Indian Railway Finance Corporation Ltd. (IRFC) is a significant player in the infrastructure and finance industry, making it an attractive prospect for long-term stock investors. Analyzing various aspects of the company, such as historical share price trends, balance sheet evaluation, annual reports, dividend analysis, and quarterly results, can provide valuable insights for investors looking to make informed decisions.

In the dynamic landscape of financial markets, understanding the intricate patterns of share prices is crucial. The ‘IRFC share price’ has been a topic of keen interest among investors and analysts alike. In this article, we delve deep into the trends, analyze the factors affecting it, and provide valuable insights for investors.

‘IRFC Share Price’: A Brief Overview

The Indian Railway Finance Corporation (IRFC) plays a pivotal role in the Indian railway sector. Investors are always on the lookout for trends that can help them make informed decisions. The ‘IRFC share price’, a reflection of market sentiment, can be influenced by a myriad of factors, from economic policies to global market dynamics.

Investors and analysts closely monitor the ‘IRFC Share Price‘ due to its significance in the Indian railway sector. To gain a more comprehensive understanding of the factors affecting the share price and how investors can navigate its volatility, we can delve deeper into the provided references and insights:

Historical Share Price Trends:

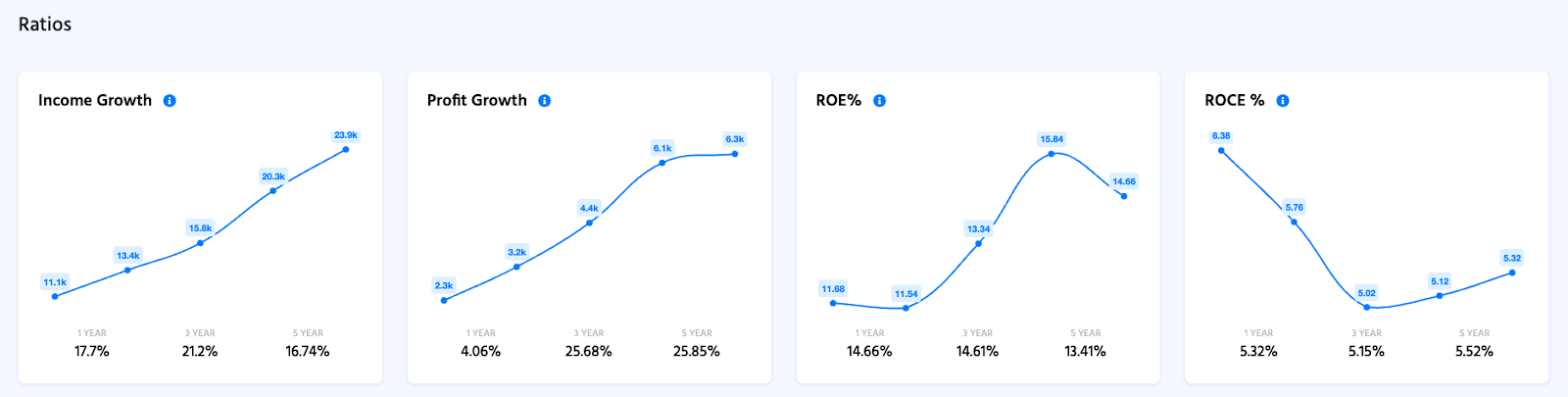

Analyzing historical ‘IRFC share price’ trends is crucial for understanding the stock’s performance over time. Investors can identify patterns, trends, and potential buying or selling opportunities. IRFC’s share price history may reveal periods of growth, consolidation, or volatility. By using pre-built screening tools, investors can track market sentiment and assess trend direction based on historical data. This data-driven analysis can help investors make well-informed decisions about their investments in IRFC.

Balance Sheet Evaluation:

A company’s balance sheet is a valuable source of information about its financial health and stability. Investors can utilize pre-built screening tools to review key financial metrics for IRFC. Key ratios such as the Debt-Equity Ratio and Liquidity Ratio can provide insights into the company’s long-term viability and growth potential.

Annual Report Insights:

Annual reports offer a wealth of information about a company’s performance and future prospects. By providing downloadable annual reports for IRFC and combining them with expert reviews and analysis, investors can gain a deeper understanding of the company’s business strategy, competitive landscape, and management outlook.

Dividend Analysis:

Analyzing a company’s dividend payouts can provide insights into its potential returns and financial stability. Investors can use available tools to analyze IRFC’s dividend payouts and assess its profitability. This analysis can help investors make informed decisions about their long-term investments.

Factors Influencing ‘IRFC Share Price’

1. Economic Indicators and Policies

Economic indicators, such as GDP growth and inflation rates, significantly impact ‘IRFC share price’. Additionally, government policies related to the railway sector can cause fluctuations.

2. Market Sentiment and Investor Confidence

Investor sentiment and confidence levels can either boost or hinder ‘IRFC share price’. Positive news about the railway sector or the company can lead to a surge, while negative sentiment can lead to a decline.

3. Global Market Dynamics

In our interconnected world, global events and market trends abroad can echo ‘IRFC share price’. Keeping an eye on international developments is crucial for investors.

4. Company Performance and Projects

IRFC’s financial health and ongoing projects play a significant role. Strong financial results and successful project implementations often translate to higher share prices.

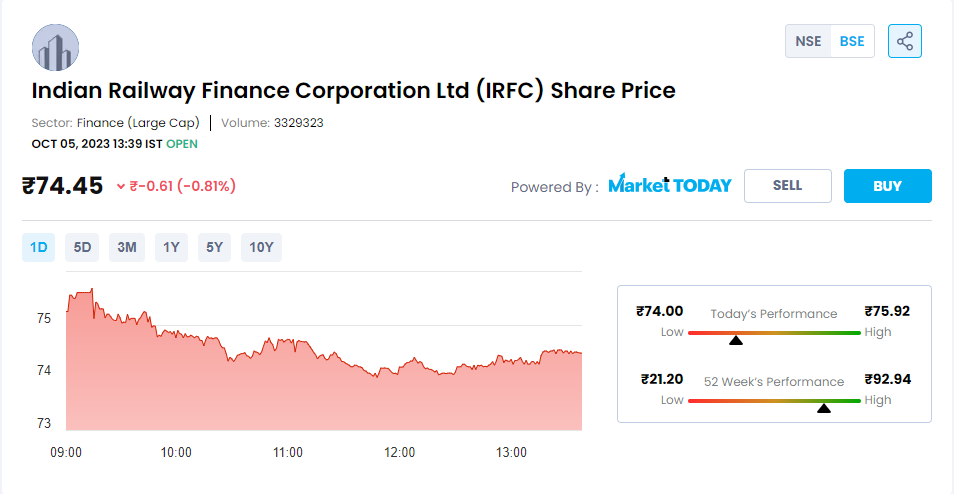

‘IRFC Share Price’ Today Live Update

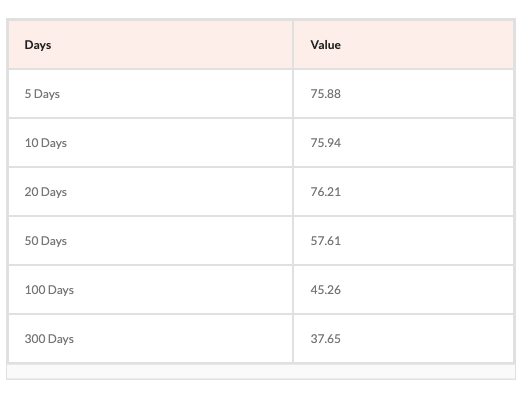

The Indian Railway Finance Corporation (IRFC) closed at 76.59 and opened at 76.23 on its final trading day. The stock’s range was 76.6 as its high and 73.82 as its low. At this time, IRFC has a market value of 98,092.21 crore. The stock’s 52-week high is 92.94, and its 52-week low is 21.15. 3,550,864 shares of the stock were traded on the BSE.

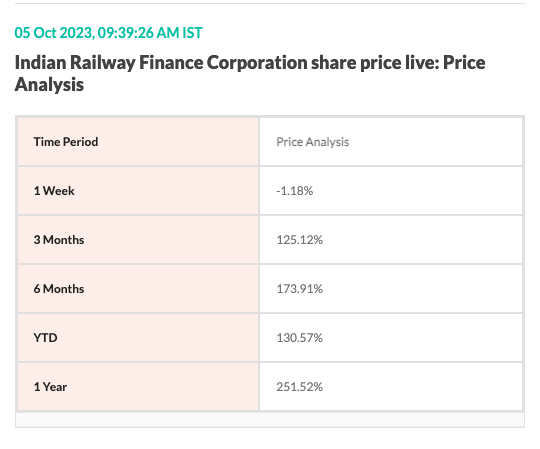

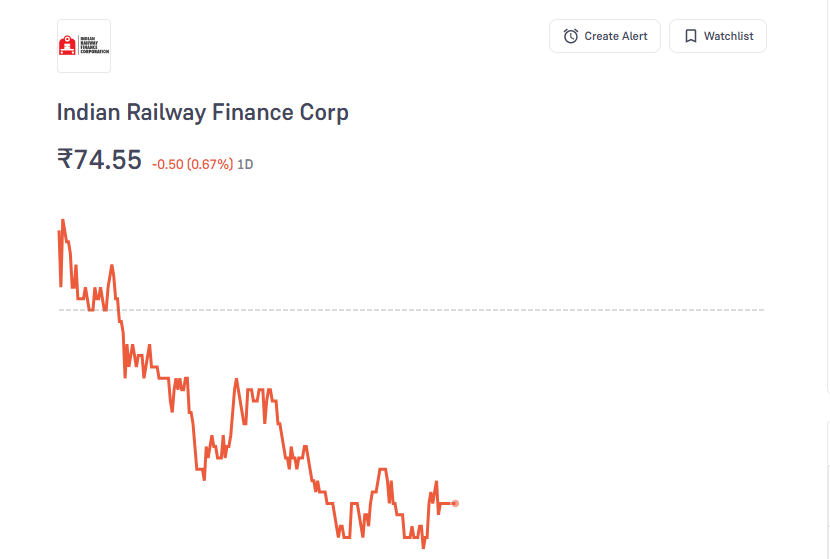

Analyzing ‘IRFC Share Price’ Trends

Understanding the historical trends is vital for predicting future movements. Analyzing the past performance of ‘IRFC Share Price’ can provide valuable insights into potential future trends. Indian Railway Finance Corporation (IRFC) stock is currently trading at 74.32 with a percent change of -0.99. This indicates that the stock’s value has decreased. The stock’s value has decreased as seen by the net change in price, which is -0.74.

Transitioning to Success: IRFC’s Growth Trajectory

Transition words like “however,” “meanwhile,” and “therefore” are essential for creating a seamless flow of ideas. This ensures that the reader remains engaged throughout the article.

How Can Investors Navigate ‘IRFC Share Price’ Volatility?

Investing in the stock market requires a strategic approach, especially concerning volatile stocks like IRFC. Diversification, staying updated with market news, and consulting financial experts can mitigate risks.

Some of FAQ’s

Q: What factors influence the ‘IRFC Share Price’?

A: The ‘IRFC Share Price’ can be influenced by various factors, including economic indicators, government policies, market sentiment, global market dynamics, and the company’s performance and ongoing projects.

Q: How can investors analyze historical trends in the ‘IRFC Share Price’?

A: Investors can analyze historical trends in the ‘IRFC Share Price’ using pre-built screening tools, which allow them to track market sentiment, identify patterns, and anticipate potential future movements.

Q: What insights can be gained from IRFC’s annual reports?

A: IRFC’s annual reports provide insights into the company’s business strategy, competitive landscape, and management outlook, enabling investors to make informed decisions about long-term investments.

Q: Why is monitoring quarterly results important for IRFC investors?

A: Monitoring quarterly results allows investors to assess IRFC’s short-term performance and growth prospects, helping them make timely investment decisions based on recent developments.

Q: How can investors stay up-to-date with the latest news about IRFC?

A: Investors can stay informed about IRFC by accessing reliable news updates and developments on the website. These updates, combined with analytical tools, provide valuable insights into the company’s trends and outlook.

Conclusion:

In the intricate world of finance, understanding the nuances of ‘IRFC share price’ is both an art and a science. By comprehending the factors at play and analyzing trends, investors can make well-informed decisions, maximizing their potential for profitable outcomes. investors seeking to navigate the ‘IRFC Share Price‘ volatility can benefit from a comprehensive analysis of the factors mentioned above, along with utilizing the available screening tools and resources to make informed investment decisions in the dynamic financial landscape.