TNG Digital together with Principal Asset Management Berhad (Principal) have introduced Principal PRS (Private Retirement Schemes) on the Touch ‘n Go eWallet (TNG eWallet) app. This allows TNG eWallet users to get started on their retirement savings from as little as RM100 and users get to choose to invest in either Shariah-compliant or conventional fund.

The Principal PRS Target Date Funds empowers TNG eWallet users to save up for their retirement years in addition to their mandatory retirement savings. The funds are managed towards a particular targeted date year based on when the investor is expected to withdraw funds to support their retirement needs.

TNG eWallet introduces retirement fund powered by Principal

Users can save up and invest with a minimum contribution of RM100 and the investment options are tailored towards individual retirement ages and goals. According to TNG eWallet, the funds will progressively shift from aggressive to conservative investments as the users approaches their retirement age, aligning with their changing risk tolerance.

As announced during the recent Budget, Malaysians can claim income tax relief of up to RM3,000 for PRS contributions until 2030.

TNG Digital CEO Alan Ni said, “Our goal is to make financial security accessible and achievable for every Malaysian. By adding the Principal PRS to GOfinance, we are offering over 22 million TNG eWallet users an easy, reliable way to actively plan for a comfortable retirement. Together with Principal, our long-time partner, we’re providing a robust and safe investment path that not only complements current savings but strengthens users’ long-term financial resilience.”

Meanwhile, Principal CEO of Malaysia and Global Shariah Munirah Khairuddin said, “We launched our Target Date Funds (TDF) in 2022, and we are very excited to bring this into the TNG eWallet ecosystem. This innovative PRS solution is the first-of-its-kind in Malaysia and leverages on our global expertise in asset allocation.”

She added, “It’s never too early to start building your future and the TDF makes it easier than ever. The TDF is a hassle-free solution with an asset allocation glide path which takes into account the investor’s age and expected year of retirement. The investments are allocated into more aggressive, growth focused strategies during the investors’ younger years when they can afford to take more risks. As the investors ages, the investments are gradually rebalanced to more moderate strategies as they age and approach their retirement. This way, the investor doesn’t need to worry about proactively managing or rebalancing their investments in PRS – just stay consistent with your contributions, and let the fund do the heavy lifting for you.”

How to start your PRS savings with TNG eWallet?

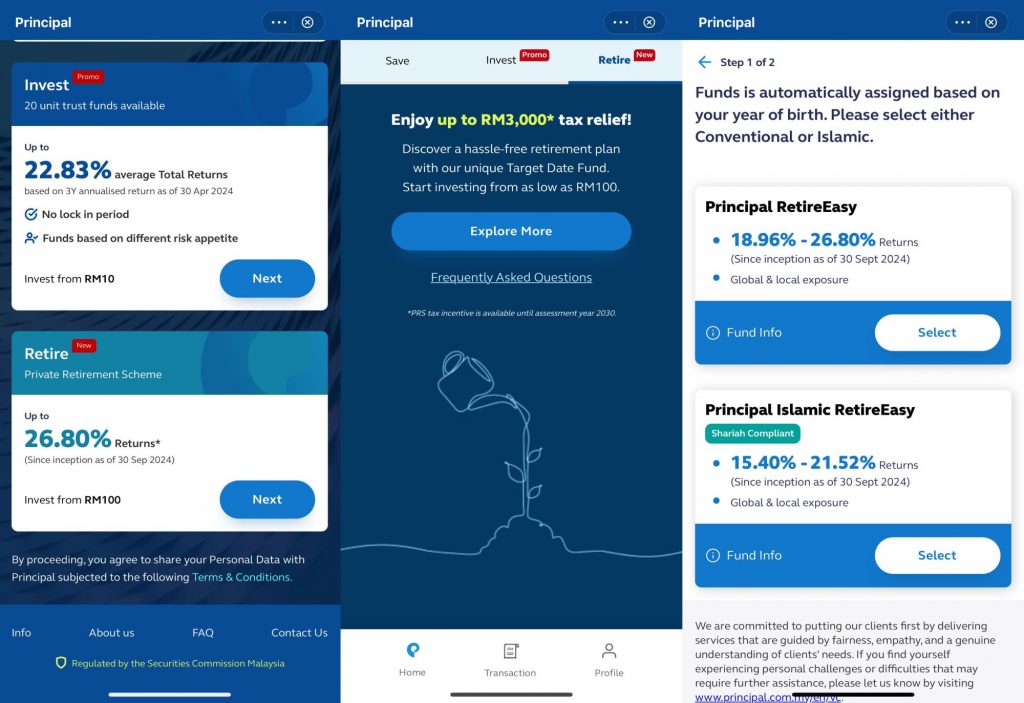

To get started, you can launch the TNG eWallet app and then tap on GoFinance at the bottom, then tap on Investment and then tap on Principal. Next, tap on the Retire tab and you can start saving with either Principal RetireEasy or Principal Islamic RetireEasy (Shariah Compliant).

At the time of writing, Principal RetireEasy is listed with an estimated returns of 18.96% to 26.80%, while Principal Islamic RetireEasy is listed with an estimated returns of 15.40% to 21.52%.

To encourage users to invest in Principal PRS, users who make an investment of RM100 or more from now until 31st December 2024 will be eligible to enjoy additional reward of up to 8% per annum for 30 days.

For more information, you can visit TNG eWallet’s GoInvest page.