YTL Digital Bank Berhad, a joint venture between YTL Digital Capital Sdn Bhd and Sea Limited, has officially introduced Ryt Bank. The digital bank joint venture has received their digital banking licence and they have also been given the green light to commence operations from 20th December 2024.

Ryt Bank is described as Malaysia’s first AI-Powered Digital Bank and it prides itself for “Banking Done Right”. The digital bank will be launched to the public in phases in the coming months to ensure a smooth rollout.

Ryt Bank boasts next-generation AI-powered banking platform

Ryt Bank CEO Melvin Ooi said “Ryt Bank, backed by the formidable strengths of YTL Digital Capital Sdn Bhd and Sea Limited is set to redefine banking in Malaysia. By harnessing the power of artificial intelligence (AI) to provide an unequalled customer experience, we will deliver financial services that are meaningful and inclusive while helping customers achieve their financial goals”.

In its press statement, Ryt Bank says it is proud to be a bank built by Malaysians for Malaysians. By empowering local talent, the digital bank says they have built a next-generation AI-powered platform that simplifies the customer experience from fast and seamless onboarding to daily transactions. This is done while delivering personalised and collaborative banking through advanced customer behaviour insights.

The digital bank wants to democratise banking to make it more accessible and to serve the country’s ambition to fully meet the banking needs of the population. It said that 15% of the population remains underserved and underbanked.

Malaysia’s newest Digital Bank is called Ryt Bank. The YTL Digital Bank is described as Malaysia’s first AI-powered digital bank. pic.twitter.com/xn0HAjTV5W

— SoyaCincau (@Soya_Cincau) January 14, 2025

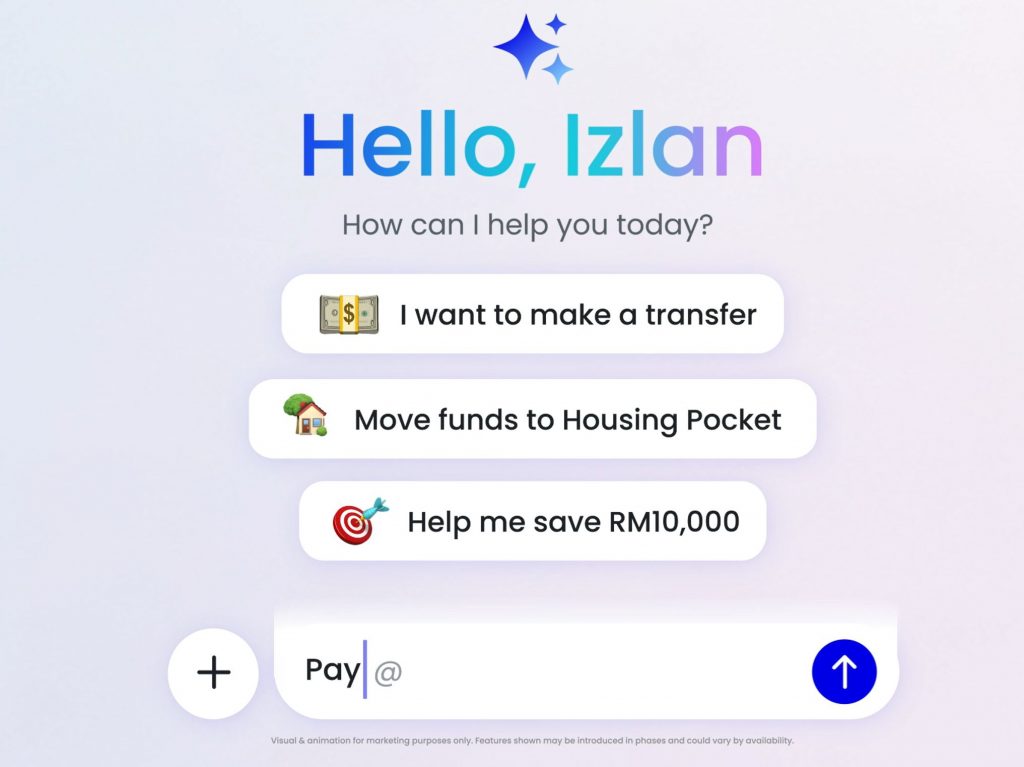

Ryt AI: ChatGPT-style AI-powered Private Banker

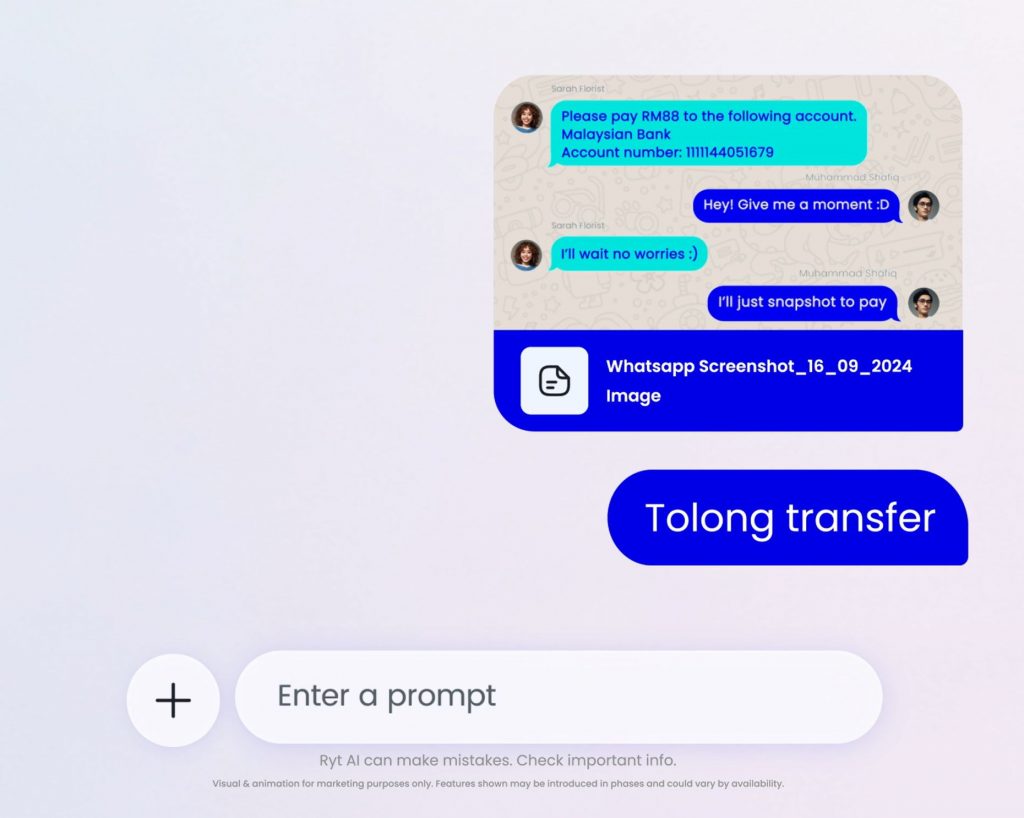

The core of the product is its Ryt AI chatbot which appears to be a ChatGPT-style AI-powered private banker that is designed to help simplify banking services, deliver tailored financial insights and manage advanced savings strategies. As shown in the promo video, you can command Ryt AI to perform normal day to day banking transactions such as fund transfers with a simple text prompt.

Ryt AI is claimed to be intelligent enough to handle attachments to help you save time. In the example given, you can provide it with a screenshot of a chat conversation requesting for a payment and Ryt AI will take over the menial task of entering the transaction amount and bank account number to initiative a fund transfer.

Ryt AI is said to be developed to ensure accessibility and it will support multiple languages to meet various needs.

For greater peace of mind, Ryt Bank says they place security and transparency at its core and customers will benefit from advanced encryption, multi-layer security, biometric face-matching verification and real-time fraud monitoring.

The upcoming digital bank also offers PIDM protection of up to RM250,000 for each depositor. It added that its digital banking services will come with no hidden fees, to reflect their commitment to honesty and trustworthiness.

Ryt Bank is established as a partnership between YTL and Sea. YTL is a prominent Malaysian infrastructure company with 70 years of experience, while Sea is a global consumer internet company that owns Garena, Shopee and SeaMoney.

![[Industry Direct] Opening a New Chapter in VR Gaming – ‘The ChicKing Dead’ Enters Early Access! [Industry Direct] Opening a New Chapter in VR Gaming – ‘The ChicKing Dead’ Enters Early Access!](https://roadtovrlive-5ea0.kxcdn.com/wp-content/uploads/2025/04/2_CKD_Screenshots_1-640x360.jpg)