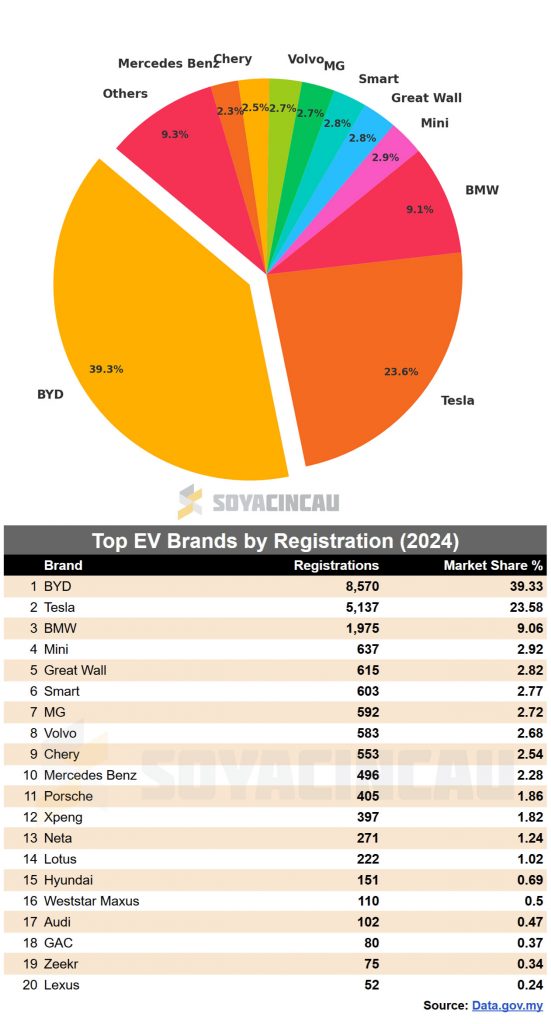

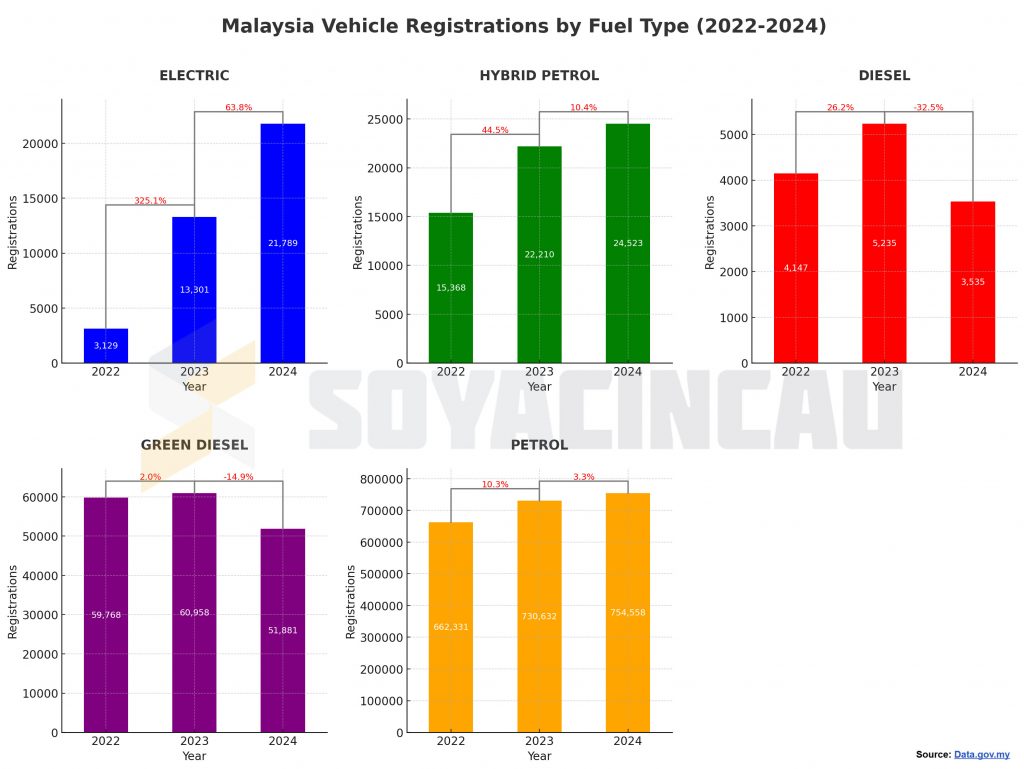

Electric Vehicles (EV) continue to show strong growth in Malaysia with 21,789 vehicles registered throughout 2024 according to the latest data shared by JPJ. This marks a 63.81% Year-on-Year (YOY) growth versus 13,301 units registered in 2023.

In 2024, EVs accounted for 2.54% of all vehicle registrations in Malaysia, and 4 out of 10 EVs registered are BYDs.

BYD dominates Malaysia’s EV market with 39.33% market share

BYD dominates the Malaysian EV segment with 39.33% market share (8,570 units), followed by Tesla with 23.58% (5,137 units) and BMW Group (BMW + Mini) with 11.98% (2612 units). The other players command less than 3% market share each.

Throughout 2024, GWM recorded 615 registrations, followed by Pro-Net’s Smart with 603 registration, MG with 592 registrations, Volvo with 583 registrations, Cherry with 553 registrations and Mercedes-Benz with 496 registrations.

Zeekr which launched only in December, still managed to get onto the Top 20 list with 75 units registered.

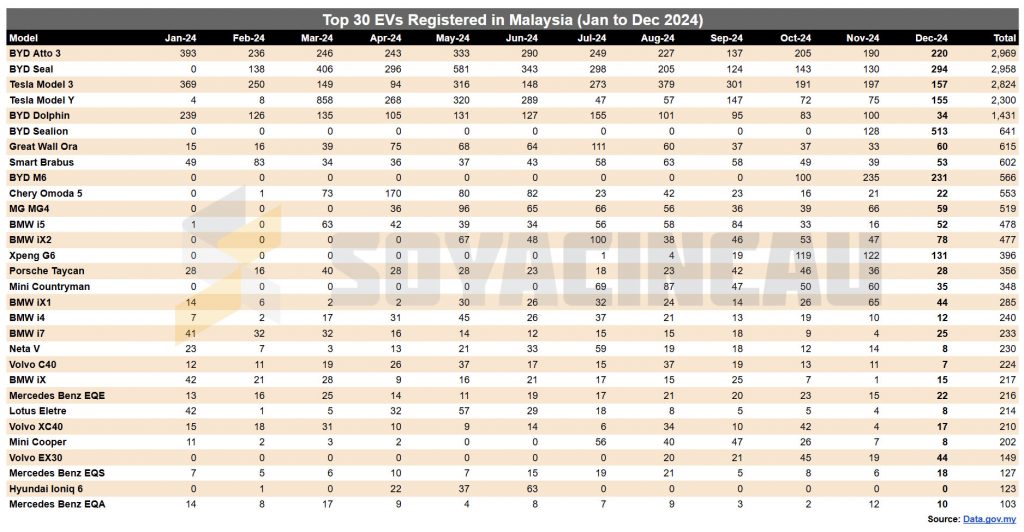

Top 30 EV models in Malaysia for 2024

BYD Atto 3 remains the most popular model for 2024 with 2,969 units registered, followed by BYD Seal with 2,958 units, Tesla Model 3 with 2,824 units, Tesla Model Y with 2,300 units, BYD Dolphin with 1,431 units and BYD Sealion 7 with 641 units.

The GWM Ora 07 and Good Cat (JPJ combines both data) have recorded 615 registrations while the Smart #1 and #3 (combined) recorded 602 units. SAIC’s MG4 had recorded 519 registrations for the full year.

For the premium EV brand segment, BMW continues to lead with the BMW i5 recording 478 units, followed by the BMW iX2 with 477 units.

Meanwhile, the Xpeng G6 which only made its local debut in August has already recorded 396 registrations.

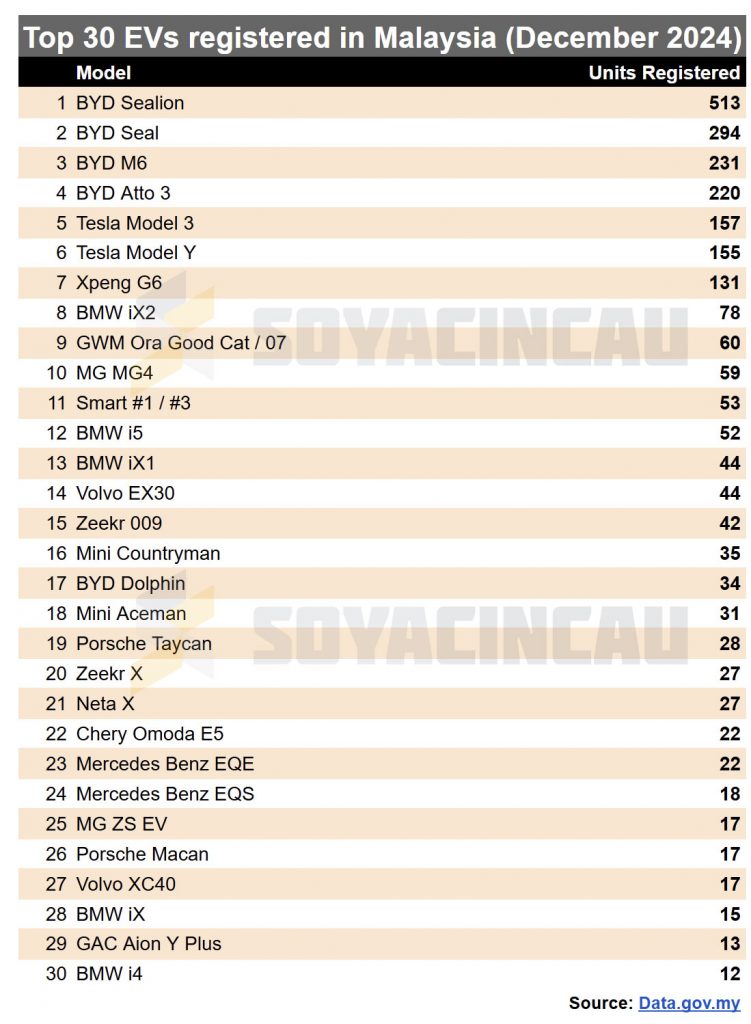

Top 30 EVs in Malaysia for December 2024

In December 2024, a total of 2,581 EVs were registered and BYD dominated the top four spots. BYD Sealion 7 is the most popular EV last month with 513 units, followed by BYD Seal with 294 units, BYD M6 with 231 units, BYD Atto 3 with 220 units, Tesla Model 3 with 157 units and Model Y with 155 units.

The XPeng G6 remains on the top 10 list with 131 units registered, and this is followed by the BMW iX2 with 78 units, GWM Ora Good Cat/07 with 60 units and the MG4 with 59 units. Interestingly, the BYD Dolphin had fallen down to #17 with only 34 units registered.

What happens after 2025?

Among all categories, the electric category has shown the strongest growth in Malaysia at 63.8%, followed by hybrid petrols at 10.4% and petrol at 3.3%. Both diesel and green diesel segments have shown a decline following the diesel subsidy rationalisation. If the market maintains its momentum, EVs could overtake hybrid petrol registrations in 2025.

Not forgetting that the Proton e.MAS 7 will begin deliveries this year and is expected to drive further growth in the segment. Perodua has also committed to launch a sub-RM90,000 EV by the end of this year, but details remain scarce at the moment.

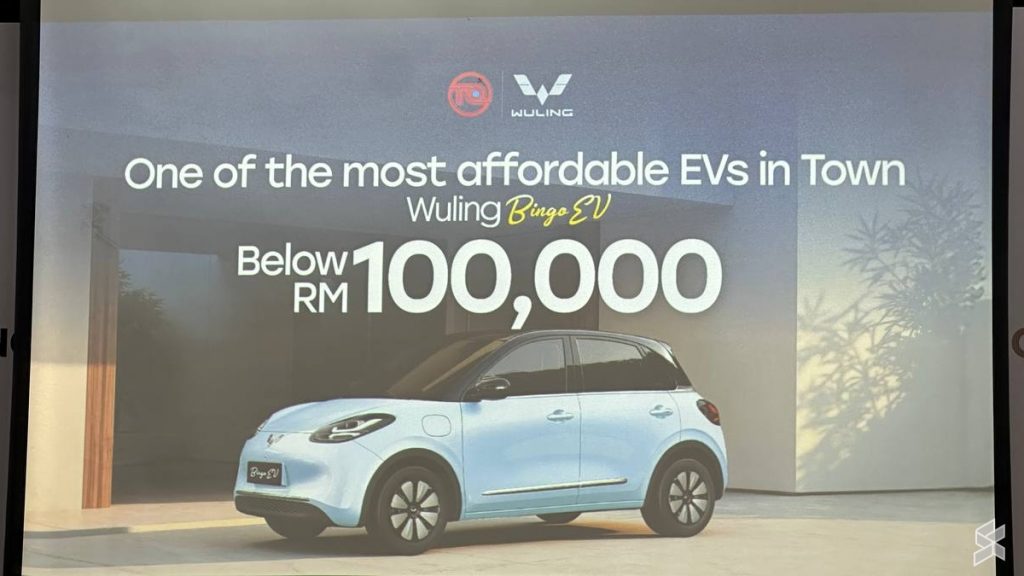

However, there’s uncertainty for EV sales beyond 2025 as the top 7 EV brands in Malaysia (83.2% market share) currently do not locally assemble their EVs locally. The current tax exemptions for fully imported EVs priced above RM100,000 is set to end on 31st December 2025, while tax exemptions for locally assembled EVs are set to end on 31st December 2027.

The only brands that have started local assembly of EVs in Malaysia are Volvo, Mercedes-Benz and Chery. In a recent roundtable session, BMW Group says long term certainty and clarity is needed before they venture in local assembly of BMW EVs.