Aeon Bank officially launched yesterday and it is Malaysia’s first Islamic Digital Bank. From day one, Aeon Bank users can start spending via a Visa Debit card or by scanning a DuitNow QR code. If you’re using the debit card as your primary mode of payment, do note that the transactions may take a while to reflect in the app’s transaction history.

Aeon Bank Debit Card transactions are not shown immediately

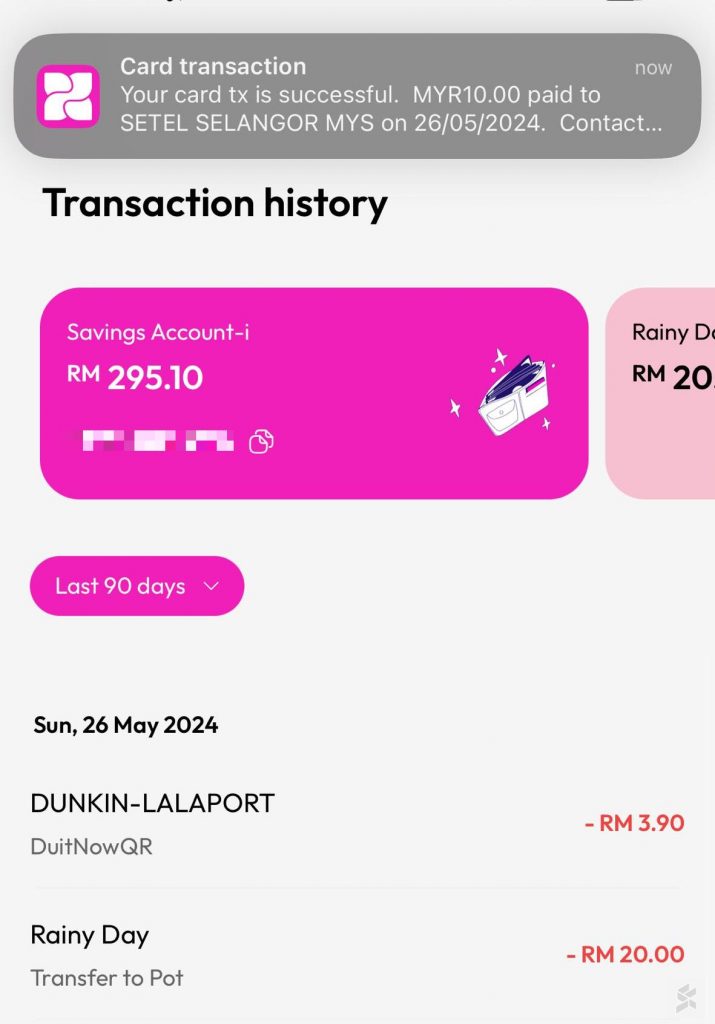

Based on our usage for online and physical in-store payments, the Aeon Bank app will push notifications after a successful card transaction is made with your Aeon Bank debit card. Despite the notification, you won’t find the payment in the app’s transaction history. From the looks of it, it may take up to 2 days for the card transactions to reflect within the app, which is a similar experience to using traditional bank cards.

As shown in the screenshot above, we did get a RM10 transaction notification for topping up our Setel account, but it isn’t shown on the transaction history list.

This experience isn’t great if you’re making multiple transactions in a single day and it is hard to keep track of your spending and actual savings account balance at a glance. Since this is a digital bank product, users would expect real-time updates of all transactions.

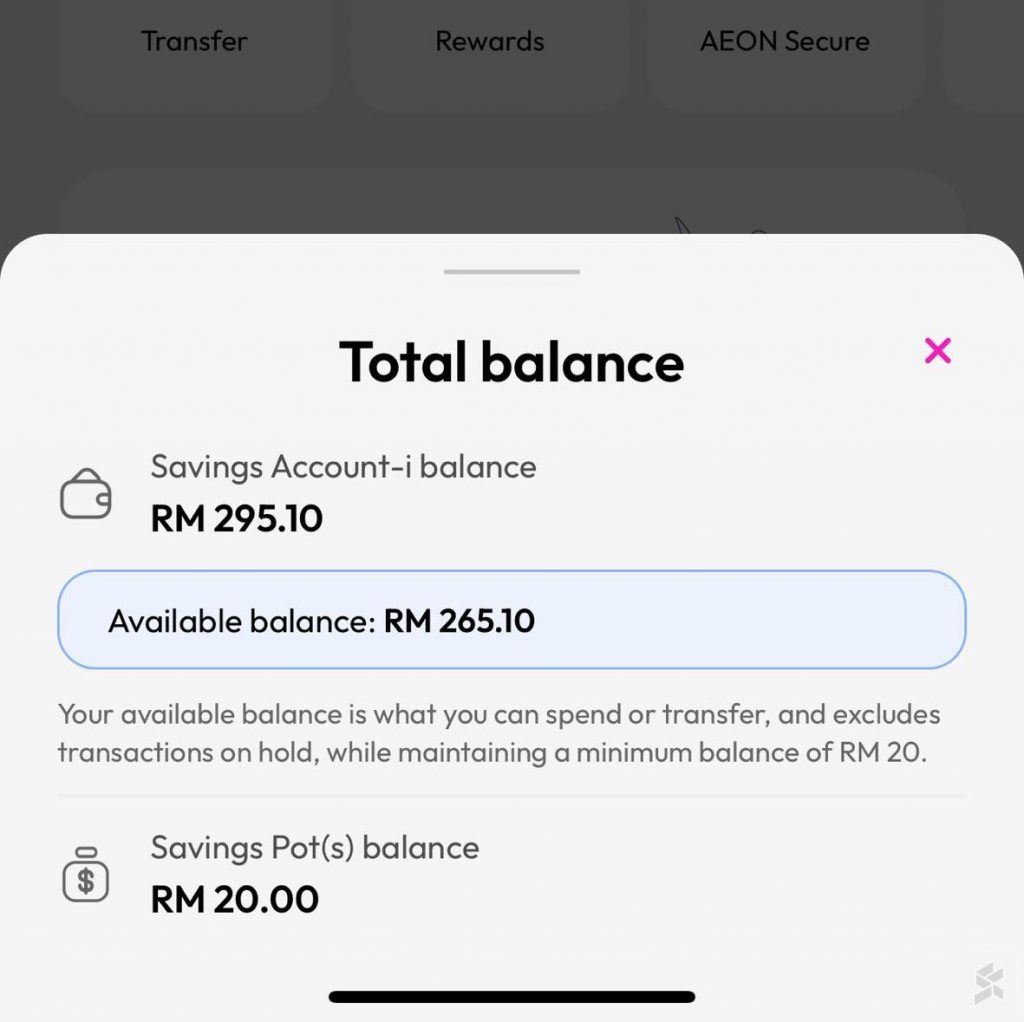

There is a way, however, to view your actual balance after making card transactions but it takes an extra step. You’ll have to tap the exclamation mark icon (!) next to your “Total Balance” to view the actual balance. As shown above, the Savings Account-i Balance shows RM295.10 but the actual available balance is RM265.10 after deducting the RM10 card transaction for our Setel top-up and the RM20 minimum balance required.

As a comparison, the GXBank app does show the card transactions immediately and this makes it more convenient for cardholders to track their spending and view the foreign currency exchange rates in real-time while travelling overseas. This is similar as well for other prepaid cards such as TNG eWallet Visa and Wise.

As a digital-first platform, we hope Aeon Bank will address this concern as users would want to be better informed about their card usage as it happens.

DuitNow QR transactions are reflected immediately

If you’re using the Aeon Bank app to pay via DuitNow QR, the transactions are reflected in real-time and the displayed total balance is deducted automatically.

Similar to GXBank, the Aeon Bank app only supports the “user scan merchant” method for QR transactions, which is the primary way of scanning DuitNow QR codes at a majority of small and medium-sized merchants. However, the app doesn’t offer the “merchant scan user” method like TNG eWallet as the digital bank app doesn’t currently support the feature.

From now until 31st August 2024, Aeon Bank is offering several perks for new users including a free waiver for the Aeon Debit Visa Debit Card-i issuance fee (RM12) and the annual Aeon Points programme membership fee (RM12). In addition, users can enjoy a special 3.88% p.a. profit rate for deposits made to the Savings Account-i and Savings Pot.

In addition, new Aeon Bank users can receive 3,000 Aeon Points and also 3x Aeon Points for every RM1 spent on the debit card. The accumulated Aeon Points can be converted to cash at a rate of 200 points to RM1. This campaign effectively provides users with 1.5x cashback during the promo period.