The Proton e.MAS 7 is set to be Malaysia’s first “national” EV and the official launch is expected to take place in the next couple of months. During the weekend, Proton unveiled the EV’s estimated pricing of RM120,000 along with details of its early bird offers.

While the e.MAS 7 is probably the biggest EV in the price segment, many expressed disappointment that Proton’s first EV won’t be sold below RM100,000. Some claimed the EV is overpriced compared to its Geely twin, the Galaxy E5.

The question is, is it fair to do a direct price comparison with a Chinese EV model? And is the Malaysian government offering the same incentives as China? Let’s take a closer look at the EV pricing for both markets.

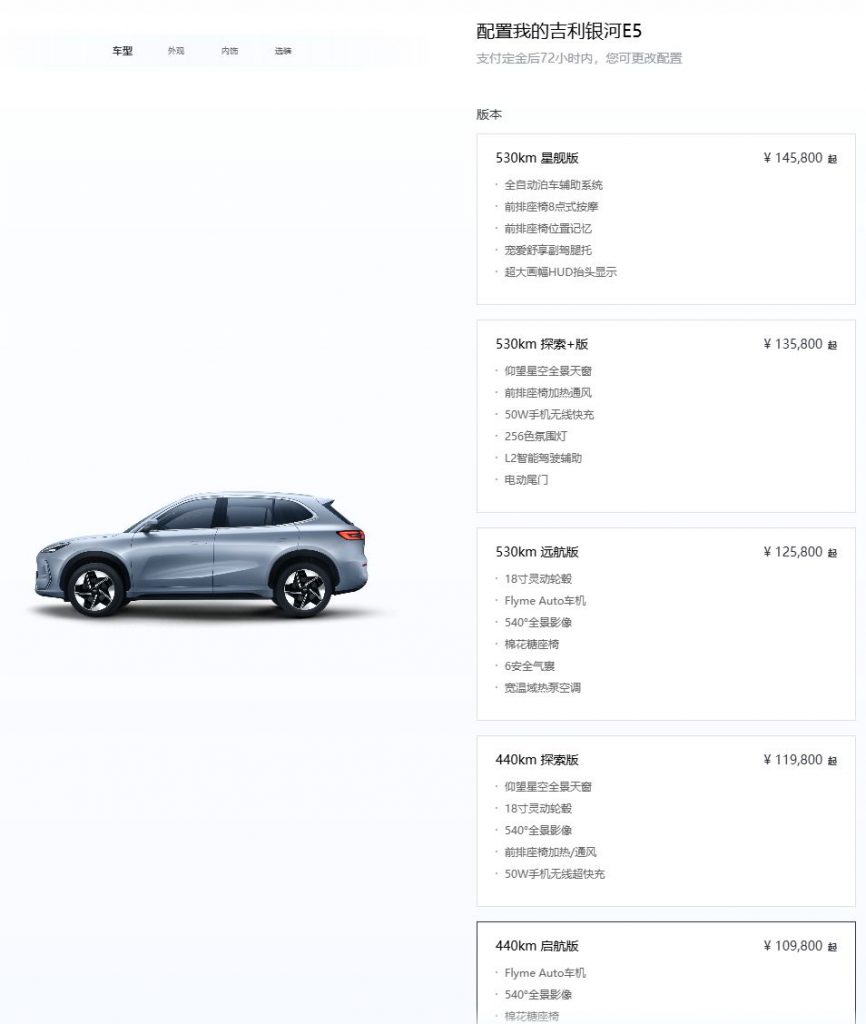

Proton e.MAS 7 vs Geely Galaxy E5 pricing

Despite being a “national” EV, the first batch of Proton e.MAS 7 are fully imported from China. As we’ve covered previously, the e.MAS 7 isn’t just a mere rebadge as the Proton model comes with additional tweaks and upgrades to better suit our local market.

Assuming that the indicated RM120,000 e.MAS 7 price is for the base-spec model, we reckon the higher-spec version with the larger 60.22kWh battery could cost about RM15,000 to RM20,000 more. We reckon that both variants should be priced below RM150,000.

In China, the Galaxy E5 is offered in a total of 5 variants. The bottom two models come with a smaller battery with a CLTC-rated 440km of range. Meanwhile, the top three variants get the larger battery with a CLTC-rated range of 530km.

The cheapest Galaxy E5 costs CNY109,800 (about RM67,268) while the range-topping model is priced at CNY145,800 (about RM89,323).

If you do a direct currency conversion, it is easy to conclude that Proton is putting a huge markup, but wait until you compare the prices of other EVs sold in China.

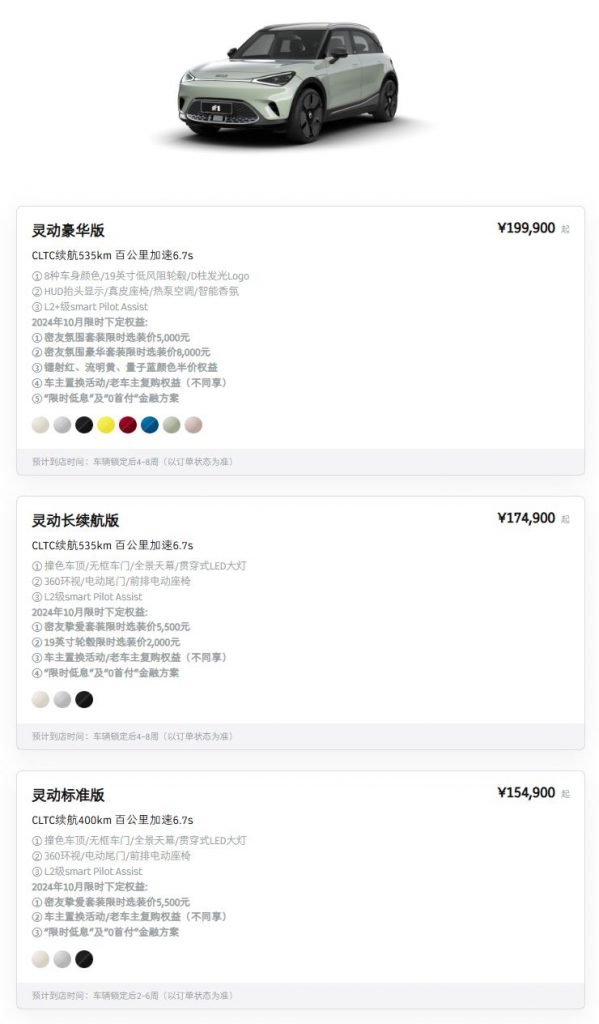

Pricing of other EVs in China vs Malaysia

The Smart #1 in Malaysia is currently priced at RM169,800 for the base-spec “Pro” model with the smaller battery and RM209,000 for the mid-spec “Premium” with a larger battery.

In China, the base-spec Smart #1 is going for only CNY154,900 (about RM94,899), while the higher-spec model is going for CNY199,900 (about RM122,467). That’s almost a whopping RM90,000 difference in pricing!

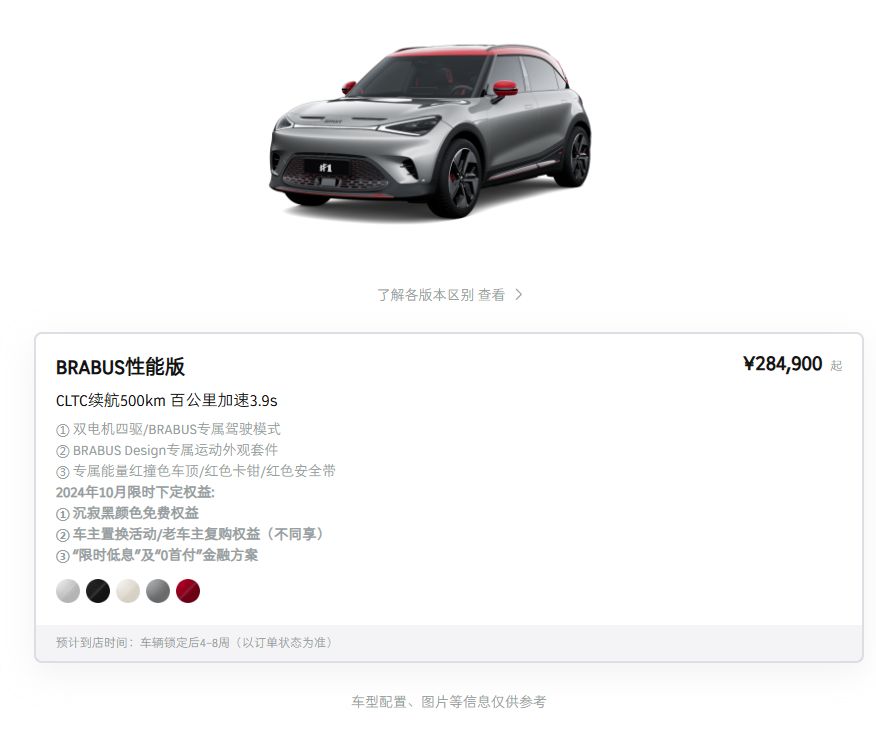

Meanwhile, the Smart #1 Brabus in Malaysia which is currently priced at RM249,000 is only going for CNY284,900 (about RM174,542) in China.

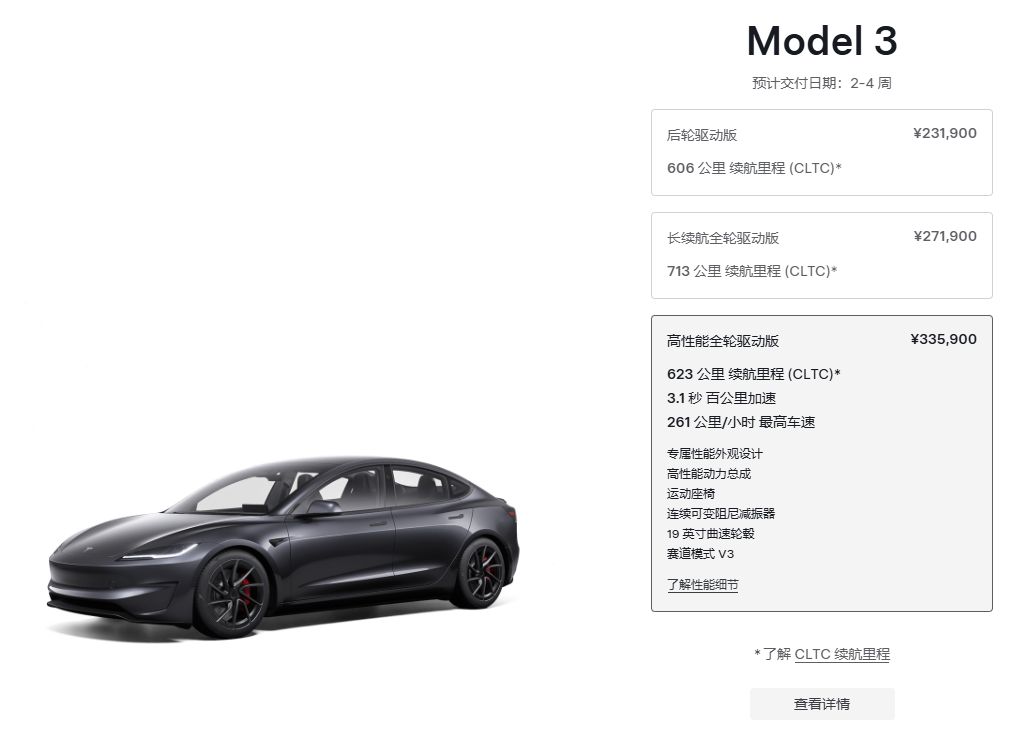

But what about Tesla, which is one of the most competitively priced EVs in the market?

With the latest price reductions, the Tesla Model 3 RWD is priced from RM181,000 while the Long Range AWD model starts from RM210,000. If you want the insane Tesla Model 3 Performance that can do 0-100km/h in 3.1 seconds, that EV starts from RM242,000.

As a comparison in China, the Model 3 starts from only CNY231,900 (about RM142,072) and the Long Range mode is priced from CNY271,900 (about RM166,578). Meanwhile, the Model 3 Performance is priced from CNY335,900 (about RM205,787).

Comparing both markets, Tesla customers in China are paying about RM40,000 less than Malaysia for the same model.

It is also worth noting that specs and equipment levels could vary depending on the market. For example, most Chinese EVs only come with a single-phase 7kW AC on-board charger but the Malaysian units like the Proton e.MAS 7 are equipped with a higher three-phase 11kW AC on-board charger.

Factors that drive lower EV pricing in China

It is normal to expect cars made in China to be cheaper in their domestic home market. Compared to the rest of the world, China’s market is highly competitive with over a hundred EV manufacturers ranging from small microcars to luxury people movers. It is reported that most of these Chinese brands are selling EVs at a loss just to keep up with the competition.

In order to export vehicles overseas, there will be additional costs involved such as shipping, compliance with local regulations and establishing a local network for service and spare parts. The price gap widens as China continues to offer incentives and subsidies to encourage its citizens to jump on the EV bandwagon.

If you buy an EV in China between 1st January 2024 to 31st December 2025, you can enjoy a purchase tax exemption of up to CNY 30,000 (about RM18,379). Although fully imported EVs in Malaysia are still exempted from import and excise duties until the end of 2025, the sales tax is still applicable. Malaysia previously provided sales tax exemption but it ended on 31st March 2023 and it’s only for bookings made until 30th June 2022.

On top of that, China is also providing extra subsidies by offering CNY 20,000 (about RM12,252) to traditional combustion vehicle owners to switch to EVs.

Even Chinese smartphones cost more in Malaysia

EVs aren’t the only products with a significant price gap between China and Malaysia. If you look at Chinese smartphone brands, the prices in mainland China are significantly cheaper than in Malaysia.

For example, the Xiaomi 14 12GB RAM + 256GB is priced at CNY 4,299 (about RM2,633) in China and the same device was launched in Malaysia for RM3,499.

Meanwhile, the Huawei Pura 70 Ultra 16GB + 1TB is priced at CNY10,999 (about RM6,738) in China but the same model was released in Malaysia for RM7,199.

At the end of the day, the price of a product varies worldwide due to several factors including local demand, competition, taxes, local regulations and cost of operations.