns: Investments promising huge gains often come with higher risks.

- Ignoring costs: Brokerage fees, taxes, and fund expenses can eat into your profits.

- Overtrading: Frequent buying and selling leads to unnecessary costs and emotional decision-making.

The solution is to stay disciplined. Stick to your plan, and resist the temptation to follow market trends without thorough research.

Embrace Long-Term Thinking

Short-term market movements are unpredictable. Focusing on the long-term allows you to benefit from compounding, which grows your investment exponentially over time. For example, $10,000 invested in a stock with a 6% annual return will more than triple in 20 years.

Patience is your greatest ally in achieving financial security. Avoid panic during market dips and maintain your strategy. Long-term investing also reduces the impact of transaction costs and taxes.

Regularly Reassess Your Investments

Markets change constantly. Reviewing your holdings annually ensures they remain aligned with your goals. For instance, a shift in interest rates may require reducing exposure to certain sectors or increasing positions in others. Reassessment is especially crucial during major life events, like a new job or growing family expenses.

Rebalancing helps maintain the intended risk level. For example, if stocks outperform bonds in a given year, you might need to shift some funds back to bonds to restore balance. Regular adjustments improve your portfolio’s efficiency and effectiveness.

Conclusion

Investing requires a mix of knowledge, discipline, and patience. Start by setting clear goals and building a diversified foundation. Use automated tools to reduce errors and improve precision. Focus on long-term growth and reassess your holdings regularly to adapt to changing conditions. By taking calculated steps, you’ll create a portfolio that withstands volatility while delivering steady returns. Keep learning, stay consistent, and success will follow.