Oppo leads when it comes to smartphone shipments in Southeast Asia for 2024 according to the latest report by Canalys. After two years of decline, its analysts say that the Southeast Asian market has rebounded strongly with 11% year-on-year growth, outpacing global growth of 7%.

For the first time, Oppo has overtaken Samsung for the #1 spot in the region, capturing 18% market share with 16.9 million shipments which marks a 14% annual growth. However, in the last quarter (Q4 2024), Transsion (Infinix, Techno, itel) came up on top with a total of 4.1 million shipments while commanding a market share of 17%.

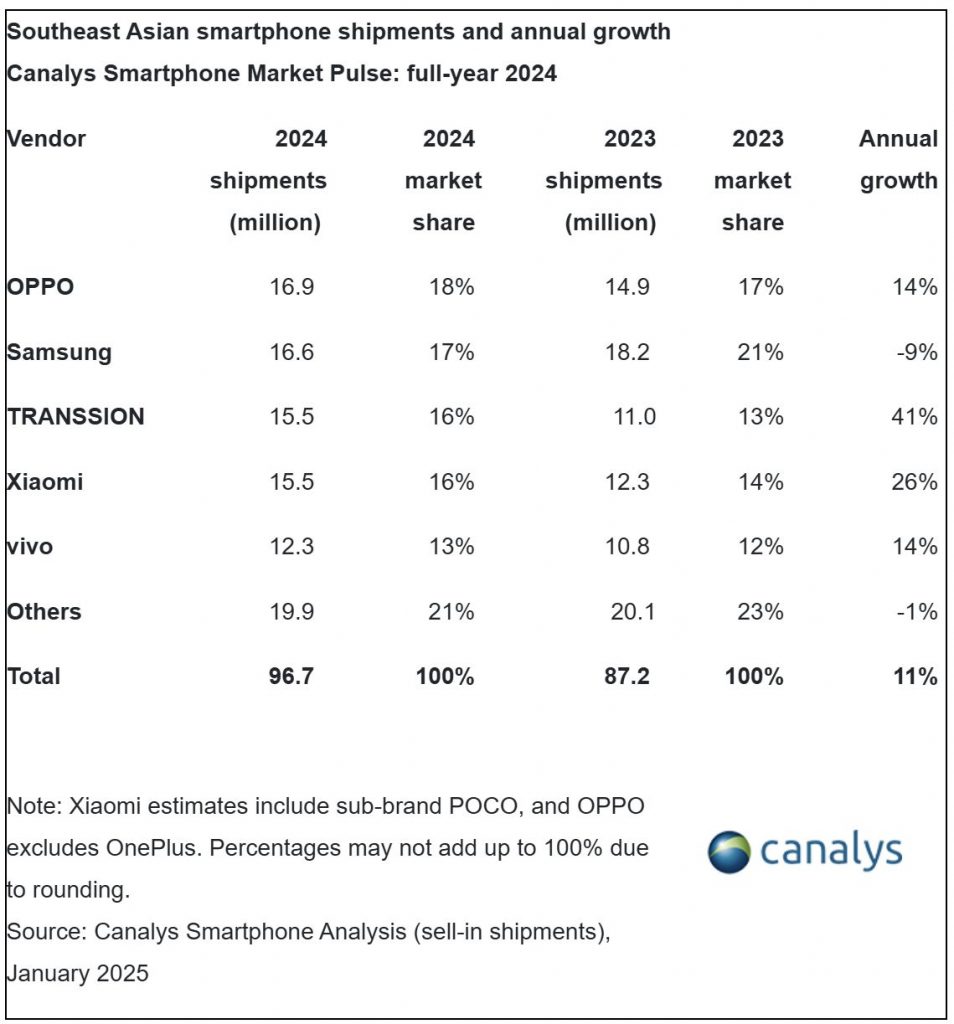

Top smartphone brands in SEA in 2024

For the full year of 2024, the Southeast Asian region recorded 96.7 million smartphone shipments which marks an 11% growth compared to the previous year. Oppo’s annual shipments increased by 14% from 14.9 million in 2023 to 16.9 million in 2024, while Samsung’s annual shipments show a decline of 9% from 18.2 million in 2023 to 16.6 million in 2024.

Transsion toook third place with 15.5 million shipments, which is a 41% increase from 11 million shipments in 2023. Xiaomi in fourth place has also shown a healthy growth of 26% from 12.3 million shipments in 2023 to 15.5 million in 2024. This is then followed by Vivo taking fifth place at 12.3 million shipments, which is a 14% increase from 10.8 million shipments in 2023.

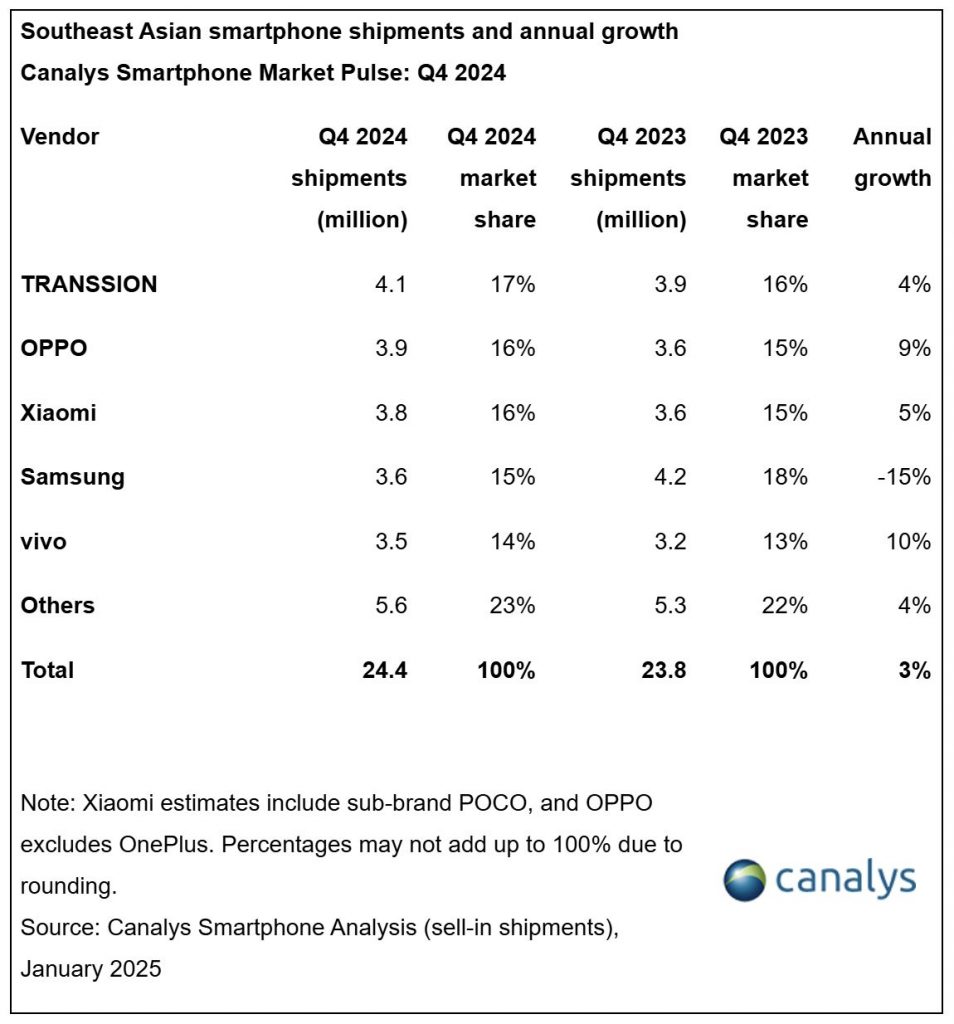

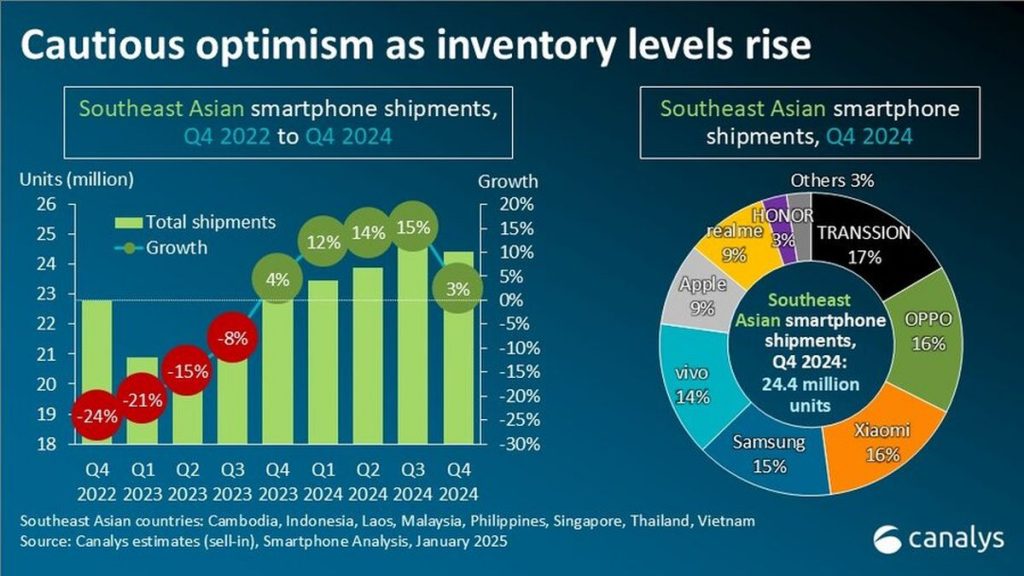

Top smartphone brands in SEA in Q4 2024

Things have become more interesting in the final quarter of 2024 as Transsion took the lead with 4.1 million shipments, followed by Oppo with 3.9 million shipments and Oppo at 3.8 million shipments. Samsung and Vivo followed closely behind with 3.6 million shipments and 3.5 million shipments respectively.

In Q4 2024, the region recorded 24.4 million smartphone shipments which marks a 3% growth year on year. Transsion’s sudden growth is attributed to its strong performance in Indonesia and Philippines. For the full year of 2024, Transsion is #1 in the Philippines and #2 in Indonesia.

Xiaomi leads smartphone shipments in Malaysia

In Malaysia, Xiaomi still leads for the full year of 2024 with a 16% market share, followed by Vivo with 14% market share. Meanwhile Transsion is in third place with 13% marketshare, followed by Honor at 12% and Samsung at 11%.

Samsung sees growth in premium models

Canalys Anayst Le Xuan Chiew revealed that Oppo’s strong performance last year reflects its success in product calibration and high-end investments. He added that the Oppo A18 was the brand’s best selling model and the rebranded A3x has helped to drive higher channel shipments. Contrary to global trends, he said that the the Average Selling Price (ASP) has dropped in Southeast Asia due to increasing price sensitivity in region.

It was also mentioned that Transsion took the lead in Q4 2024 due to its entry-level Hot and Smart series. The smartphone group has expanded dealer distribution, as the brand is pushing brand volume to gain more awareness in tier-two cities.

Although Samsung’s overall shipments have dropped in Southeast Asia, its ASP has bucked the market and increased by 14% from USD 285 (about RM1,272) in Q4 2023 to USD 326 (about RM1,454) in Q4 2024. Canalys found that the strong growth of more premium models such as the Galaxy A55 and Galaxy S series have made up for volume declines among its mass-market models such as the Galaxy A1x and A2x series.

He also highlighted that the high-end smartphone market in Southeast Asia has gained momentum and brands that have invested in their channels in 2023 are now capitalising on those efforts. For example, Honor has recorded an 11% shipment growth in 2024 which was supported by investments in the operator channel and medium to high-end portfolio in Malaysia. The reported also added that Apple has achieved a 15% year-on-year growth in 2024, driven by successful emerging market strategy and expanded distribution network.

[ SOURCE ]