Boost Bank has finally launched and it’s Malaysia’s third digital bank licensed and regulated by Bank Negara Malaysia. Formed by a consortium of Axiata’s Boost and RHB, Boost Bank claims to be the first home-grown digital bank in Malaysia.

Registrations for the digital bank are now open and users can download the official app via the Apple App Store and Google Play Store. It is open to Malaysians aged 18 years old and above.

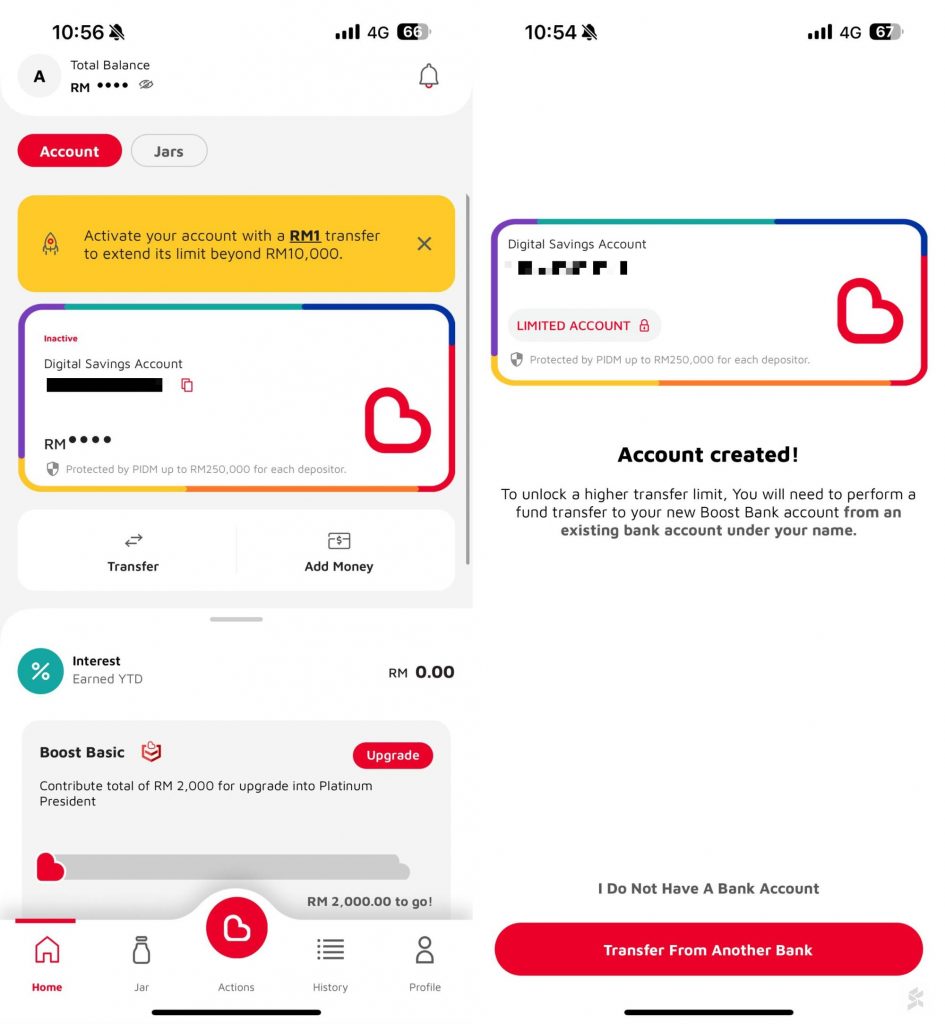

Boost Bank offers Limited Savings Accounts for unbanked users

Unlike GXBank and Aeon Bank, Boost Bank wants to be more inclusive by allowing users without an existing bank account to sign up. Unbanked users can create a Savings Account but it is a limited account with a maximum limit of RM10,000. However, they can enjoy still other benefits including earning interest rate for their deposits.

To unlock more features and a higher transfer limit, Boost Bank users are required to deposit a minimum of RM1 from their existing bank account registered under their name. This is a similar process as other digital banks as a form of verification.

Boost Bank offers up to 3.6% p.a. daily interest, higher during promo

Boost Bank offers a default interest rate of up to 3.6% but it is tiered depending on your account level and where you deposit the money. For the Boost Basic account, they offer 0.5% p.a. daily interest for the Savings Account and a higher 1.5% p.a. daily interest on the Savings Jars.

If you upgrade your account to Platinum President, you’ll get a higher 2.5% p.a. daily interest for the Savings Account and 3.2% p.a. daily interest on Savings Jars. As part of Boost Bank’s promo which runs until 31st August 2023, they are now offering a higher 3.6% p.a. daily interest on the Savings Jar.

Interestingly, there’s a higher tier called Platinum President with Partner Benefits. This tier is unlocked for users who shop with selected merchant partners, and they will enjoy a higher default 3.6% p.a. daily interest rate for Savings Jar. During the promo period from 13th June until 30th September 2024, Platinum President with Partner Benefits users will enjoy a higher interest rate on the Savings Jar but the actual rate is listed as coming soon.

To unlock the Platinum President tier, you’ll need to deposit and maintain a minimum of RM2,000 in your Savings Account and/or Savings Jar.

The interest rate for the Savings Accounts and Savings Jars are calculated daily but it is credited every week.

To stretch your ringgit further, Boost Bank is allowing users to earn up to 3x Boost Stars and they are providing extra cashback and discounts for selected participating merchants.

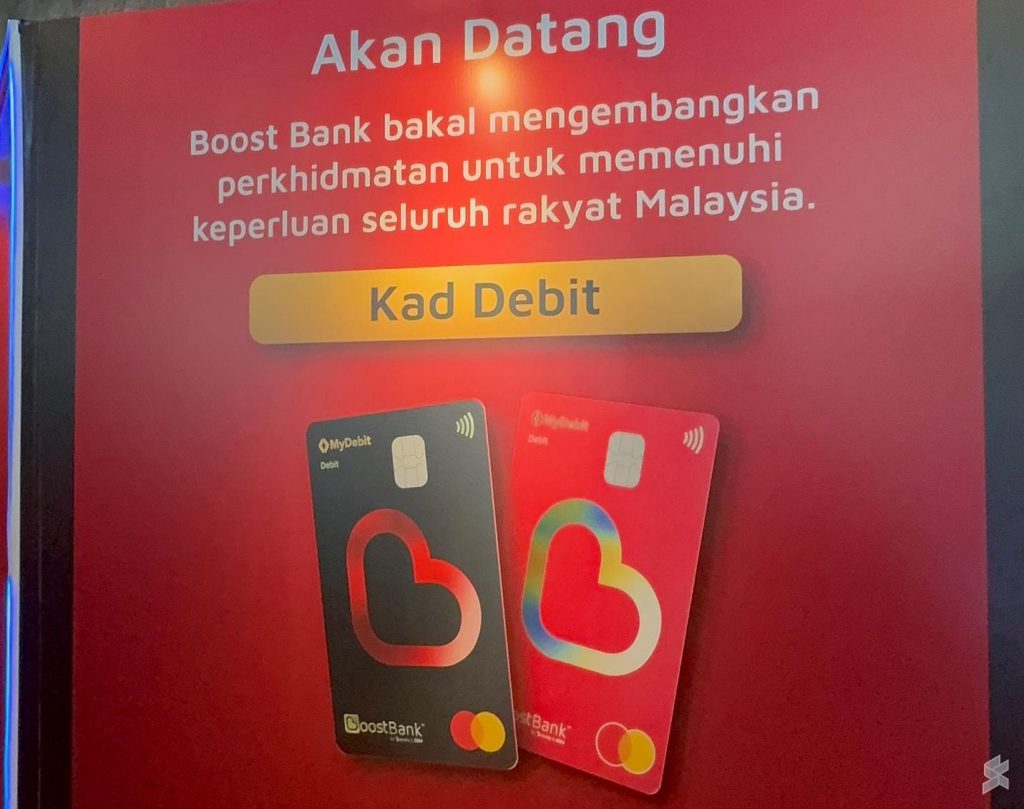

Boost Bank Debit Card coming soon

Similar to GXBank when it first started, you can’t use your Boost Account for spending. The app in its current form doesn’t support native DuitNow QR cashless payment and there’s no virtual card number. You can start making deposits into your Savings Account and perform fund transfers to other bank accounts via DuitNow.

If you wish to use your Boost Bank account balance for QR payments, you can link Boost Bank to your Boost eWallet account and use the eWallet app to scan DuitNow QR code.

As teased by Boost Bank earlier, they will soon introduce its Mastercard Debit Card with contactless payment support which may come in either Black or Red.

During the press conference, Boost Bank says they are looking into Apple Pay and Google Pay integration but the priority right now is to serve the unserved market as well as micro-SME and SMEs.

For more info, you can visit Boost Bank’s website.