Following the award of the second 5G network implementation to U Mobile, the largest shareholder, ST Telemedia (Singapore Technologies Telemedia Pte Ltd) via its wholly-owned subsidiary Straits Mobile Investments, is selling off a major stake in the telco.

As announced by U Mobile last month, it will reduce its majority foreign shareholding to 20% to ensure greater Malaysian control and invite participation from local investors.

ST Telemedia sells partial stake in U Mobile to Mawar Setia

In a statement issued yesterday, ST Telemedia says they have entered into a conditional share purchase agreement whereby Mawar Setia Sdn Bhd, a private limited company based in Malaysia, will acquire a majority stake in U Mobile.

The statement didn’t reveal the value of the transaction and how much shares it is selling. It mentioned that once the sale is concluded, ST Telemedia will hold a minority stake of approximately 20% of U Mobile, and U Mobile will cease to be a subsidiary of ST Telemedia.

The statement added that the completion of the proposed transaction is subject to the satisfaction of certain conditions precedent including the receipt of regulatory approvals and it is expected to take place no later than the third quarter of 2025.

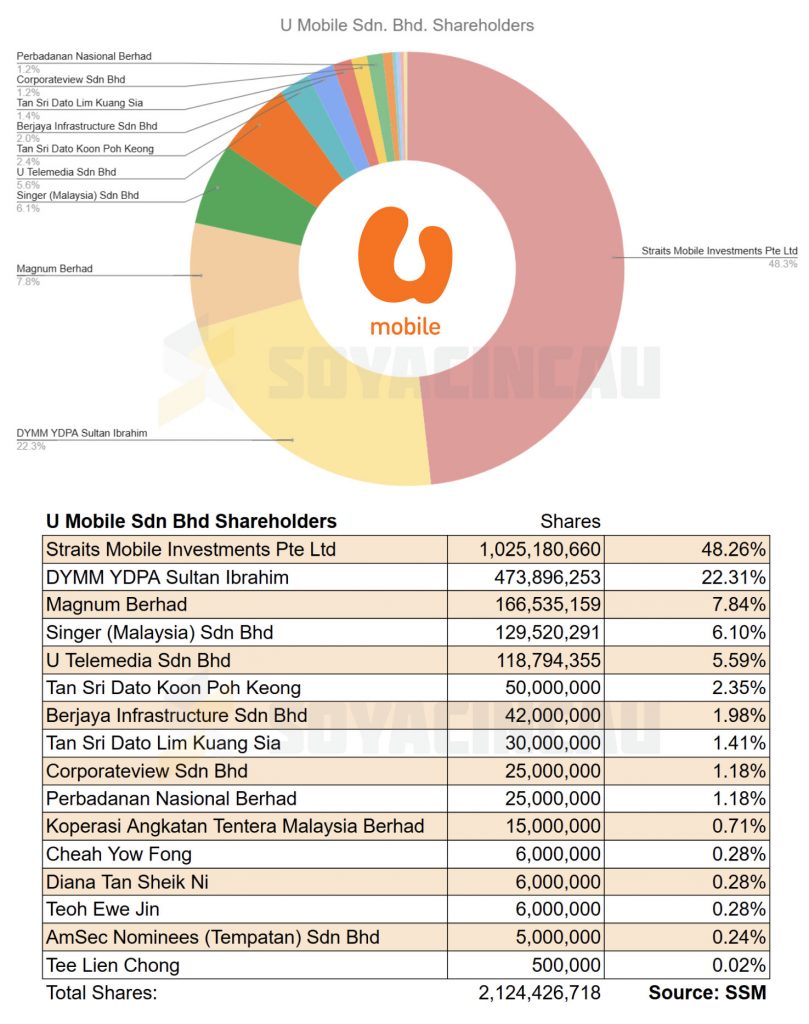

Based on SSM data obtained last month, Straits Mobile Investments Pte Ltd is U Mobile’s largest shareholder holding 48.26%, followed by DYMM YDPA Sultan Ibrahim at 22.31%, Magnum Berhad at 7.84% and Singer (Malaysia) Sdn Bhd at 6.1%.

Last month, Tan Sri Vincent Tan issued a statement highlighting that His Majesty Sultan Ibrahim of Johor has been an investor in U Mobile for almost a decade. According to U Mobile’s press release issued in 2015, Sultan Ibrahim acquired his initial 10% stake in U Mobile in 2014 and eventually increased his stake to 15% in December 2015.

Who owns Mawar Setia Sdn Bhd?

According to SSM, Mawar Setia Sdn Bhd was incorporated on 16th April 2024 with Tan Sri Vincent Tan owning 70% of the company. Meanwhile, Johor princess YAM Tunku Tun Aminah Sultan Ibrahim owns the remaining 30% share, which is effectively a 8.5% stake in U Mobile.

Once ST Telemedia’s Share Purchase Agreement to sell its majority stake to Mawar Setia is concluded, the Johor royal family is set to become the largest shareholder in the telco with a cumulative 30.8% stake.

When is the roll out of the second 5G network?

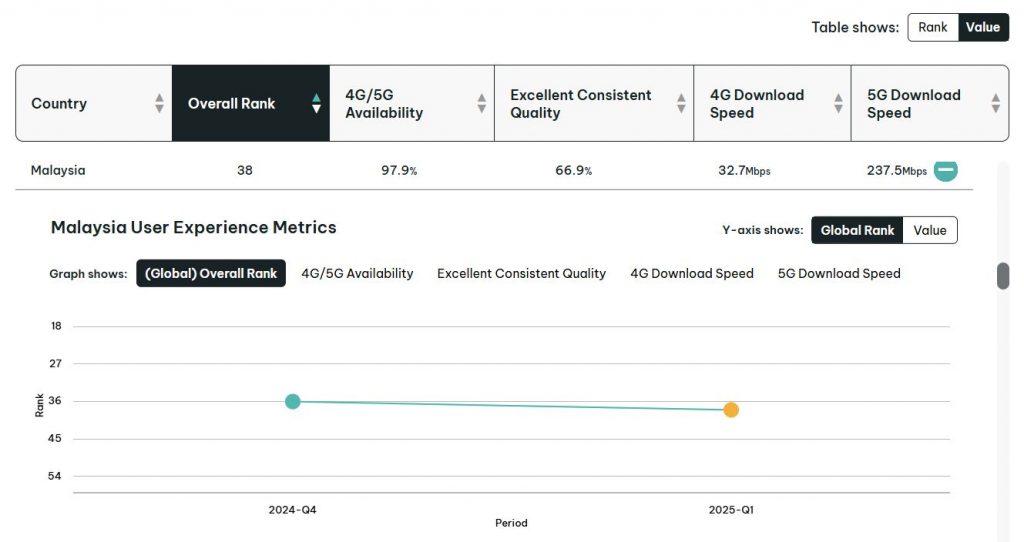

Following the announcement of the winner of the second 5G network tender, the Malaysian Communications and Multimedia Commission (MCMC) has yet to provide further details on new 5G network rollout including coverage targets and applicable conditions.

Among the top three mobile contenders for the second 5G network, U Mobile is the smallest telco in terms of subscribers, existing network sites and revenue. The decision had raised concerns and some have called upon MCMC to be transparent on the “scoring process” to pick the winner.

Interestingly, MCMC mentioned that U Mobile is allowed to collaborate with other telcos in the implementation of the new 5G network, subject to the regulator’s approval. The orange telco stated last month that it was eager to work with CelcomDigi, TM and Huawei to implement the second 5G network. In order for a dual network approach to work effectively, the MCMC has to ensure that both 5G networks are sustainable while enabling healthy competition to drive innovation.

Last week, Digital Minister Gobind Singh has debunked claims that Malaysia’s first 5G network implemented by Digital Nasional Berhad (DNB) was fully funded by the government. DNB’s estimated budget of RM16.5 billion covers a period of 10 years and so far they have spent RM5 billion for the development and implementation of the 5G network which currently achieved 82% 5G population coverage.

He clarified that DNB was mostly funded via private borrowings, while the government via the Ministry of Finance (MoF) had only injected RM950 million into DNB for initial equity injection and shareholder loan.

Gobind also added that the second 5G network will not be implemented until MoF gets their money back. He iterated that the government’s RM950 million funding and bank loans guaranteed by the government will be taken over and to be repaid back by the telcos as part of the process to transition from a Single Wholesale Network to Dual Network model.