Online scams, especially those related to online banking, are unfortunately but increasingly common nowadays, stirring fear among online bank users. To help tackle and reduce the number of online scams, Maybank has introduced a new feature in their MAE app called Money Lock, the first counterfraud security feature in Malaysia.

Prior to the launch of Money Lock in Malaysia, the same feature was first introduced by Maybank in Singapore back in mid-2024.

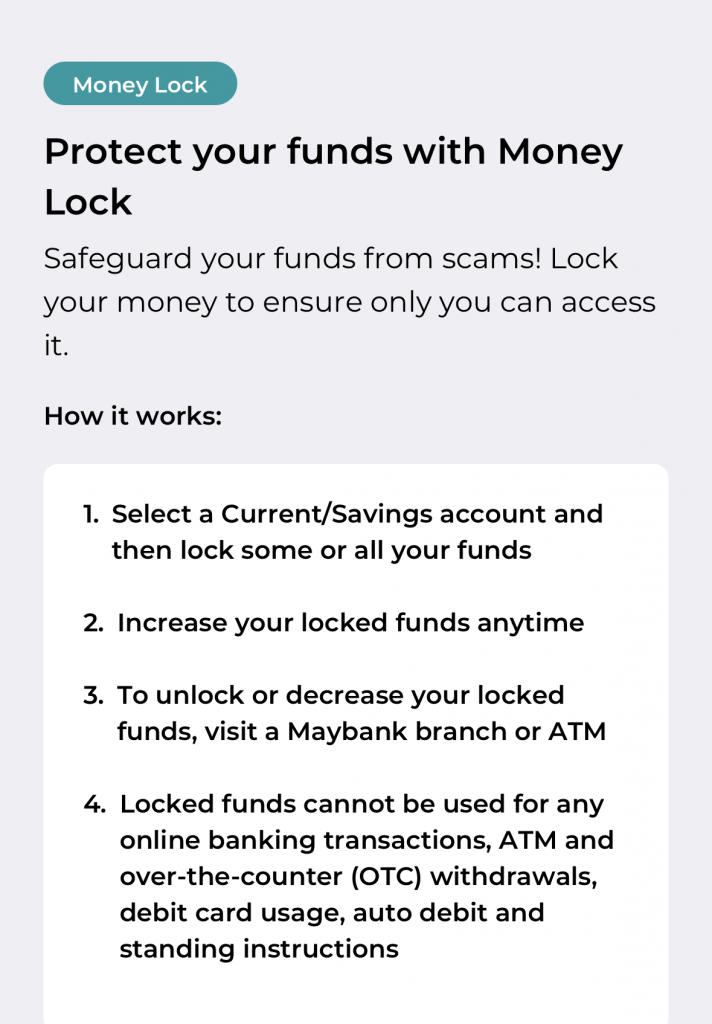

What is Money Lock and how does it work?

Money Lock essentially allows customers like you to lock funds in your savings or current accounts of your choice, keeping them from being digitally accessed, and thus safe from online scammers. You can choose to lock your preferred amount, from as little as RM10 to the total available balance in your Maybank accounts.

You can increase any locked amount directly from your MAE app, with no fee imposed and no limit on the number of times Money Lock can be activated. You will also continue to earn the same interest or profit rate on the locked funds, as part of your account balance.

But if you wish to unlock your funds or decrease the amount of locked funds, you can visit any Maybank ATM or branch nationwide for a quick verification process. Maybank says this step is taken to ensure that locked funds remain secure from unauthorised access. Upon successful verification, the funds will be instantly unlocked or decreased, depending on your request.

How does Money Lock protect my funds from being accessed by scammers?

For customers’ safety, locked funds are kept protected against any online banking and ATM activity. The locked funds cannot be used for transactions such as online transfers, ATM withdrawals, debit card usage, bill/credit card/loan payments, fixed deposit placement, standing instructions, and more, thus adding another layer of protection for customers.

To mitigate fraud risk and protect its customers, Maybank has implemented various measures to combat fraud, including:

- Replacing SMS OTP with Secure2u, effectively tampering SMS TAC fraud

- Restricting online banking access to one device per customer, which blocks scammers from accessing customers’ accounts on unauthorised devices

- Enforcing a cooling-off period for transfer and payment limit increase, and Secure2u activation for the first time or on a new device

- Allowing Secure2u activation to be performed via Maybank ATMs only, enabling customers to have heightened supervision over their own banking accounts

- Introducing Malware Shielding, a preventive security measure embedded within the MAE App with the capability to detect malware in customers’ devices

- Providing a 24/7 fraud and customer support hotline to assist those who suspect they have been scammed.

In order to ensure an uninterrupted banking experience while using Money Lock, Maybank urges you to perform careful financial planning, consider upcoming financial commitments, and ensure sufficient funds are available for essential transactions before enabling the feature.

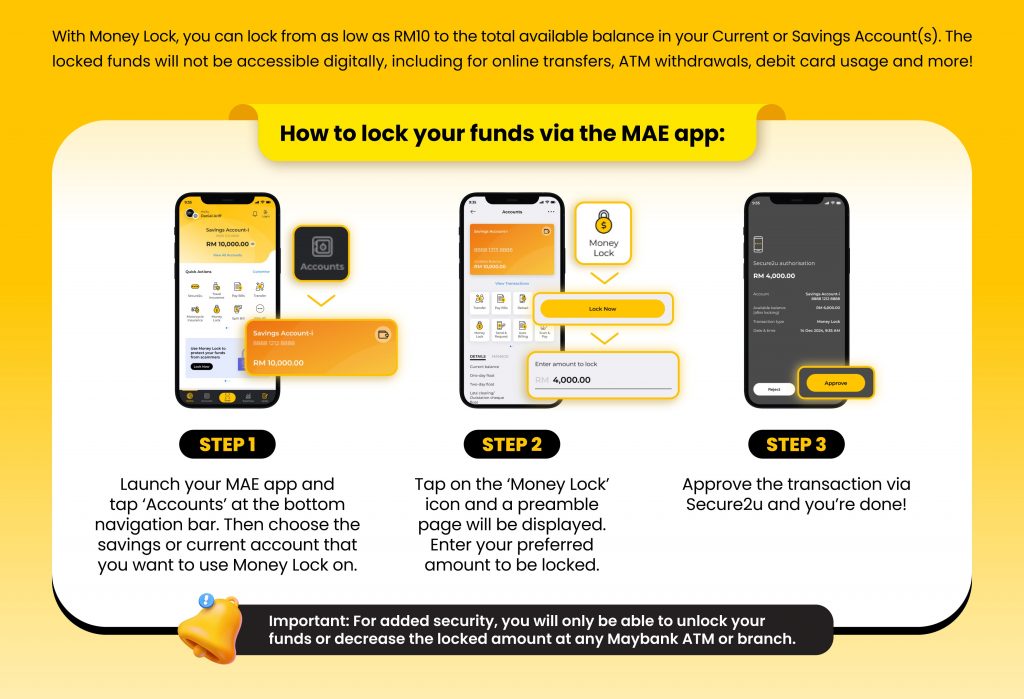

How to activate Money Lock?

Here’s a step-by-step guide on how to activate the Money Lock feature:

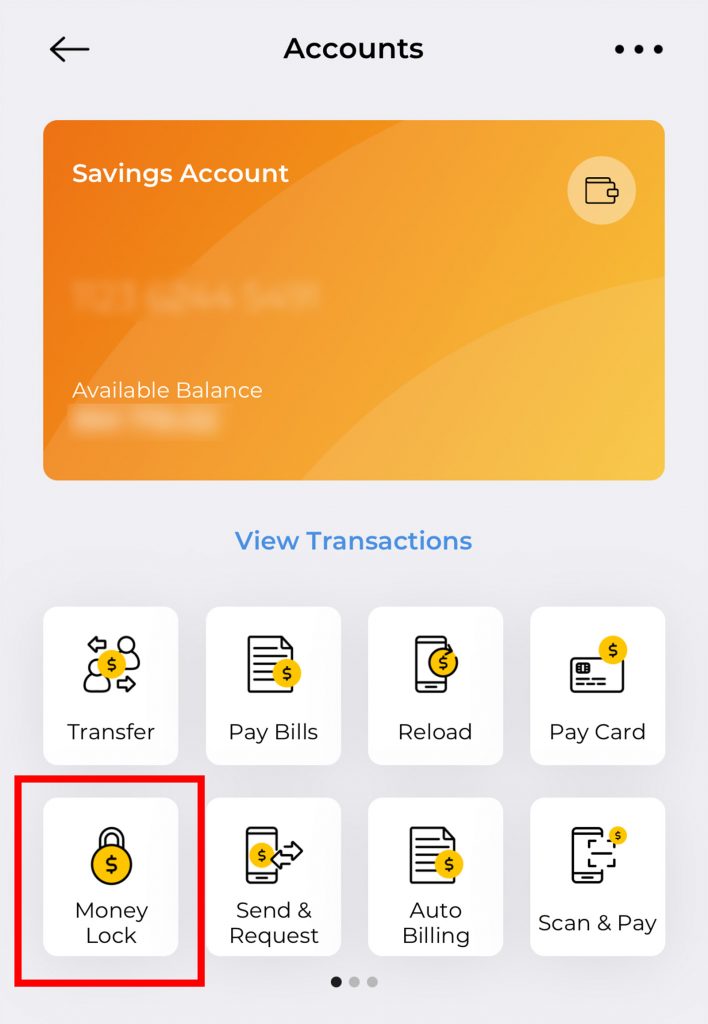

- Launch the MAE app, select the “Accounts” tab and choose the savings or current account to use Money Lock on.

- Click on the Money Lock icon, and select the preferred account and amount to be locked. A summary page will be displayed.

- Approve via Secure2u to activate Money Lock.

You may visit Maybank’s official website to learn more about the new Money Lock feature.