Introduction

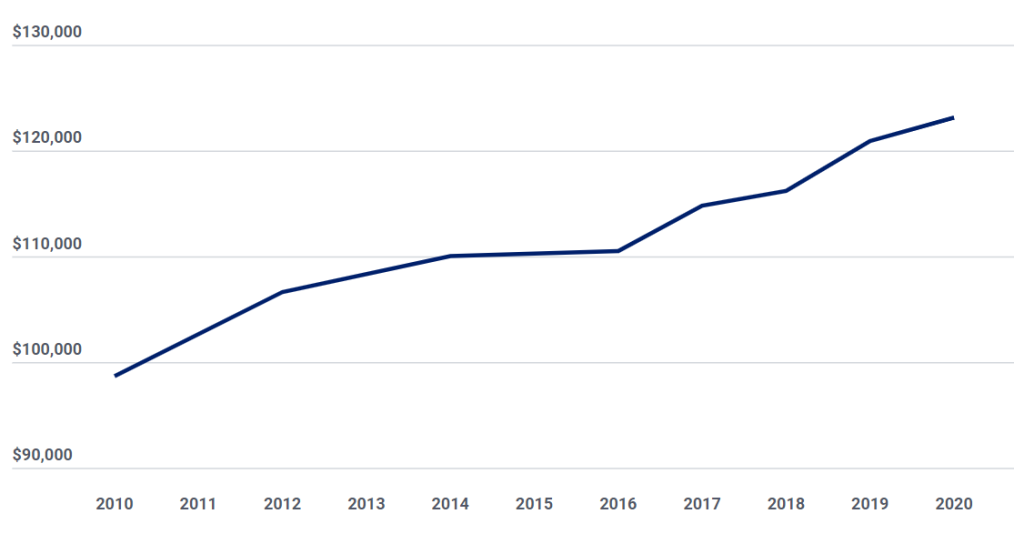

According to data reported by the Actuary Salary in US Bureau of Labor Statistics (BLS), the median annual pay of an actuary—an individual who analyzes statistical data to forecast risk and liability—was $111,030 as of May 2020, the most recently available data.

This equates to an average compensation of $53.38 per hour.1 The typical actuary works full time in an office for a particular employer. Actuary Salary in the US, but some work as consultants, traveling frequently to meet with clients. Here we are discussing Actuary Salary in the US.

Actuaries working with insurance brokerages and financial institutions earned $112,800—whereas those working for general companies earned $99,550.

A person working as an Actuary in the United States typically earns around 135,000 USD annually. Salaries range from 63,700 USD (lowest) to 214,000 USD (highest).

The average yearly salary includes housing, transport, and other benefits. Actuary salaries vary drastically based on experience, skills, gender, or location. Actuary Salary in the US Below, you will find a detailed breakdown based on many different criteria.

Salary Outlook for Actuaries:

How Much Does an Actuary Make?

Actuaries made a median salary of $111,030 in 2020. The best-paid 25 percent made $151,060 that year, while the lowest-paid 25 percent made $83,550.

Actuary Average Hourly Wage in US:

The average hourly wage (pay per hour) in the United States is 65 USD. This means that the average Actuary in the United States earns approximately 65 USD for every worked hour.

Hourly Wage = Annual Salary ÷ ( 52 x 5 x 8 )

Rankings for Actuaries:

Actuaries rank #7 in Best Business Jobs. Jobs are ranked according to their ability to offer an elusive mix of factors. Read more about how we rank the best jobs.

Salary Range for Actuaries:

Actuary salaries in the United States range from 63,700 USD per year (minimum salary) to 214,000 USD per year (maximum salary).

Median Salary for Actuaries:

The median salary is 144,000 USD per year, which means that half (50%) of people working as Actuary(s) are earning less than 144,000 USD Actuary Salary in US while the other half are earning more than 144,000 USD.

The median represents the middle salary value. Generally speaking, you would want to be on the right side of the graph with the group earning more than the median salary.

Percentiles for Actuaries:

Closely related to the median are two values: the 25th and the 75th percentiles. Reading from the salary distribution diagram, 25% of Actuary(s) are earning less than 93,200 USD while 75% of them are earning more than 93,200 USD.

Actuary Salary in US is average around 63,700 USD.

Actuary Earnings by Seniority Levels:

- Top-level actuary earns

$99.43per hour

$206,820per year

- Senior-level actuary earns

$73.71per hour

$153,310per year

$50.91per hour

$105,900per year

- Junior-level actuary earns

$38.61per hour

$80,320per year

- Starting level actuary earns

$30.41per hour

$63,260per year

Actuary Salaries Per Region:

The Top-Paying Industries for Actuaries:

For actuaries, as for other occupations, two factors that influence earning potential are the industry of employment and geographical location.

The BLS reported that the top-paying industries for actuaries in 2020 included:

- Securities, commodity contracts, and other financial investments and related activities, where the average wage is $139,100.

- Agencies, brokerages, and other insurance-related activities pay a mean salary of $129,610.

- Insurance carriers, pay an average annual salary of $124,550.

- Management, scientific, and Actuary salaries in US technical consulting services, where the mean wage is $121,920 per year.

- Management of companies and enterprises, where actuaries earn an average wage of $111,820 annually.

All in all, the finance and insurance industry made up 76 percent of the actuary profession in 2020, according to the BLS.

The professional, scientific, and technical services industry was the next largest employing industry for actuaries, making up 11 percent of the workforce.

Best-Paying Cities for Actuaries:

The metropolitan areas that pay the highest salary in the actuary profession are Charlotte, New York, San Antonio, Milwaukee, and Tampa.

Charlotte, North Carolina

$156,910

New York, New York

$148,230

San Antonio, Texas

$142,550

Milwaukee, Wisconsin

$134,900

Tampa, Florida

$134,670

Best Paying States for Actuaries:

The yearly salary of an actuary also varies by state. The top five payers in 2020 were New York ($154,150), Connecticut ($149,430), New Hampshire ($137,740), North Carolina ($137,190), and the District of Columbia. ($136,230)

| State | Average Actuary Salary |

| New York | $154,150 |

| Connecticut | $149,430 |

| New Hampshire | $137,740 |

| North Carolina | $137,190 |

| Washington, DC | $136,230 |

Actuary Salary by Years of Experience:

- An Actuary with less than two years of experience makes approximately 73,400 USD per year.

- While someone with an experience level of between two and five years is expected to earn 101,000 USD per year, 38% more than someone with less than two years’ experience.

- Moving forward, an experience level between five and ten years lands a salary of 144,000 USD per year, 42% more than someone with two to five years of experience.

- Additionally, Actuary(s) whose expertise span anywhere between ten and fifteen years get a salary equivalent to 176,000 USD per year, Actuary Salary in US 22% more than someone with five to ten years of experience.

- If the experience level is between fifteen and twenty years, then the expected wage is 185,000 USD per year, 6% more than someone with ten to fifteen years of experience.

- Lastly, employees with more than twenty years of professional experience get a salary of 202,000 USD per year, 9% more than people with fifteen to twenty years of experience.

Actuary Salary Comparison By Gender:

On average, Male Actuary employees in the United States earn 6% more than their female counterparts.

Education Requirements for actuaries:

Most actuaries start out with a bachelor’s degree. And no matter your major, “you have to be pretty good at math,” Manning says.

Actuaries also need to be well-versed in statistics and financial theory. Here’s how to get started:

1. Earn a bachelor’s degree. Majoring in mathematics, statistics or actuarial science is helpful for a career in this profession.

2. Gain internship experience. Internships can help students decide on which actuarial path to head down. Areas of practice may include health, life, and casualty.

3. Pass a series of exams. To become a certified actuary, you need to pass a series of actuarial exams.

Typically, students will want to have passed at least one or two of the actuarial exams before job-seeking in the actuarial field.

However, some jobs – like Manning’s first one – will hire you as a trainee and allow you to work as you study and pass a series of exams. Actuary Salary in US There are different exam requirements, depending on what sort of actuary you want to be.

Job Satisfaction for Actuaries:

Average Americans work well into their 60s, so workers might as well have a job that’s enjoyable and a career that’s fulfilling.

Actuary Salary in US is average around 63,700 USD.

A job with a low-stress level, good work-life balance, and solid prospects to improve, get promoted, and earn a higher salary would make many Actuary Salary in US employees happy.

Here’s how Actuaries’ job satisfaction is rated in terms of upward mobility, stress level, and flexibility.

Opportunities for advancements and salary –Above Average

Work environment and complexities of the job’s responsibilities –Average

Alternative working schedule and work-life balance –Average

Related Salaries for Actuaries:

Recent Salary Records for Actuary:

- An Actuary reported making $109,000 per year in Phoenix

3 months ago · $109,000· Phoenix, AZ

- An Actuary reported making $110,000 per year in Los Angeles

a year ago · $110,000· Los Angeles, CA

- An Actuary reported making $120,000 per year in Akron

a year ago · $120,000· Akron, OH

- An Actuary reported making $81,000 per year in Los Angeles

2 years ago · $81,000· Los Angeles, CA

- An Actuary reported making $120,000 per year in Los Angeles

2 years ago · $120,000· Los Angeles, CA

- An Actuary reported making $81,650 per year in Chicago

2 years ago · $81,650· Chicago, IL

- An Actuary reported making $132,000 per year in New York City

2 years ago · $132,000· New York City, NY

- An Actuary reported making $134,100 per year in New York City

2 years ago · $134,100· New York City, NY

- An Actuary reported making $103,000 per year in New York City

2 years ago · $103,000· New York City, NY

- An Actuary reported making $101,000 per year

2 years ago · $101,000

FAQs About Actuary Salary in US:

How much is an actuary paid in USA?

According to data reported by the U.S. Bureau of Labor Statistics (BLS), the median annual pay of an actuary—an individual who analyzes Actuary Salary in US statistical data for the purpose of forecasting risk and liability—was $111,030 as of May 2020, the most recently available data.

What is the maximum salary of an actuary?

An Actuary can expect a starting salary of INR 4.50 LPA whereas an Actuary with more than 10 years of experience can expect an annual average salary of INR 14.11 LPA. The monthly salary of an Actuary in India is around INR. The highest salary of an Actuary can go up to INR 1,01,000.

Is an actuary a high-paying job?

A newly qualified Fellow can expect to earn around $125,000 per year and incomes rise quickly. Senior actuaries can easily earn over $300,000 a year. Actuary Salary in US Actuaries are in demand and well-rewarded for their analytical and problem-solving skills in a growing number of industries.

Is actuary one of the highest paying jobs?

Actuary makes Time’s list of highest paying jobs in 2016. Careercast.com reported in the Wall Street Journal, that actuaries have the second-best job in 2012. An actuary is #2 in the Ranking of Best Occupations in the U.S.

Is actuary a stressful job?

Actuary tops the list as the least stressful job with an average salary of over $100,000. Actuaries often work with companies to help predict risk, Actuary Salary in US create business policy and minimize costs. Typically, actuaries possess a Bachelor’s degree and more than six years of experience.

How much tax will you have to pay as an Actuary?

For an individual filer in this tax bracket, you would have an estimated average federal tax in 2018 of 24%. After a federal tax rate of 24% has been taken out, Actuaries could expect to have a take-home pay of $102,885/year, with each paycheck equaling approximately $4,287.

Which country pays actuaries the most?

Switzerland

According to Salary Expert website, actuaries in Switzerland receive the highest remunerations. Recently-hired staff kick starts their career with an Actuary Salary in US income of 95 000 USD. After a few years of experience, their salary exceeds 137 000 USD, reaching 170 000 USD after more than 20 years of professional experience.

Can actuaries make 500k?

In fact, the highest paid position in this field is an actuary fellow in casualty insurance—which can earn you over $550,000 per year.

Which is better actuary or CA?

Being a CA would require extensive knowledge in Accounts, Economics, and laws regarding finance, and other commerce subjects. Being an Actuary would require extensive knowledge of Statistics, Economics, and Mathematics. But both the courses are leading courses and it totally depends upon your interest.

Is becoming an actuary difficult?

But unlike doctors or lawyers, actuaries need to, in order to become fully credentialed, pass a series of difficult tests called Actuarial Exams. These are very hard. Very very hard. The preliminary exams are 3 hours long, consisting of 30-35 multiple choice problems, and the pass rate is typically only 30-40%.

Are actuaries happy?

Actuaries are one of the least happy careers in the United States. At CareerExplorer, we conduct an ongoing survey with millions of people and ask them how satisfied they are with their careers. As it turns out, actuaries rate their career happiness 2.5 out of 5 stars which puts them in the bottom 5% of careers.

Do actuaries make six figures?

Once the actuary has passed all 10 exams and gained 6-7 years of experience then $125,000 to $190,000 would be reasonable. With 20+ years of experience, some actuaries reach a salary of $500,000 or more.

Conclusion

Actuary Salary in US is projected to grow 21 percent from 2021 to 2031, much faster than the average for all occupations.

About 2,400 openings for actuaries are projected each year, on average, over the decade. Many of those openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire.