The Employees Provident Fund (EPF) has updated their online platform and you can now transfer funds from Account 2 (Akaun Sejahtera) to Account 3 (Akaun Fleksibel). Account 3 is created automatically for all members below 55 years old and it provides members the flexibility to withdraw at any time.

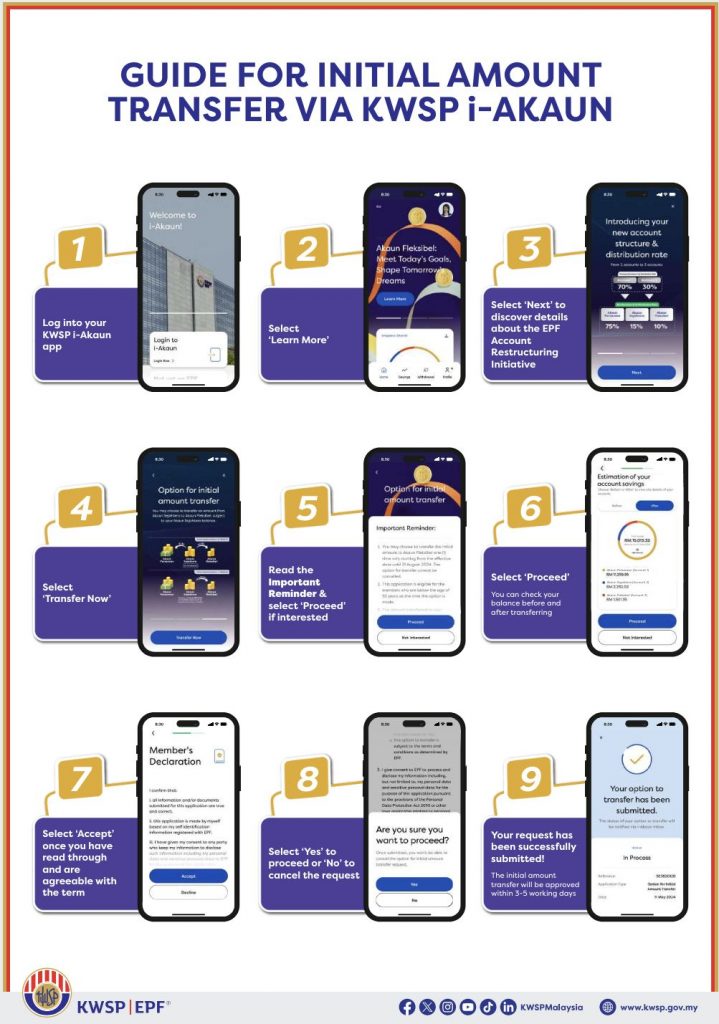

Here’s a step-by-step guide to perform a one-time transfer

The fastest way to do it is through the KWSP i-Akaun app which is available on the Apple App Store, Google Play Store and Huawei App Gallery. Alternatively, you can also use EPF’s official website.

If you’ve never registered an i-Akaun app before, you will be required to perform an eKYC (electronic Know Your Customer) process which requires you to scan your IC, perform TAC verification and take a selfie.

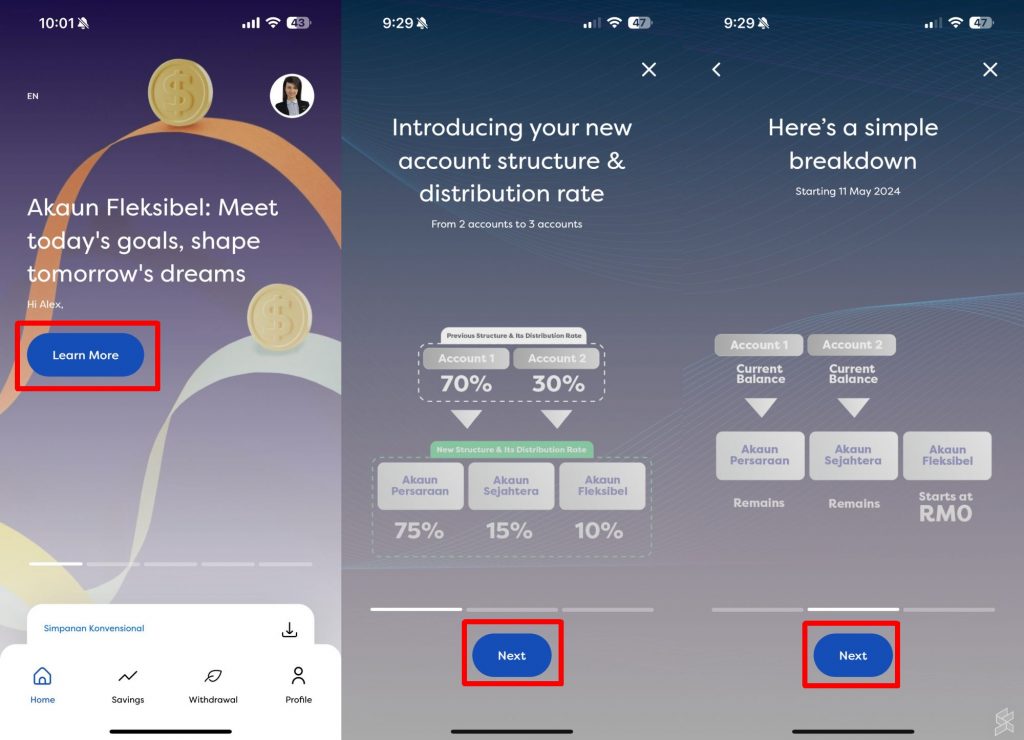

Step 1: After launching the KWSP i-Akaun app, you should see an updated home screen with “Akaun Fleksibel: Meet today’s goals, shape tomorrow’s dreams” banner. Click on “Learn more”.

Step 2: The app will go through a visual explanation of the new EPF Account restructuring including Account 3 (Akaun Fleksibel), the contribution distribution rate and the option for initial amount transfer. Click “Next” to continue.

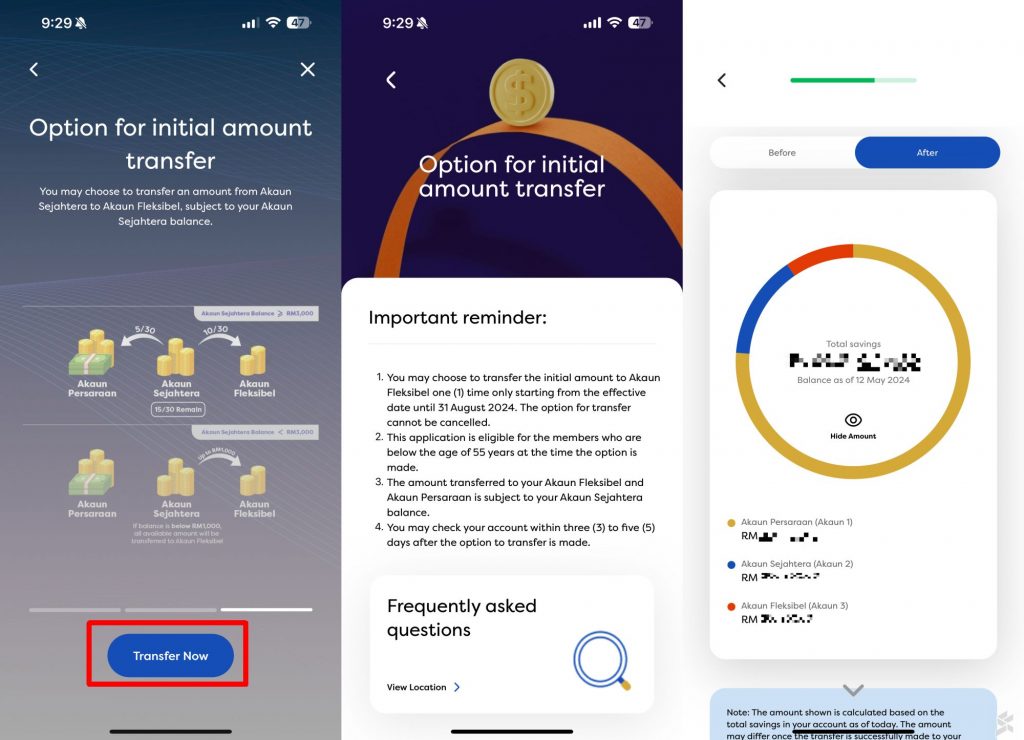

Step 3: The app will then highlight the option for initial amount transfer which can be performed for one-time only until 31st August 2024. You can read the FAQ to learn more about this one-time option for EPF members.

For greater clarity, the KWSP iAkaun app even provides a BEFORE and AFTER calculation of your EPF account balances after the one-time transfer is performed.

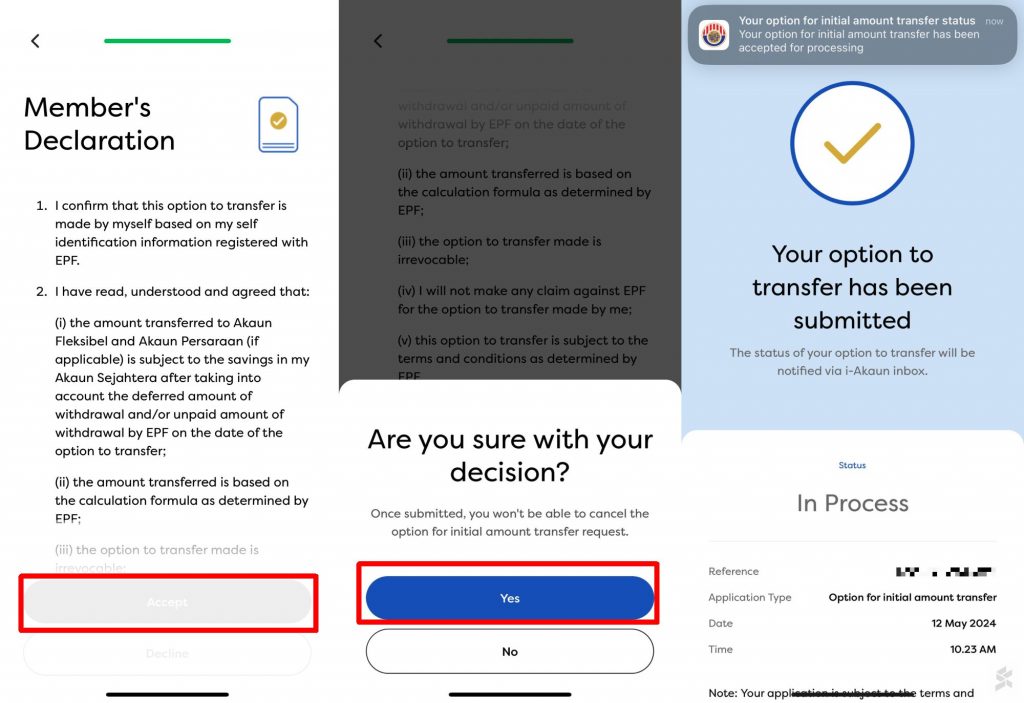

Step 4: If you’re certain that you wish to perform the one-time transfer, you’ll need to make a final member’s declaration by reading the terms.

You’ll need to click on “Accept” and then click on “Yes” to confirm your decision. Once the submission is completed, you’ll see a confirmation page with a confirmation number.

Here’s a step-by-step guide provided by EPF:

Things that you should know about the one-time transfer

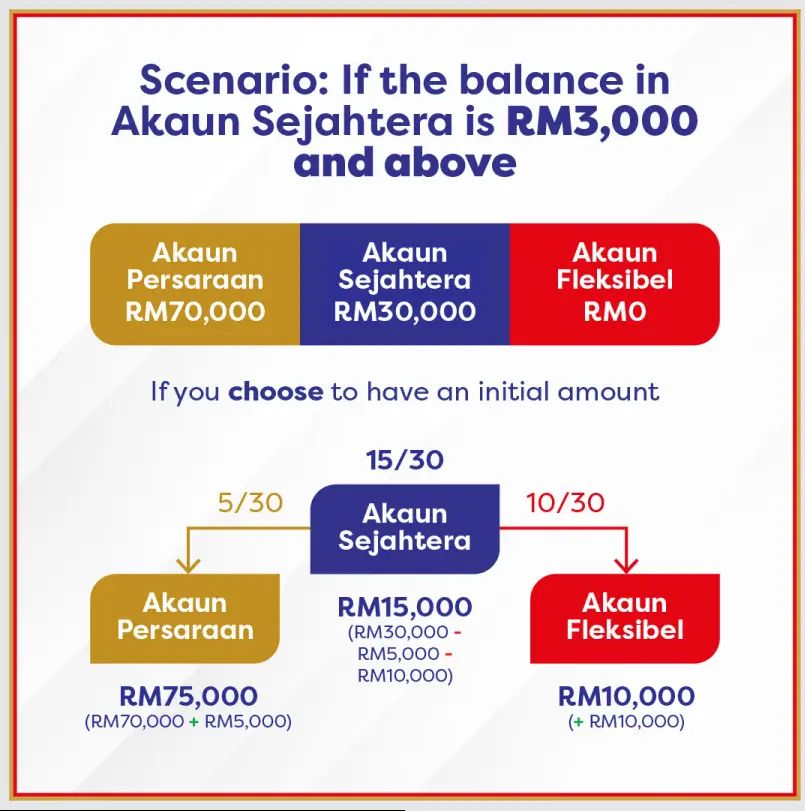

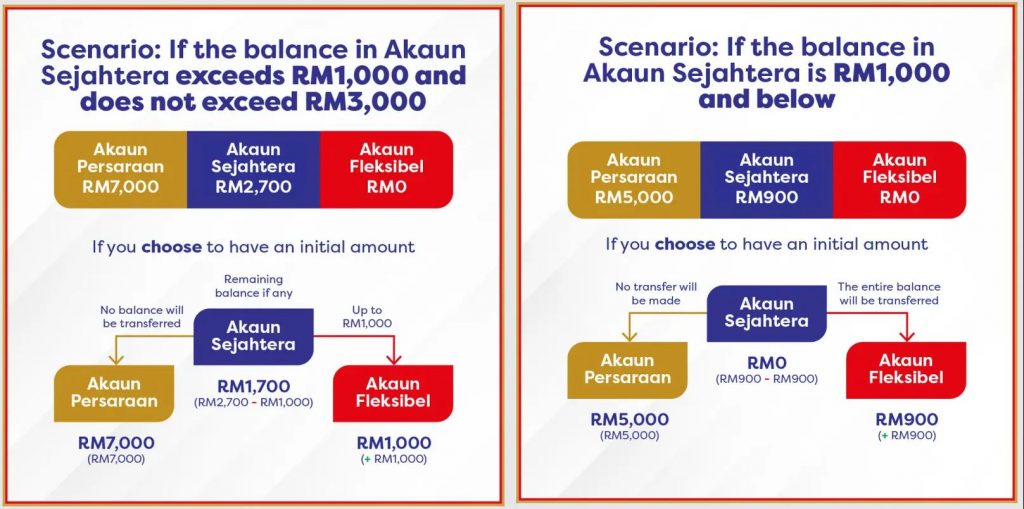

Take note that the amount that will be transferred from Account 2 to Account 3 depends on your current balance in Account 2. If your Account 2 balance is RM3,000 and above, EPF will transfer 1/3 (33.33%) to Account 3, and 1/6 (16.67%) will be transferred to Account 1.

For example, if you have RM30,000 in Account 2 (Sejahtera), the one-time transfer process will move RM10,000 to Account 3 (Fleksibel) and RM5,000 will be removed to Account 1 (Persaraan). The remaining 50% (RM15,000), will remain in Account 2 (Sejahtera).

If you have less than RM3,000 in Account 2 (Sejahtera), you can only move a maximum of RM1,000 to Account 3 (Fleksibel). The remaining balance will remain in Account 2 (Sejahtera).

For example, if your Account 2 has RM1,200, you can only move RM1,000 to Account 3. If your Account 2 has RM500, you can only move RM500 to Account 3.

You can’t decide how much exactly to transfer between the accounts as the percentage is determined by the EPF. As clarified by the EPF, the dividend rate for Account 3 at the moment will follow Account 2 and Account 1. This means you will still receive the same dividends in Account 3 if you choose not to withdraw funds in Account 3.

According to the FAQ, the one-time transfer to Account 3 will take 3-5 working days to be credited. The one-time transfer is only available from 12 May to 31 August 2024.

Members can withdraw funds when there’s at least RM50 in Account 3

Members can withdraw funds from Account 3 at any time with a minimum of RM50. This means if your Account 3 has RM5,000, you can choose to withdraw any amount between RM50 to RM5,000.

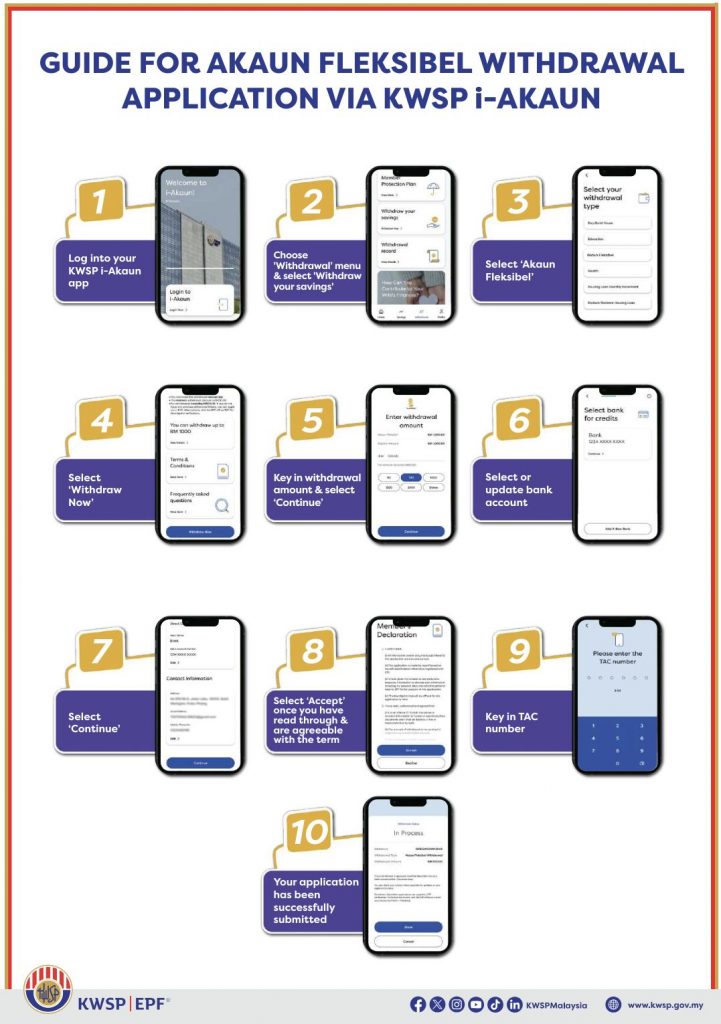

You can apply to withdraw from the KWSP i-Akaun app and the withdrawal amount will be credited to your bank account which must be registered under your name.

It is stated that EPF members generally don’t need to be physically present for identity verification to withdraw funds as it can be done online. However, it is subject to previous withdrawal history and the withdrawal amount does not exceed RM30,000.

According to the FAQ, the payment will be made within 7 working days upon application approval. Here’s a step-by-step guide for the Akaun Fleksibel Withdrawal application.

Beware of scammers and you should only perform the one-time transfer or withdrawal application from EPF’s official platforms. There are no third-party apps or services authorised by the EPF for such purposes.

To learn more, you can visit EPF’s Account Restructuring page.