Aeon Bank is Malaysia’s first Islamic Digital Bank regulated by Bank Negara Malaysia. As part of its introductory promo, they are offering a high 3.88% p.a. profit rate for its savings account and users can effectively enjoy 1.5% cashback with its current 3x Aeon Points promo.

But what is it like to use Aeon Bank Debit Card-i for overseas transactions? And is it better than other payment cards for travel? Here’s our experience during a short trip to Taiwan.

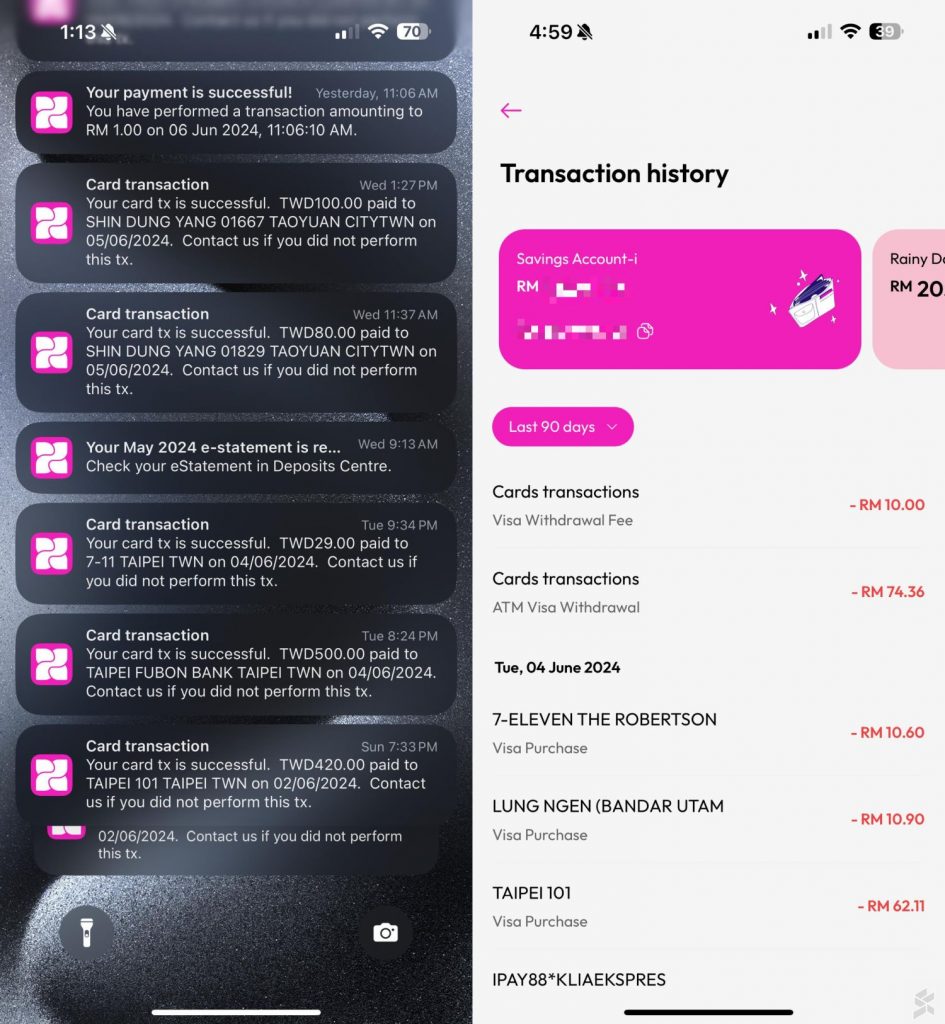

Aeon Bank app took days to reflect overseas card transactions, no foreign exchange rate info

As highlighted previously, Aeon Bank’s Debit Card transactions via Visa aren’t reflected in real-time and this can be frustrating for those who want to keep track of their spending. After making a Visa paywave payment, the Aeon Bank app does push a notification but you won’t find it in the transaction history in the app. In most occasions, the transactions will appear in about 2 days but some took almost 4 days to appear in the transaction history.

When the transactions do get recorded in the app’s transaction history, it only shows the RM value without any extra details such as the country of the transaction, foreign currency amount and exchange rate used. It gets messier too as the card transactions are sorted based on the posted date instead of the actual transaction time and date.

Understandably, some card transactions may take time to process, but other card payment platforms such as GXBank, TNG eWallet Visa and even Wise, do record these transactions in the app while it is in “Pending” or “Processing” status. After the transaction is completed, they still retain the correct chronological order based on the time and date of the transaction.

To make matters worse, the actual Savings account balance isn’t reflected on the home screen on the Aeon Bank app. You’ll have to tap on the exclamation mark icon to view the actual “available balance” which deducts the actual amount used for pending transactions.

RM10 withdrawal fee for overseas ATM withdrawal

Contrary to what we’ve been told during the launch of Aeon Bank, each ATM cash withdrawal overseas actually incurs a RM10 withdrawal fee. This is charged on top of the withdrawal amount and current currency exchange rate. If you plan to withdraw using your Aeon Bank Debit Card-i overseas, it is better to withdraw a larger amount required to maximise the RM10 fee.

If the ATM asks you if you want to convert to MYR, you should always choose the local (foreign) currency for the best rates. Always select the local currency (e.g. EUR, USD, TWD, GBP, etc) and the same goes for card terminals that ask you to choose between the local currency or MYR.

As a comparison, the ATM withdrawal fees are currently waived by GXBank and Wise (two transactions, up to RM1,000 per month).

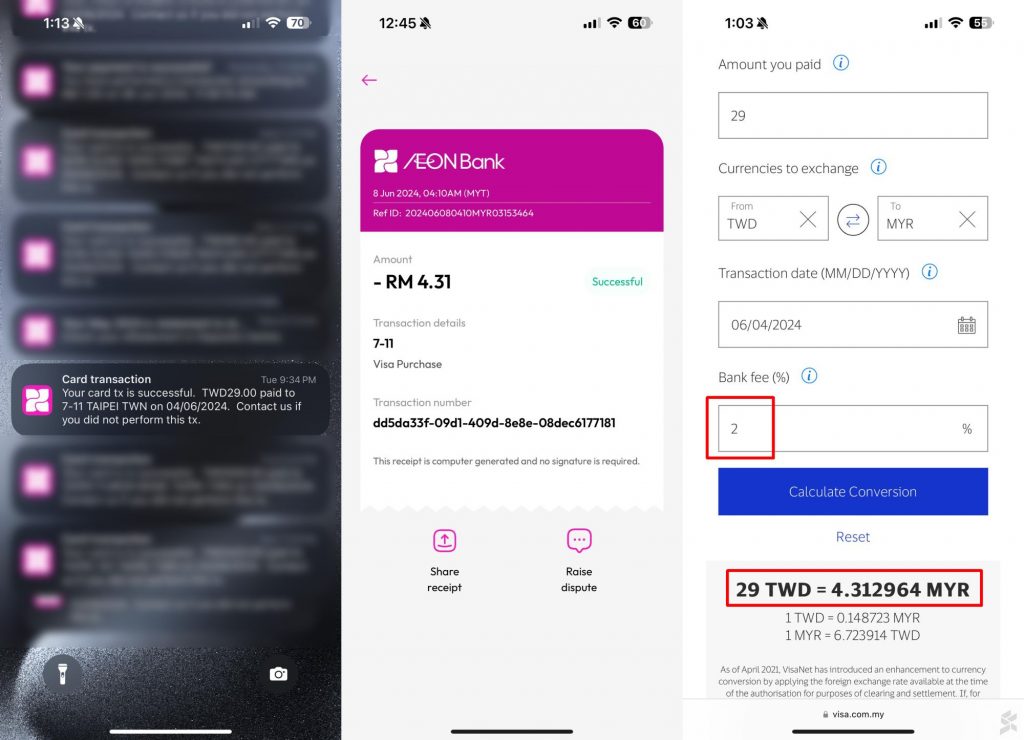

Aeon Bank Debit Card-i has a 2% markup for foreign transactions

During the launch, Aeon Bank claims they don’t charge any FX markup for foreign transactions. However, from our recent trip, it does appear that there’s a 2% markup for our card transactions overseas.

As shown above, a TWD 29 transaction with the card at a 7-11 in Taipei costs RM4.31, which is equivalent to TWD 100 = RM14.86. As a comparison, TNG eWallet Visa which still offers 0% FX markup gave us a lower rate of TWD 100 = RM14.58, which is RM0.28 cheaper.

If we refer to Visa’s Exchange Rate Calculator for 04/06/2024, it appears that Aeon Bank Debit Card-i imposes a 2% bank fee for overseas usage.

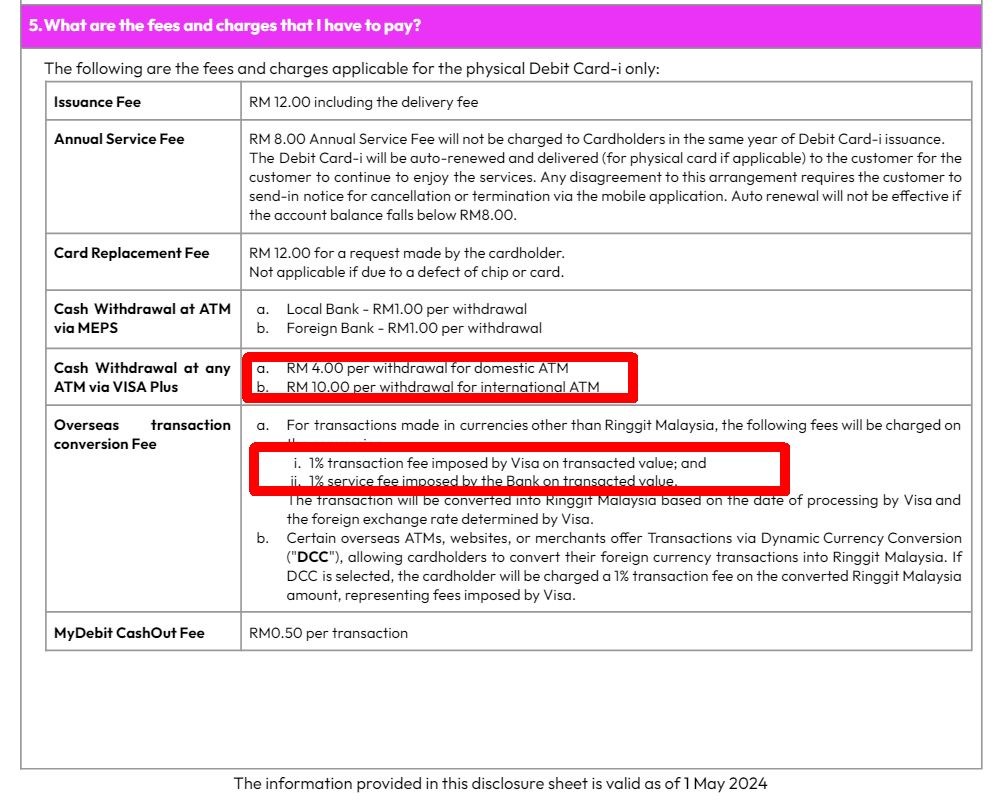

Aeon Bank Debit Card charges are not shown upfront to customers

Unlike other digital banks or digital payment platforms, Aeon Bank doesn’t highlight its transaction fees and charges upfront. There’s no mention of foreign ATM and transaction fees on its FAQ.

Meanwhile, the Product Disclosure Sheet for the Debit Card-i is actually hidden under the Corporate Governance section instead of the actual product page.

According to the Product Disclosure Sheet for the debit card, cash withdrawals at international Visa ATMs will cost RM10.00 while local ATM withdrawals via MEPS will cost you RM1.00.

On top of that, the sheet also highlighted that transactions made in currencies other than Ringgit Malaysia will be imposed with a 1% transaction fee by Visa and another 1% service fee imposed by Aeon Bank. In total, that’s a 2% markup for foreign transactions.

If a cardholder chooses to convert their foreign currency transaction into RM during the transaction, there’s a 1% transaction fee imposed by Visa on the converted RM amount.

The document also mentions that the Aeon Bank Debit Card has an annual service fee of RM8.00 which will not charged in the same year of card issuance.

Aeon Bank needs to be more transparent to consumers

While Aeon Bank has several interesting offers for domestic uses, there’s still a lot of room for improvement if it aspires to be the digital bank of choice. Real-time data and transparency are two important things for digitally savvy consumers especially when promoting financial literacy. Consumers expect more from digital banks as they are supposed to be more seamless and competitive than traditional banks.

As a fully digital platform, card payments should be reflected instantly (not days) with more data so that customers are better informed about their spending. On top of that, the transaction fees should be communicated clearly so that there are no surprises while spending overseas.