Lawmakers return to Washington this week to begin a packed pre-recess session.

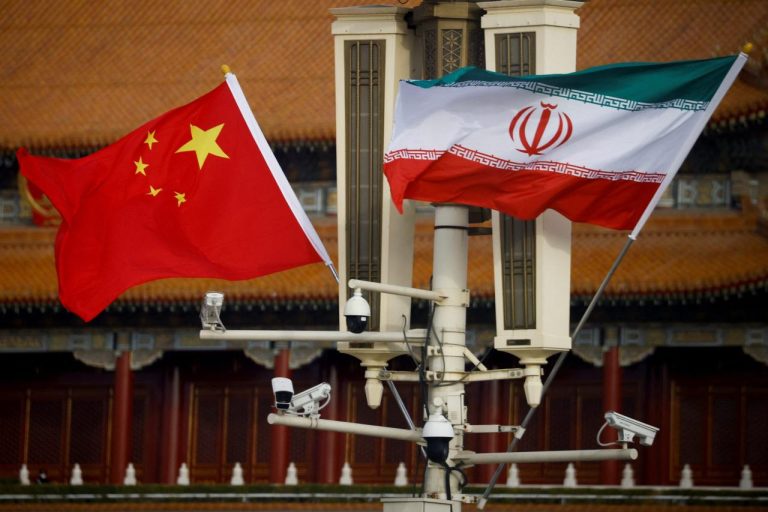

And as economic data, federal policy and government shutdowns come into focus, there are now protests against the VV shutdown in China that investors should consider.

With that in mind, here are three important business and political stories to watch this week:

When the protests began, Washington opposed China’s coronavirus policy.

Some politicians They oppose Chinese President Xi Jinping’s anti-coronavirus policies, which have sparked rare protests from Shanghai to Beijing compared to those in Tiananmen Square in 1989.

China’s state-controlled media continues to support Xi’s policies; However, the protests exposed Xi’s government to a new generation of democratic opponents.

©Courtesy of Yahoo Finance Americans sit down to protest coronavirus (Covid-19) restrictions and hold white papers and remember the victims of the Urumqi fire as the virus continues to spread in Beijing, China. November 27, 2022 Photo: Thomas Peter/Reuters

©Courtesy of Yahoo Finance Americans sit down to protest coronavirus (Covid-19) restrictions and hold white papers and remember the victims of the Urumqi fire as the virus continues to spread in Beijing, China. November 27, 2022 Photo: Thomas Peter/Reuters

President Biden, for his part, has so far remained silent on China’s Covid policy. The protests in China began earlier this month when Biden and Xi tried to defuse tensions between the two countries during face-to-face talks in Bali. But over the weekend, other administration officials hinted at how the administration might respond.

“[China’s coronavirus policy] is clearly not our strategy,” Martha Radz, the White House’s coronavirus response coordinator, told Ashish Jha. We don’t think it’s true, and certainly not for the American people. Our strategy is to vaccinate people and create immunity in the population. This is how something like Omicron takes on such an infectious form.

From an economic perspective, the protests and China’s response to them highlight the risks American companies face doing business in China.

Look no further than Apple. Shares in the tech giant fell nearly 2 percent on Friday after unrest at Foxconn’s Zhengzhou factory, where thousands of workers were angered by the zero-virus policy, the main iPhone maker.

Fed Chairman Powell entered the economic war

Federal Reserve Chairman Jay Powell will speak at the Brookings Institution on Wednesday, and economists are wary of hinting at what the central bank will do with interest rates.

Market watchers will look to employment data when the US Labor Department releases its November employment report on Friday.

As economists continue to forecast a modest contraction next year, employment data along with China’s response to worsening public discontent are two important cards for the Federal Reserve.

As Greg Vallier, chief US policy strategist at AGF Investments, wrote in the weekly Washington Note, “[Powell] is poised to announce that the central bank will cut interest rates by 75 basis points, which could be a half-point increase.” FOMC meeting.” Scheduled for December 13-14.

© Yahoo Finance US Federal Reserve Chairman Jerome Powell speaks during a press conference at the bank’s headquarters on November 2, 2022 in Washington, DC. (Photo by Chip Somodevilla/Getty Images)

© Yahoo Finance US Federal Reserve Chairman Jerome Powell speaks during a press conference at the bank’s headquarters on November 2, 2022 in Washington, DC. (Photo by Chip Somodevilla/Getty Images)

Congress has a busy schedule for a lame duck session.

A Dec. 16 deadline has passed for lawmakers to pass a public finance bill to avoid a partial government shutdown.

Complementarity in the public spending package continues to support Ukraine’s bilateralism. The White House says Ukraine wants $38 billion to fight Russia

But there is also a big unknown that could derail the talks: a possible rail strike.

Republicans and Democrats have said they will introduce legislation to prevent rail strikes, which the Association of American Railroads says cost the U.S. economy $2 billion a day .

© Yahoo Finance America. Count again. Brian Fitzpatrick, R-Penn., left, listens to Sen. Joe Manchin, R-Va., during a news conference on a bill to ban Russian oil imports, Thursday, March 3, 2022, on Capitol Hill in Washington. (AP Photo/Jacqueline Martin)

© Yahoo Finance America. Count again. Brian Fitzpatrick, R-Penn., left, listens to Sen. Joe Manchin, R-Va., during a news conference on a bill to ban Russian oil imports, Thursday, March 3, 2022, on Capitol Hill in Washington. (AP Photo/Jacqueline Martin)

The U.S. Trade Act allows Congress to pass legislation to end strikes, CNBC reported. The bipartisan group of problem solvers said they will not allow the rail strike to hurt the economy.

“Failure is not acceptable here,” said the speaker. Brian Fitzpatrick (R-Penn), group co-chairman, Fox News Sunday. “We can’t blame our transportation system for delivering one-third of our products across the country. That’s not an option.”

How will this affect the government shutdown? Speaking time in the House and Senate comes at a premium, so spending any time defending the rail strike — perhaps a top priority — will make it more difficult for lawmakers to reach agreement on a funding package.

Kevin Cirelli is a visiting fellow at the Atlantic Council’s Global China Center and the Crook Institute for Technical Diplomacy at Purdue. Follow him on LinkedIn here .

Click here for political news about business and finance

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android devices.

Follow Yahoo Finance on Twitter , Facebook , Instagram , Flipboard , LinkedIn and YouTube.