Wall Street was very busy in the last week of October as major corporations released their financial results and the government released its quarterly economic data in the United States.

In terms of earnings, tech giants Microsoft (MSFT), Alphabet (GOOGL), Meta Platforms (FB), Apple (AAPL) and Amazon (AMZN) will make up about a quarter of the S&P 500. Among 165 companies. , took a close look at the headlines based on data from the reporting season.

A flurry of economic reports will also keep investors busy, with preliminary third-quarter gross domestic product (GDP) data due Thursday. Economists are expecting a preliminary estimate showing the U.S. economy grew 2.3% at an annualized rate last quarter, following repeated contractions in the first and second quarters, according to Bloomberg Consensus Forecasts.

The more than terrible gains so far helped the S&P 500, Dow Jones and Nasdaq post weekly gains of around 5% for each index on Friday, the best five-day performance since June. The Fed's announcement that officials may consider cutting interest rates later this year also sparked optimism among investors.

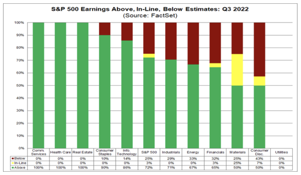

The number of S&P 500 companies that reported surprisingly positive earnings this quarter and the size of those estimates remained below their 5- and 10-year averages, according to FactSet Research. But the pace of third-quarter earnings growth improved last week from the previous week.

Earnings for Tesla (TSLA) and Snap (SNAP) offered little hope of their industry peers continuing the trend next week as Tesla earnings disappointed analysts and Snap reported the weakest revenue growth of its IPO in 2017 since.

© Provided by Yahoo Finance US On an annual basis, the S&P 500 index posted its weakest earnings growth since the third quarter of 2020. (Source: FactSet Research)

© Provided by Yahoo Finance US On an annual basis, the S&P 500 index posted its weakest earnings growth since the third quarter of 2020. (Source: FactSet Research)

Google's parent company, Alphabet, will announce the first in a series of tech giants on Tuesday. Analysts warn that macroeconomic challenges, such as currency headwinds, could hamper the growth of businesses and other mega-communications technology companies.

The strengthening US dollar has hit businesses hard. According to Citigroup strategists, a 10% appreciation of the dollar will reduce S&P 500 earnings per share by $15 to $20. The dollar index rose more than 17% against a basket of other currencies, including the euro and the yen. For US companies, this means that any foreign earnings will be diluted when converted into dollars.

That headwind should show up in Amazon's earnings on Thursday, given that about 30% of the e-commerce conglomerate's revenue is generated internationally, according to a CFRA study. The same goes for Microsoft. Goldman Sachs analysts warn that demand for the company's commercial IT offerings and cloud services will persist, even as "foreign exchange opponents remain overwhelming."

For Apple, the dynamics of iPhone demand will be one of the most important factors watched by market watchers. Morgan Stanley analyst Eric Woodring predicted in a recent note that "demand has been better than expected in recent months."

Meta and Twitter (TWTR) will also report on Wednesday and Thursday, respectively, as part of their 72-hour earnings report.

Other notable financial players include Coca-Cola (KO), General Electric (GE), General Motors (GM), Ford Motor (F), Comcast (CMCSA), Visa (V), Mastercard (MA), and Exxon. Mobile (XOM) etc

In economic data, GDP data is expected to show the U.S. economy expanded in the past quarter after two straight quarterly readings, though a group of NBER economists said the government is expected to formally declare a recession.

Economic reports on the weekly calendar also include the S&P Case-Shiller home price index, new and pending home sales data and consumer confidence from the Conference Board.

© New York, USA, 17 October 2022, Floor of the New York Stock Exchange (NYSE), Provided by Yahoo Finance USA Expert Trader . REUTERS/Brendan McDermid

© New York, USA, 17 October 2022, Floor of the New York Stock Exchange (NYSE), Provided by Yahoo Finance USA Expert Trader . REUTERS/Brendan McDermid

Ian Shepherdson, chief economist at Pantheon Economics, said the expected recovery in GDP, the broadest measure of economic activity, was due to a recovery in net exports, a decline in the first and second quarters and technical factors that have inflated stocks.

"However, the outlook for the first half of next year has deteriorated significantly and the likelihood of a near-term recession has increased due to a significant and broad-based tightening of financial conditions," Shepherdson added, citing higher rates along the curve. expanding companies. spreads. . , falling stock prices, moving house prices and a strong dollar.

–

Economic calendar

Monday. Chicago Fed National Activity Index , September (prior month 0.00); S&P Global US Manufacturing PMI , preliminary October (51.0, 52.0 expected last month); S&P Global US Services PMI , through October (49.6 expected, 49.3 last month); S&P Global US Composite PMI , through October (49.5 the previous month)

Tuesday. FHFA House Price Index , August (-0.6% last month, -0.6% expected); S&P CoreLogic Case-Shiller 20-City Composite m/m Aug (expected -0.80%, last month -0.44%); S&P CoreLogic Case-Shiller 20-City Composite VV Aug (expected 14.00%, last month 16.06%); US National S&P CoreLogic Case-Shiller House Price Index (+15.77% last month); Conference Board Consumer Confidence , October (105.5 expected, 108.0 last month); Current Situation Conference Board , October (149.6 last month); Conference Board Expectations , October (80.3 last month); Richmond Fed Manufacturing Index , October (expected -5.0 last month)

Wednesday. MBA mortgage programs , week ending Oct. 21 (-4.5% last week); Goods trade balance advance, September (expected -$87.7 billion, last month – $87.3 billion); On a monthly basis, wholesale inventories , preliminary data for September (expected 1.1%, 1.3% last month); Retail Sales m/m, September (expected 1.2%, last month 1.4%)); NSA New Home Sales , September (580,000 expected, 685,000 last month); New Apartment Sales m/m, September (expected -15.3%, last month -28.8%)

Thursday. GDP VY, QQ, Q3 (expected 2.3%, -0.6% previously); Durable Goods Orders, last September (expected 0.6%, last month -0.2%); Personal consumption Q3 Q3 (0.8% expected, 2.0% previously); Durable goods ex-transportation , last September (expected 0.2%, last month 0.3%); GDP Price Index , QQ, Q3 (expected 5.3%, previously 9.0%)); Preliminary data for September (0.2% of the previous month, expected 0.3 %); Core PCE , quarterly, Q3 A (4.6% expected, 4.7% previously); preliminary data for September (0.3% of the previous month), transport of goods excluding defense, excluding aircraft . Initial jobless claims, week ending Oct. 22 (225,000 expected, 214,000 last week); Continuing claims , week ending October 15 (1.385 million previous week); Kansas City Manufacturing Index , October (expected -2.1 last week)

Friday. Employment Expenditure Index , Q3 (expected 1.2%, 1.3% last quarter); Personal income on a monthly basis, September (previous month forecast 0.3%, 0.3%) ); Personal expenses on a monthly basis, September (prior month expected 0.4%, 0.4%) ); Actual personal expenditure on a monthly basis, September (expected 0.1%, last month 0.1%) ); Monthly PCE deflator , September (expected 0.3%, last month 0.3%); PCE Deflator YTD – September (6.3%, expected 6.2% last month); Core PCE deflator m/m September (expected 0.5%, last month 0.6%); Expected monthly home sales , September (last month -5.3%, expected -2.0%); Home sales expected NSA , YY, September (-22.5% last month); University of Michigan Consumer Sentiment , October Summary (expected 59.7, previously 59.8)

–

income schedule

Monday. Bank of Hawaii (BOH), Crande (CR), Discover Financial Services (DFS), Logitech International (LOGI), Schnitzer Steel (SCHN), Zions Bancorp (ZION)

Tuesday. 3M (MMM), Alphabet (GOOG, GOOGL), Archer-Daniels-Midland (ADM), Biogen (BIIB), Boyd Gaming (BYD), Chipotle Mexican Grill (CMG), Chubb (CB), Coca-Cola (KO) : ), General Electric (GE), General Motors (GM), JetBlue Airways (JBLU), Kimberly-Clark (KMB), Mattel (MAT), Microsoft (MSFT), Sherwin-Williams (SHW), Skechers (SKX), Spotify (SPOT), Texas Instruments (TXN), UPS (UPS), Valero Energy (VLO), Visa (V), Wyndham Hotels & Resorts (WH), Xerox (XRX)

Wednesday. Boeing (BA), Boston Scientific (BSX), Bristol Myers Squibb (BMY), Coursera (COUR), Ford Motor (F), General Dynamics (GD), Harley-Davidson (HOG), Hilton Worldwide Holdings (HLT). , Kraft Heinz (KHC), Lending Club (LC), Meta Platforms (META), O'Reilly Automotive (ORLY), Spirit Airlines, (SAVE), Thermo Fisher Scientific (TMO), Upwork (UPWK), VF Corp (VFC ). ) ) ), Wing stopper (WING)

Thursday: Amazon.com (AMZN), Apple (AAPL), Altria (MO), Ares Management (ARES), AutoNation (AN), Caterpillar (CAT), Capital One (COF), Comcast (CMCSA), CubeSmart (CUBE) , Gilead Sciences (GILD), Hertz Global (HTZ), Honeywell (HON), Intel (INTC), Keurig Dr Pepper (KDP), Mastercard (MA), McDonald's (MCD), Merck (MRK), Northrop Grumman (NOC) , Oshkosh (OSK), Overstock.com (OSTK), Pinterest (PINS), Royal Caribbean (RCL), S&P Global (SPGI), Shopify (SHOP), Southwest Air (LUV), T. Rowe Price (TROW), Twitter (TWTR), T-Mobile (TMUS), Willis Towers Watson (WTW)

Friday. AbbVie (ABBV), AllianceBernstein (AB), Aon (AON), Bloomin' Brands (BLMN), Colgate-Palmolive (CL), Exxon Mobil (XOM), Newell Brands (NWL), NextEra Energy (NEE)

–

Alexandra Semyonova, Yahoo Finance reporter. Follow her on Twitter @alexandraandnyc

Click here to view the latest stock quotes on the Yahoo Finance platform.

Click here for in-depth analysis, including the latest stock market news and market events.

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android .

Follow Yahoo Finance on Twitter , Facebook , Instagram , Flipboard , LinkedIn and YouTube.